Diversity Is In

Homogeneity is out; diversity is in. Moving clients to the center of the microfinance discourse is producing new data on who they are and how they use (or could use) financial services.

Financial inclusion means much more than simply having or not having a bank account: it goes beyond the mere availability of services to their adoption and usage. The recently published Measuring Financial Inclusion report rightly distinguishes between access and use. It also notes that the majority of clients with formal accounts make one to two withdrawals or deposits a month, while 10 percent of formal accounts are inactive. In a study covering four providers, CGAP observed that a staggering 70 percent of cell phone banking accounts are currently inactive. While this is an old issue in microcredit, it seems to have re-emerged with new buzz. The old keyword was ‘drop outs’. The implicit argument was that lower-than-expected retention rates reflected client failure to see the value of the product, rather than a provider’s failure to appreciate their market.

Today, such arguments are recognized as overly simplistic, and consumer behavior is understood to be far more complex. Now that they are forced to differentiate among access to, adoption of or usage of formal financial services, practitioners must grapple with the way that consumers actually use financial services and why. For example, we often overlook one of the perceived benefits of signing up for cell phone banking and smart cards. For low-income consumers in the developing world, the motivation to use these technological services is their desire to be part of the 21st century.

Many microfinance providers assume that consumers, once enrolled, will use their financial products constantly. Yet, just like providers, clients take their time in testing out the added value of new microfinance products – not just loans, savings, and insurance, but also smart cards and cell phone banking – as they come on the market. The report recognizes this and also notes that frequency of use is not synonymous with continuous use. Without exception, the data show that incomes in the lower quintiles are often too small and too variable to permit continuous use of all types of financial services. For the consumer, these choices are trade-offs; by contrast, providers tend to view products in silos.

The report also notes that, while 30 percent of adults have borrowed in the last 12 months, informal sources of finance are dominant among the poor. Even in countries such as Bangladesh, Bolivia, Sri Lanka, and Thailand, the numbers of consumers using formal loans range only from 23 percent to 15 percent. Drawing on evidence from a number of financial diaries studies, the report also recognizes that the financial portfolios of most poor people contain a blend of formal and informal services. The emerging evidence from Kenya and Malawi suggests that the choice of what source of finance to use at any given moment is a function of why it is needed, what is available, and the sequence of transactions that precedes it.

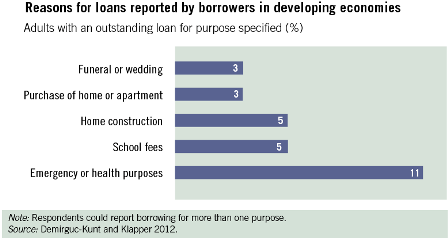

Putting clients at the center calls for deeper insights into low-income consumers, including a better understanding of their financial priorities and preferences and the drivers of their financial behavior. Research shows that for low-income populations, ‘life is one long risk’ and managing shocks is a complicated process. Similarly, the report finds that the most frequent use of credit and savings is for emergencies (see figure below).

Absent from the higher level of data presented in this report is information on how clients prioritize and in what order they use financial services. For poor people, building financial assets is hard. Savings are usually earmarked for meeting financial goals and are reluctantly redirected to other uses, including health emergencies, the death of a loved one, crop loss or theft, and fire. Faced with a shock, the first stop tends to be borrowing from family, friends and associates; credit from formal financial service providers is used least. But it is worth noting that accessing formal credit is rarely timely, especially when the situation is urgent.

Changing patterns of financial behavior is not easy. Most risk-mitigation strategies have been well honed over time. Behavioral shifts will require a strategy that affects changes in consumer knowledge, skills and attitudes, at the same time as triggering new product offerings and/or delivery methods by financial service providers. This is no small challenge, since financial service providers and their clients often perceive the same situation very differently.

Our goal must be to diminish the perception gap between the users and the providers, moving each toward a point where their gains are optimized. We need a more level playing field, one where clients have the resources and confidence to negotiate in their self-interest. Financial education, with its emphasis on building new knowledge, skills and attitudes, can change behavior and increase consumer capability to assess the financial products available to them. And providers of financial services all along the value chain should make it a priority to gain a much richer understanding of the dynamic behaviors within their market segments if they are to maximize the adoption and usage of their service offerings.

