In Ghana, DFS Helps Spur 41% Increase in Financial Inclusion

CGAP has worked in the digital financial services sector in Ghana for the last several years. For much of that time, we have written about the challenging regulatory environment and the surprising lack of momentum in a market that, on paper, appears well placed for mobile money. Despite a relatively well-educated, well-off and financially advanced population that has one of the highest mobile penetration rates in Africa, and near universal awareness of mobile money, the industry languished.

But in the last year or so, this narrative has changed for the better. The Bank of Ghana issued new regulations in July that were widely hailed by industry as well as independent observers as a best practice framework. And uptake of mobile wallets has been steadily climbing: By the time the new regulations launched, there were a total of 4 million mobile money accounts in the country, 2.5 times as many since 2014. Mobile financial services in Ghana are finally breaking through. Today, we can present the verdict on what that has meant for financial inclusion in a country where the most recent FinScope data—from 2010—saw almost half of the population excluded from access to any form of financial services.

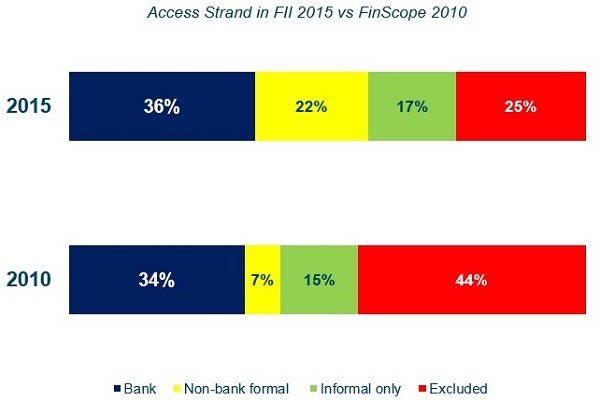

According to the 2015 Financial Inclusion Insights (FII) survey which CGAP funded and InterMedia executed, access to formal financial services has increased by 41% since 2010. As a result, financial exclusion has been nearly halved, falling by 43% in five years—a significant achievement for the country.

Mobile money is driving financial inclusion

The main driver of this change is a substantial increase in access to nonbank formal financial services, which tripled in the last five years. Within this category, half of the expansion is directly attributable to mobile money—which was virtually nonexistent in 2009 but is now actively used by 25% of Ghanaians. In fact, access to mobile money is now nearly at par with access to banking: 29% and 36% of adults, respectively, use mobile financial services. Also, bank account holders are nearly twice as likely to have an inactive bank account—one that hasn’t been used in the last three months- than mobile wallet holders (26% vs. 14% of the respective groups).

Other means of financial access contributed little to the growth in formal inclusion. Access to bank accounts ticked up a mere 2 percentage points, from 34% to 36%, while other nonbank formal services tripled: from 7% to 22% of adults. The share of the population relying on informal services for financial access also expanded by only two points, from 15% to 17%.

Still room for improvement

While this broadening of access is an achievement worth celebrating, we must also note that it still leaves a full quarter of Ghanaians excluded from any form of financial services. Moreover, the type of services accessed through the mobile accounts are still limited: Only 7% of active mobile money account holders say they save via mobile money and a mere 0.5% have taken a mobile loan. Receipt of wages and government payments are both around 2% and even bill payment—typically one of the big early use cases—is only done via mobile money by 5% of active mobile money account holders. The Ghanaian mobile money market is still almost entirely about cash-in/cash-out transactions, remittances and airtime top-ups. This may change over the next couple of years, due to some significant changes in the way mobile products work. For instance, mobile money providers are preparing to launch credit products. In addition, the new regulations passed this summer require providers to enable customers to collect interest on funds stored in their mobile money accounts.

Ghana also has a high share of unregistered users: More than one-third of active mobile money users are transacting in cash over-the-counter (OTC) or using other people’s accounts—a substantially higher share than in the leading markets in East Africa. While this doesn’t have to be a problem - the new regulatory framework has put in place ID checks for OTC customers, and mobile money operators make sizeable margins on their OTC business - it does limit the opportunities for delivering a broader range of account-based services to those users.

Moving ahead

Despite these reservations, the findings that emerge from our new data should be cause for optimism in Ghana and beyond. It has taken longer than most people expected, but mobile money in Ghana is finally taking off—and is rewriting the country’s financial access landscape in the process.

Currently, neither government nor corporate sectors make much use of mobile money. But with a fifth of the population now registered with mobile accounts, deploying solutions that leverage them to strengthen customer value, reduce cost and increase transparency is becoming an increasingly attractive proposition.

The future of mobile money in Ghana also depends on whether and when the country’s banks make their peace with mobile money and recognize it as complementary, not contrary, to their own core business. While banks are right to reflect on what the rise of alternative providers means for them, they need not see it as an existential threat. At the end of the day, almost every aspect of mobile money in some way also benefits the banking sector. The wallet balances of previously unbanked customers are swept up by mobile money, but held in bank accounts; and while the interest banks must pay on these funds will be higher—since mobile money operators will shop around for the best terms—their cost of deposit mobilization is also near zero. Nonbank e-money issuers are also not allowed to offer credit or insurance products themselves, but must partner with a bank or insurer to underwrite these products. This brings within reach of the traditional financial institutions vast new customer groups which they have thus far had very little contact with. All of this presents new opportunities for the bold and agile—and the first movers.

Comments

While mobile financial

While mobile financial services in Ghana is helping in financial access, it is still leaving out a lot of Ghanaians from any form of financial services. The type of services that the mobile money providers have been giving are powerful enough. However, financial access requires something beyond financial services provided by mobile money providers. It requires the involvement of all the stakeholders (e.g. banks, non-babnks, government, corporate sectors, and non-governmental sectors). The non-governmental sector of Ghana can play a big role in making mobile financial services an effective tool in financial access. Frontline staff of different NGO's can come forward in helping people understand the benefits of mobile money. Better understanding of mobile financial services can actually help more Ghanaians to get financial access. To know how frontline staff can get involved in encouraging more people in mobile financial servies, read: http://cfi-blog.org/2015/09/11/five-ways-to-get-frontline-staff-excited…

Add new comment