The Case for Off-Grid Solar Companies as Mobile Money Agents

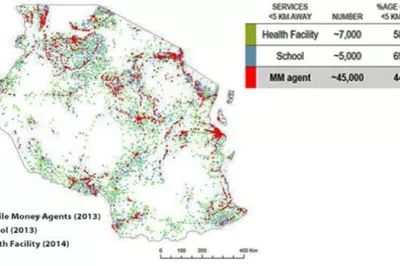

Off-grid, or pay-as-you-go (PAYGo), solar companies are becoming popular across Africa. Yet their business models hinge on collecting digital payments over long periods of time, and the lack of digital infrastructure — mainly mobile money agents — in many places is limiting their growth. As we discussed in an earlier blog post, “Building Payment Rails in Frontier Areas Through Off-Grid Solar,” many companies have taken it upon themselves to educate customers about digital payments, connect them to agents and assist with payments. According PAYGo companies that have spoken with us, these workarounds can be costly and ineffective. So we began to wonder: What if PAYGo companies actually became master agents (also known as “agent network managers”)? Could this be a less costly approach to enabling customers to make digital payments?

To test this idea, we partnered with Zola Electric (formally known as Off Grid Electric), a leading PAYGo provider in Tanzania. Together, we built a financial model (see a generalized version) to help us to better understand the implications of becoming a master agent. The model helped us to quantify the amount of revenue Zola Electric was losing because of payment frictions and to estimate the costs of its payment collection workarounds. We then used the model to compare these costs to that of those that run a master agent service.

How does this model work? Let’s look at what it could tell us about a hypothetical PAYGo company in East Africa with 50,000 customers. This company’s customers pay $30 up front for a home solar system and make 12 monthly payments of $15. Unfortunately, around 30 percent of its customers experience frictions when making payments. This means there are delays in top-ups and days when customers are remotely locked out of their solar systems. On average, such delays extend these customers’ lease terms from 12 to 15 months. To minimize frictions and delays, the company incentivizes agents to facilitate PAYGo payments by compensating them 5 percent of the collected revenue.

Based on these assumptions, which are in line with anecdotal evidence from PAYGo companies in East Africa, our model demonstrates the following:

- Switching from current payment workarounds to a master agent model would increase revenue 18 percent over a three-year period. Continuing to rely on workarounds leads to a $19.6 million loss over three years, because of days when solar electricity is not used, expensive workarounds for payment collections and loss of customers as a result of payment frictions. The master agent model boosts revenue by a little over $8.1 million over the same period by decreasing nonuse days and customer churn. Importantly, the benefits start accruing almost immediately. The model eliminates the costs of payment workarounds and becomes cost-neutral in less than a year.

- The master agent model is 33 percent cheaper than current workarounds. Paying agents (both roving and stationary) 5 percent of the revenue collected adds up to more than $500,000 over three years. Assuming agent compensation structures for cash-in/cash-out that are in line with the East African market, the master agent approach proves considerably cheaper. Importantly, based on the transaction volumes we’ve assumed, our hypothetical PAYGo company starts to see a small, ancillary revenue stream from the master agent business in the first year.

- Agents should be business owners. Our PAYGo company in this example uses standalone agents whose sole source of revenue is mobile money transactions. Since these agents are in rural areas with low populations and poor infrastructure, they average 10 transactions per day with small transaction values — mostly for needs like airtime and cash-in/cash-out. Assuming the master agent takes responsibility for liquidity rebalancing and shares the float investment, it would take a rural agent at least three months just to break even on his or her investment in the agent business. (An urban agent, who may see 35 or more transactions per day, could break even in as little as one month.) This suggests that PAYGo companies in frontier areas should enlist agents who are interested in supplementing revenue from an existing business, such as small fast-moving consumer goods retailers, rather than standalone mobile money agents.

When Zola Electric applied this model to its business, it concluded that losses because of payment frictions justified experimenting with an agent solution. The company initially considered building its own mobile money agent network, but ultimately it decided to partner with payments aggregator Selcom. This approach reduced Zola Electric’s go-to-market time and helped it to evaluate the true costs of building out a noncore business in the Tanzanian market. Moreover, Selcom is already integrated into most mobile network operators in Tanzania. Zola Electric and Selcom launched a pilot that enabled agents to conduct cash-in transactions only — airtime purchases, deposits into wallets and bill payments, including PAYGo. They recruited nine agents to increase collections in 10 areas designated by Zola Electric, while 10 other areas with similar characteristics and payment challenges received no agents.

Zola Electric saw that areas with agents had a 4 to 7 percent higher payment rate than the control areas with no agents. These results were convincing enough that Zola Electric decided to ramp up its agent approach. It is now exploring the possibility of setting up a mobile money agent business alone or through more strategic partnerships like the one with Selcom.

Is it worthwhile for other PAYGo companies to become master agents? The answer, of course, depends on the company and context. Some might see it as a distracting parallel business to operate. Others may consider it a diversified offering that supports customer and agent retention. In any case, we hope this model will help companies explore the possibility.

Add new comment