Recent Blogs

Blog

Protecting Consumers Means Thinking Like Consumers

People often make unexpected, even counter-intuitive, financial decisions. Understanding why is the starting point for good financial consumer protection policy.Blog

Bank-Led Digital Finance: Who’s Really Leading?

In countries where regulators favor “bank-led” digital finance models, nonbanks are playing important – even dominant – roles in digital finance.Blog

The Biometric Balancing Act in Digital Finance

Biometric technologies are facilitating the rise of collaborative customer due diligence. It is crucial to understand all aspects of biometric solutions – security, cost, convenience, inclusiveness and accuracy – and how prioritizing one may come with trade-offs to others.Blog

Blockchain: A Solution in Search of a Problem?

Blockchain may be capable of expanding poor people's access to financial services, but does it work better than other existing technologies?Blog

What Can We Learn from Sierra Leone’s New Regulatory Sandbox?

Sierra Leone's approach to setting up a regulatory sandbox for financial inclusion holds important lessons for other countries.Blog

Public Clearinghouse Could Shake Up China’s Mobile Payment Market

China will soon require payments providers, including Alipay and WeChat Pay, to connect to a public online payments clearinghouse. Here’s what we know so far about how this institution will work and what it could mean for mobile payments.Blog

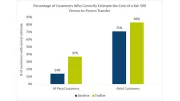

Kenya’s Rules on Mobile Money Price Transparency Are Paying Off

Kenya's pricing transparency rules have made customers more aware of the costs of using certain digital financial services, according to a new CGAP survey.Blog

Data Privacy and Protection – Providers Share Their Perspectives

Just like customers themselves, providers deeply value the protection and security of the customer data they hold. They just have different reasons.Blog

KYC Utilities and Beyond: Solutions for an AML/CFT Paradox?

From KYC utilities to blockchain apps and new ways to collaborate on customer due diligence, recent developments are chipping away at a major barrier to financial inclusion: the high cost of meeting anti-money laundering and terrorism financing requirements.Blog

RegTech and Digital Finance Supervision: A Leap into the Future

Are digital finance supervisors in emerging markets ready to adapt the latest regulatory compliance technologies?Blog

Why Digital Finance Supervisors Should Automate Data Collection

Today’s technology has made it possible for supervisors to collect massive amounts of granular data from financial services providers – but should they? Yes, but only if they automate data collection.Blog

A Six-Ingredient Recipe for Data Protection

While data breaches in high-income countries dominate the news, data protection is also emerging as a major issue in lower-income countries. Here are six key questions to ask when evaluating a country’s legal protections for its citizens’ personal data.Blog

Better Regulations Can Spur Agent Banking in WAEMU

Regulations in the West African Economic and Monetary Union have enabled mobile money providers to double their agent networks since 2014, while restricting banks and microfinance institutions. Better regulations would create a level playing field and expand financial inclusion.Blog

What Should We Realistically Expect from Regulatory Sandboxes?

Just how far could regulatory sandboxes go toward spurring financial innovations in low-income countries?Blog

How Developing Countries Can Prevent Their Own Equifax Breach

The Equifax data breach that exposed 145 million people's personal information holds two big lessons for developing countries: avoid centralized databases and let consumers control their own data.Blog

Digital Credit: Data Sharing Can Improve Product Diversity

In a CGAP and M-Kopa pilot in Kenya, customers with greater control over their credit histories took up more credit and were more likely to pay it off in full.Blog

Regulatory Sandboxes: Potential for Financial Inclusion?

Regulatory sandboxes are now being used to spur FinTech innovations in 18 countries. What impact could these new regulatory tools have on financial inclusion going forward?Blog

A Practitioner and a Regulator Talk Digital Credit

Do the benefits of digital credit outweigh the risks for consumers? A practitioner and regulator share their viewpoints.Blog

Innovation in Mobile Money: What Are the Risks?

As mobile money continues to evolve, new kinds of fraud are emerging. Here are some steps that providers and regulators can take to keep up.Blog