Filling the Smallholder Household Data Gap: A New Learning Agenda

When Dalberg and the Initiative for Smallholder Finance set out earlier this year to understand the landscape of impact and risk standards in smallholder finance, what we found was complex. It was a labyrinth of standardized metrics, siloed data sets, and nascent new technologies. As a result, we saw that practitioners and donors seeking to create new appropriate financial products for smallholder farmers had little to no data, particularly on the demand side, on which to base their efforts.

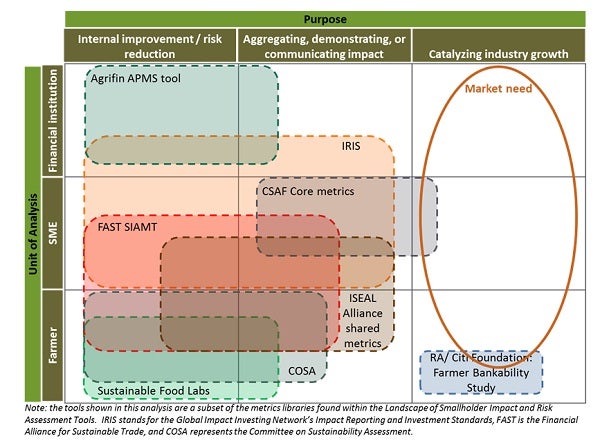

In an effort to help the industry take stock of what we do know, we created a smallholder impact literature wiki and built an interactive map of smallholder finance impact and risk assessment tools. Further, in our industry briefing, Smallholder Impact and Risk Metrics: A Labyrinth of Opportunity, we pointed out that while a large amount of data exists, very few metrics initiatives have focused on catalyzing industry growth. Rather, the lion’s share of efforts has sought to help organizations demonstrate their impact or reduce their risk. There is very little shared knowledge about the smallholder clients that many financial service providers want to reach.

Filling this information gap will require new efforts and a shared learning agenda. In recognition of this need, Dalberg recently joined colleagues at Root Capital and the Aspen Network of Development Entrepreneurs to establish a new framework for this next phase of metrics and data collection. We call it “Metrics 3.0.”

Articulating this new vision for shared metrics in Stanford Social Innovation Review, we reflected that while metrics platforms and data collection efforts were once focused on accountability and standardization, future success lies in collecting actionable information that drives shared value creation. We presented four opportunities in which metrics and data collection can drive value at the organizational and ecosystem levels. The fourth opportunity—building a learning agenda—seeks to encourage industry collaboration to establish an actionable evidence base around what works. In most impact sectors, funding for market research, pilot projects, and innovation is scarce. Too often, though, isolated actors with similar goals are trying the same approaches, collecting the same information, and pushing the field a single step forward. Coordinated learning agendas and shared knowledge bases will allow practitioners to repurpose what others have already learned and utilize scarce resources to fill information gaps and drive the entire field forward.

Armed with a Metrics 3.0 state of mind, the Initiative for Smallholder Finance and Dalberg recently released a briefing titled Lending a Hand: How Direct-to-Farmer Finance Providers Reach Smallholders that examines the supply side by looking at over 150 finance providers offering finance directly to smallholder farmers. The briefing introduces four distinct business model archetypes that have been successful to date in reaching smallholder farmers and highlights the common practices and challenges financial providers face as they try to reach smallholder farmers with appropriate financial products. The briefing also identifies key next steps in understanding the business model archetypes, opportunities to share knowledge and blend approaches, and areas ripe for innovation.

The Direct-to-Farmer Finance Innovation Space Playbook that accompanies this briefing was informed by new primary research into the demand side of smallholder lending. The playbook introduces five opportunities for direct-to-farmer finance innovation: 1) In-field efficiency, 2) Agronomic learning, 3) Credit assessment, 4) Portfolio diversification, and 5) Individual motivation. The playbook then explores specific innovations underway in each area and uses new primary data to suggest concrete examples of new products, services, and strategies that financial service providers might employ to better meet the needs of smallholders.

CGAP’s efforts to conduct financial diaries of smallholders and to survey smallholder households will fill key gaps in market knowledge, and it’s exciting to see CGAP join Dalberg, the Initiative for Smallholder Finance, Financial Sector Deepening, and others in taking an active role in this learning agenda. As we collaboratively build this knowledge base, we hope to arm financial institutions with the research necessary to develop better products and processes to meet the financial needs of the world’s 450 million smallholder farmers and their families.

Add new comment