Does Market Saturation Increase the Risk of Over-indebtedness?

When and why do microcredit borrowers get into too much debt? One driver of widespread over-indebtedness commonly cited is “too much available credit.” This may occur when too many micro-lenders crowd in and target the same types of borrowers. Over-indebtedness is thus commonly linked to overly penetrated markets. However, pinning down the truth of these hypotheses and whether market saturation truly drives over-indebtedness, is not as simple as these “too much credit” arguments would suggest.

To dig deeper, our team at the Center for Microfinance (University of Zurich) developed comparable indicators of microfinance market penetration for more than 80 countries from 2004 to 2010. We define market penetration as the ratio between current and potential low-income customers in a given geographical market, typically a country. We use the population below the national poverty line at working age (15 – 64 years) to define potential customers. We find that “market penetration” is in fact a good way to analyze supply and demand in microcredit markets. We also conclude that more can and should be done to identify highly penetrated markets before they reach a tipping point and experience widespread default.

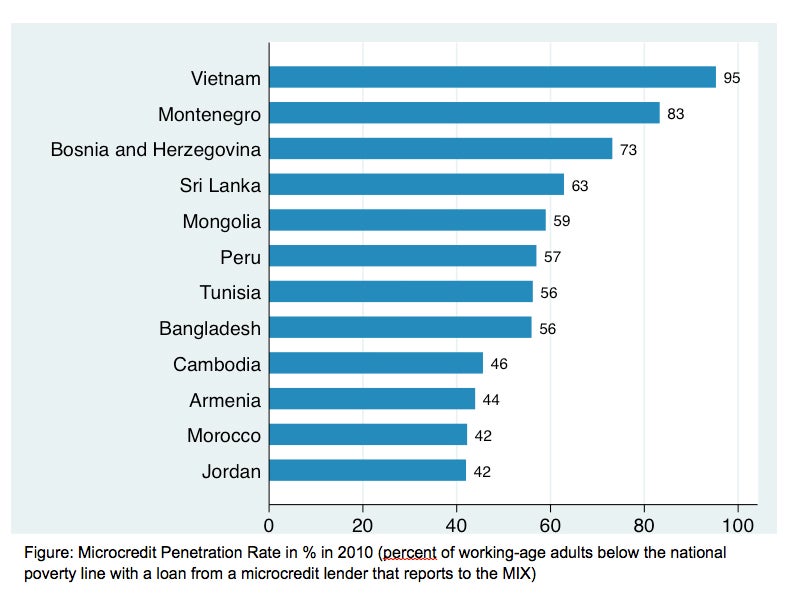

The cross-country variation in market penetration for microloans is enormous. In our 88-country survey it ranged from 0.2% (Central African Republic) to 95% (Vietnam) in 2010. Twelve countries had a credit market penetration of more than 40% in 2010 (see the figure). In other words, in those countries at least 40% of the poor working-age population had a microcredit from a lender reporting to the MixMarket.

What does this mean? Which microcredit markets have penetration rates that are too high or too low, and how should we go further in comparing markets to one another? Our analysis sheds light on these questions and raises important questions for the industry.

First, market penetration is related to the extent of multiple borrowing.

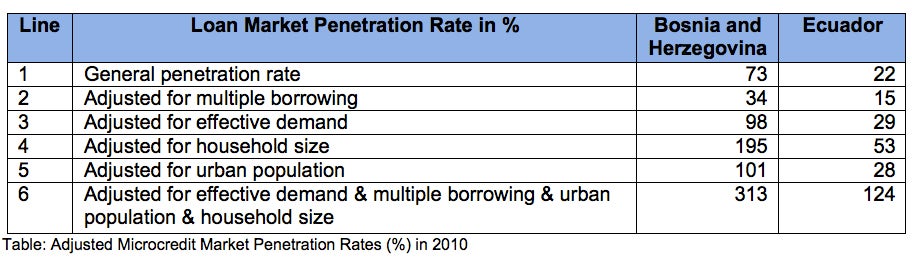

Take the example of a well-documented crisis country: Bosnia and Herzegovina (BiH) in 2008/2009. MIX data suggests that around 73% of the poor working-age population had a microcredit loan from reporting BiH MFIs in 2010 (line 1 in the table). Is that really the case? No, due to the problem of double counting.

In BiH at the time, many customers were known to have multiple micro-loans from multiple MIX-reporting MFIs, as well as from banks not reporting to the MixMarket. When we adjust for this, microcredit market penetration stands at only 34% (line 2 in the table). Adjusting for this in a country with medium-level market penetration, Ecuador, leads to similarly drastic changes in market penetration.

Widespread multiple borrowing suggests that MFIs likely use similar risk assessment methods to target and appraise potential borrowers, and offer products fitting mostly those standard customer profiles. In these markets, product differentiation may be too limited to allow MFIs to carve out distinctive market segments, and it is likely that other potential customer segments may not be served.

Market penetration rates are sensitive to the definitions and numbers used to determine current and potential borrowers. Adjusting for multiple borrowing, for example, can drastically change market penetration estimates. For this reason, it is very important to measure multiple borrowing on an ongoing basis. If MFIs do not report verifiable information on the extent of their customers’ multiple borrowing or credit registry information is not available and comparable, we would need standardized demand-side surveys to better understand actual market penetration.