Comments

Dear Monique Cohen

Dear Monique Cohen

Thanks for a Great refreshing post with the focus on ‘client at centre’ as topical ‘choice’ in MF discourses reflecting more prudently from demand side perspectives in the midst of unabated ‘voices’ and ‘noises’ on ‘outreach’, ‘access’ and ‘inclusion’ and its speed of coverage after the advent of mobile magic from supply point of view partially for the social mission undertaken

Many of the postings in the blog, covered the various types of ‘means’ of delivery of the products and contentment with successful deed in delivering the product – micro credit to the poor as it has facilitated business growth for the provider. But no body knows and even wants to know what happened after the delivery on utilization and the achievement of purpose for which it is delivered at poor client’s households? I have also raised this issue earlier in this blog. Perhaps conventional wisdom demands conveniently is to have some positive assumption on utilization or the reach of ultimate purpose of MF by default or automatic. This is irrational in asset management, ironical in MF realm and unethical in social mission with which the concept MF emerged..

Two disturbing events happening after delivery of product, which have not been made transparent or not covered even in academic or research discourses and even in MIS (MIX) in this industry are ‘drop outs’ and ‘being inactive’ or defunct or inoperative pointing out unceremonious exclusion and wastages. These facts including ‘group mortality’ or ‘defunct’ also of this recurring epidemic phenomenon more particularly in SHG –MF system ( a major conduit for MF in India and Bangladesh having lions’ share of world poor) merit more attention than the glittering statistics on financial inclusion be it brick and mortar mode and branchless mobile mode, for remedial action Besides development wastages, supportive evidences reveal that this phenomenon also incurs cost to the promoters(SHPIs) For instance, cost of formation of a SHG $175, for NGO and $ 72 for the bank, apart from maintenance cost, (NCAER study) and promoters’ cost of SHG promotion as $259.( CGAP occasional paper 2007 ).Apart from this economic wastages and developmental efforts, this kind of exclusion results in widening the inequality gap between included intentionally and excluded incidentally or accidentally.This causes concern equally in the process of poverty reduction through MF .In this regard, how to make immunization for this disease from pathology to epidemiology?

Regarding the use of product , again it depends of poverty level of the client. Poverty is multifaceted with diverse nature of vulnerability and persistent deprivation due to unpredictable social contingencies contextually. These facts which affect household budget some time with ratchet effects, do influence the frequency and continuity or even attrition

In this regard to the argument stating client’s poor perception on the values of the products as causative factor for the above epidemic, I strongly assert following

When the products are designed and delivered with or without technology , it is important that products are made tailoring to the varying needs of the poor with ‘diversity in’ according the capability of the poor in the pyramid and given area potential. Therefore it is the responsibility of the provider for appropriate product designing and make adequate financial literacy on the values of product and technology device handling since the poor as market niche is unique and for whose concern only the MF concept emerged.

In fine Client Protection Principles holds the key more particularly after delivery or inclusion. For making ‘ diversity in’ in MF sector benignly , a comprehensive pathway with ethically coded ‘ten commandments for the use of MF arsenals in the divine battle against poverty’ is being discussed in CGAP linked in group , microfinance professional groups may be useful

Thanks for sharing my views

Dr Rengarajan

Dear Dr. Cohen,

Dear Dr. Cohen,

The more you talk about the link between financial edcuation and developing appropriate financial services for the poor, the more it becomes clear that there is a gap that has yet to be tackled. Going by what you have said, if I were to advise a microfinance institution on how to develop a product or products for the poor, I would say ‘send an intelligent employee researcher as under cover to study the financial behaviour of a poor neighborhood population for a couple of months. Then he would go back to the office and advise his organisations’s product developers on suitable products for the poor and how to create products that would beat the informal ones available and in frequent use for them.(but one may not need to do that because research through Financial diaries has been done with excellent revelations for any organisation wanting to create financial products for the poor) I say that because it is becoming evident that there is a misinterpretation among financial services providers on what services the poor really want. The existing products are based on what they think the poor want.Then they wonder why their products uptake is not as fast as anticipated in the boardroom meetings.

The elite might not understand the poor at the speed they want to understand them. The managers of microfinance institutions for example calling a few poor people in their groups and asking them a few questions is not knowing the poor. Rutherfold Stuart acknowledged that one almost has to live with the poor to know them. A single encounter means nothing and the data derived from a first encounter is not a worthy result. Being poor doesn’t mean being daft. You will not encounter the poor one or two times and expect them to reveal to you their financial lives, just like that. I respect the financial diaries research because that was the best tool to understand the financial behaviour of the poor. The patience with which it was carried out demonstrates the seriousness that understanding the poor needs. And as Dr. Cohen is saying, if one really wants to reach the biggest band of consumers in the BOP, then you better be ready to take time to study and develop suitable suitable products.

It is now clear that the poor are sophisticated and have their own ways of financial survival. So, going to them means designing solutions that suit their needs and come at their own terms. If a bank will ask a poor customer who comes for an emergency loan to meet a hospital bill to start saving for six months, you can imagine what such a person will tell others back in the neigbourhood. The local shylock may be expensive but will disburse emergency loan same day needed. He may not bother what financial inclusion or exclusion means.

Add new comment