Mobile Money in Bangladesh Plateaus after Fast Start

Mobile money in Bangladesh had a fast start, with a particularly rapid growth of over-the-counter (OTC) use. Recent data from a Financial Inclusion Insights (FII) survey and Bangladesh Bank, however, show that while use is still increasing, the rate of growth in transaction value and volume is tapering off.

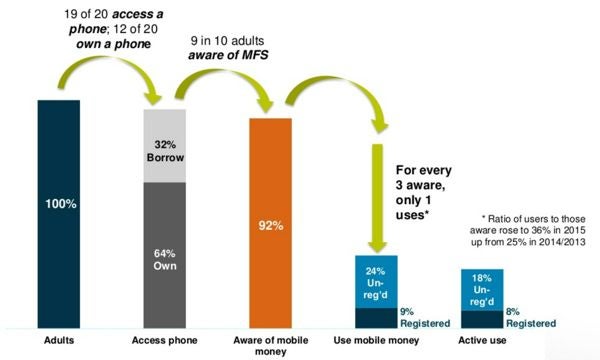

In addition, Bangladesh shows a big drop off between awareness and use – 92% of adults are aware of mobile money, but only 33% use mobile money, and only 9% of adults have a registered account.

Why aren’t more of those who are aware of mobile money using the services? And, why is OTC use still dominating the market? To understand what’s going on, we looked at a number of possible explanations in the FII data and were able to rule out a number of possibilities:

Demographic Differences. For the group that is aware of mobile money but does not use the services (about 60% of adults), there are demographic differences, but the differences are smaller than might be expected. For example, among rural residents, 63% are aware of but don’t use mobile money, while 57% of urban residents are in this category. There is no significant difference between those with no formal education and those with secondary education. Gender is the only demographic with a substantial difference, with 69% of women, versus 53% of men aware of but not using mobile money.

Agent Access. Bangladesh Bank reported 542,400 agents in September 2015 (though CGAP estimates the number of unique agent locations to be closer to 200,000). FII data show that nearly half of adults are 15 minutes or less from an agent, and nearly a third are between 15 and 60 minutes from an agent. With Bangladesh’s dense population, there aren’t many people who lack easy access to an agent.

Lack of Trust. When nonusers were asked why they do not use mobile money, no one selected a lack of trust in the services as their main reason. Similarly, when OTC users were asked why they have not registered, a lack of trust in the safety of their money was not a top reason.

So what was the top reason nonusers gave for not using mobile money? Eighty-one percent simply said, “I do not need it.” Similarly, 40% of OTC users said they have not registered either because they do not need an account or because “I have all the services I need through an agent.”

It is possible that the current dominant use case – sending OTC transfers – is simply reaching a saturation point in that the number of people who need this single service may be nearing its limit. Families or people who need to regularly use OTC – to send money over distance – may be limited to families that have earning members living away from the household. Or they may limit the number of transactions they do in any given month or year. As with any payments, a single use case is likely to have constraints in the number of people and frequency of use.

One in five OTC users said they have not registered because using an account is difficult, illustrating another way in which accounts are not meeting needs, by being too difficult to use. CGAP’s report on risks customers experience when using digital financial services showed that wallet transactions in Bangladesh often require five or more steps, the menus can be unintuitive to work through and transactions are time-limited, so transactions often time out. This leaves customers frustrated and sometimes unsure if their transaction was completed. Difficult menus also lead to mistakes, which can be hard to correct and can result in lost funds. All of this discourages wallet use.

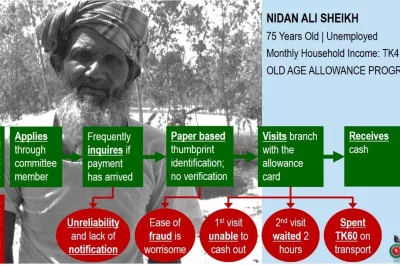

Within this broad picture, there are, of course, nuances. Mobile phone ownership, for example, is a critical barrier to registered accounts. Nearly everyone with a registered account own a personal mobile phone, indicating that it would be very difficult for someone without a personal mobile phone (such as someone who uses a shared phone within a household) to have a registered account. This is important when considering steps such as digitizing government-to-person (G2P) payments – 71% of G2P recipients do not own a mobile phone, indicating a significant barrier to them to beginning to receive payments into a mobile wallet.

Mobile phone ownership plays an important role in the gender gap as well. Phone ownership triples the likelihood that a woman is a mobile money user. The gender gap between men and women who own phones is smaller than the gender gap between men and women who do not own phones, indicating phone ownership has a slight equalizing effect. The gap is still present, though – cultural barriers continue to play an important role in holding back women’s use as well.

Bangladesh seems to be reaching a kind of plateau; it may not grow much further without more use cases. Survey analysis can help identify issues and gaps, but product and operational innovation will likely be needed to unlock additional use cases. If services are not meeting a need in a compelling way, customers have little reason to engage.

Add new comment