Second, we need to take into account that not all people actually want a loan. Adjusting the penetration rate accordingly (based on demand survey data), we find that in BiH, about 98% of those who actually want a loan were already served.

Third, calculating penetration for households instead of individuals drives up penetration rates, in the Bosnia example to nearly 200%. To help ensure borrowers’ repayment capacity, lenders should verify credit data of all household members who pool their income and expenses.

A fourth implication is that we need to better understand differences within a country, where a “hot spot” with many suppliers and high penetration might be next to an underserved area. The most feasible way to approach this is to differentiate between urban and rural customers. Increasingly (but not frequently enough), MFIs report urban/rural borrower and portfolio data to the MIX. Rural market penetration is lower than urban market penetration in most countries. For instance, in BiH, the general microcredit market penetration increases from 73% to 101% for urban markets alone. Strong differences exist in Bolivia as well (17% rural versus 33% urban penetration), or Uganda (6% rural loan penetration versus 80% urban loan market penetration).

In countries with relatively higher urban rates, promoting rural lending could achieve increased market penetration without risking urban over-indebtedness. In contrast, the rural penetration rate is higher than the urban for instance in Bangladesh, Cambodia, Chile Costa Rica, Jordan, Malaysia, Mongolia, and Montenegro. This could be due to high population densities in rural areas or a strong focus on rural microfinance. In these countries, even more differentiated geographical measurements are needed to identify potential local “hot spot” markets at risk of debt stress.

To get the most realistic assessment of microcredit market penetration, we need to take all four effects into account. For example, line 6 in the table show that even in the case of Ecuador, a country with only medium general penetration, urban markets adjusted for all factors are being overly penetrated at 124%.

Once the penetration rate in a microcredit market is “very high” as in the countries listed in the figure, MFIs need to reduce their growth expectations. Even if further growth is possible to push the boundaries of the market, it may only be achievable on a sustainable basis with higher R&D costs for new products, technologies, or delivery channels for new types of borrowers.

Finally, we have been looking only at credit. There are many countries where credit market penetration is high but that of small-scale deposits is low. In these countries, regulatory barriers to deposit-taking by MFIs might be one key factor driving higher and even unhealthy penetration in the microcredit market.

At this point, we have more hypotheses than answers. More and better data would help us test them. For instance, Vietnam’s high microcredit market penetration rate is largely due to data reported to the MIX data by a large government-owned credit program there; many comparable programs in other countries do not report. Another very important and increasingly relevant caveat is that MIX data does not capture micro-lending activity by many commercial banks or consumer lenders, which are making significant inroads into the lower-income markets in more and more countries.

Our ongoing research focuses both on improving data and probing the underlying drivers of market penetration. We also hope to gain insights on whether market “take-off” occurs once certain threshold penetration rates are surpassed and whether we can define a saturation level beyond which markets penetration cannot go up further without risking over-indebtedness or other adverse effects.

Annette Krauss is the Managing Director of the Center for Microfinance.

Laura Lontzek is the Assistant Managing Director of the Center for Microfinance.

Julia Meyer is completing her PhD in Microfinance at the Swiss Banking Institute of the University of Zurich.

Comments

Dear Annette, Laura, & Julia

Dear Annette, Laura, & Julia

The MARKET saturation analysis on risk in over indebtedness from supply side is inadequate for any meaningful forward action. More insights on demand side where DNA for over indebtedness lies, need to be perceived. To wit, apart from market penetration from institutional perspectives, three important drivers of over indebtedness in the demand side are a)credit absorbing capacity(physical resources) of the given area b) capability of the poor clients at household level and c) human behavior influenced by internal and external factors. The factors a and b decide the extent of overcrowding in a given area and degree of over heating the given household economy. The third human factor towards repayment is more influenced by his own value system ( will full default) and externally government incentives such as debt relief or waiver (political) or other peer pressure not to repay leading to over indebtedness consequences.

The persistent over indebtedness syndrome is due to over confidence on meek financial capability of sequestered micro credit and ‘one size fit for all’ product stagy for the given task in poverty sector. The ignorance of fact by the market actors is that micro credit alone is a silver bullet for poverty cure which is not true. Unless prudential micro financial planning is done taking cognizance of demand side realities as referred to above, productive functioning of micro credit will be hardly present and eventually the over indebtedness problem would continue.

Reg data on micro credit for cross country analysis , it is very weak lacking uniformity in the status of micro credit and borrower client. In western rich countries poverty is more defined in terms of low income while in poverty rich Asian and African countries in terms of vulnerability and deprivation. It is therefore micro credit alone for latter countries is inadequate without supporting services for the given task. Otherwise it leads to over indebtedness unlike in western regions.

We have enough literature and lessons on micro credit and over indebtedness. Enough is enough

For challenging this micro credit linked Over Indebtedness problem , kind attention of centre for microfinance is drawn to following book which delves in detail on demand side analysis and suggests result based prudential micro finance planning framework as covenant for the supply side

Book: Micro finance Principles and approaches- Ten commandments for responsible financing to the poor” by Dr V.Rengarajan Access platform

Amazon: http://www.amazon.com/MICROFINANCE--Principles-Approaches-Commandments-…

Notion Press Store: http://notionpress.com/store/index.php?route=product/product&filter_nam…

Dr Rengarajan

Add new comment