|

In driving uptake of electronic payments, arguably no method is as tried and tested as loyalty reward programs. For example, Starbucks executives credit the coffee shop chain’s loyalty program with increasing revenue by $2.65 billion. Used extensively and to good effect in the bank card space, such schemes are a proven way to attract new users, drive referrals, and retain existing users.

In addition, these programs collect valuable data about consumer preferences to inform further programs, campaigns, and products.

In the context of digital merchant payments, loyalty programs can be deployed at three different levels, each with its own merits and dynamics:

- Provider to customer. This is the most obvious type of loyalty scheme. End customers are rewarded for using their digital wallet for merchant transactions—typically with points or cash back as a percentage of their purchases.

- Provider to merchant. Providers can and should also reward their merchants for driving volumes over the digital payments product, for example by offering a wider range of value-added services and better terms such as reduced fees on cash-out.

- Merchant to customer. In enabling merchants to create loyalty reward schemes for their own customers, providers can create a powerful win-win situation: addressing a real need on the part of merchants while incentivizing end customers to use digital payments.

The economics of loyalty programs are simple. It is 5 to 25 times cheaper to retain a customer than to acquire a new one, depending on the industry (HBR 2014). Increasing customer retention rates by 5 percent can result in a corresponding increase in profits anywhere from 25 percent to 95 percent. Furthermore, well-structured loyalty programs can help drive sales by tailoring offerings and promotions. British retailer Tesco found that club card holders spent 28 percent more at Tesco and 16 percent less at Sainbury’s, a competitor, after Tesco used data from loyalty programs to tailor services for loyalty club members

Designing a Loyalty Program

A scan of successful loyalty programs from around the world reveals that several high-level decisions need to be made in designing a scheme.

The scope of the program

A central decision for any loyalty program is where rewards can be earned and redeemed. Can customers build up their loyalty rewards only at one or a few specific retailers or at a wide range of participating stores? And will they redeem those points for only a narrow range of rewards at one or a few places or for a broad array of benefits offered by a wide range of partners?

On one extreme there are programs like Starbucks, where points are earned and redeemed only within the company itself. On the other there are schemes like Amex’s Plenti, where customers can both earn and redeem points from a wide range of companies, including grocery stores, pharmacies, clothing stores, restaurants, fuel stations, and mobile network operators (MNOs). Somewhere in the middle are schemes like Shell’s Fuel Rewards, where customers earn points from shopping at a variety of places, but they can redeem them only for fuel from Shell stations.

Mobile money providers or other DFS players in the merchant payments space need to ask two questions: Will we offer our loyal customers only airtime and other internal bonuses or will we partner with other companies to expand the range of options for customers to redeem their loyalty rewards? Will we collaborate with other payments providers in our market, including competing DFS providers, to let customers earn points across the entire joint acceptance network formed by the respective businesses?

Given the clear arguments in favor of interoperability (see “Interoperability: Why and How Merchant Payments Providers Should Pursue It”), the arguments in favor of working with partners, including competing payments providers, are likely to be compelling. That said, it may also introduce its own challenges that need to be addressed.

Program management

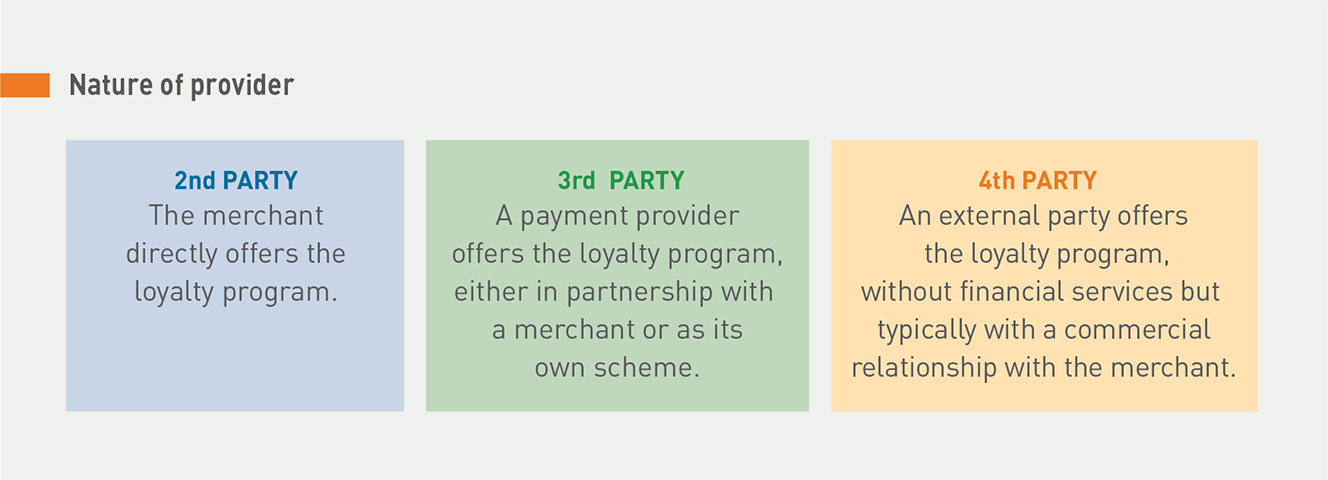

Another important decision is whether to manage the scheme in-house or to have a partner manage it. And if so, what type of partner? For example, a major retailer that wants to offer a loyalty program to its customers can design and administer the program in-house, as Starbucks has done. But it can also choose to run it in partnership with a payments provider, as it is with Macy’s Visa card, or engage a fourth-party program administrator that exclusively does that.

The choice is effectively between playing the third-party role or working with an external organization to manage the program. In the latter case, this could be done, for example, by working with an existing loyalty program in the market or by creating an alliance with one or more providers using an outsourced solution in the middle.

The table below compares second-, third-, and fourth-party loyalty models based on some key aspects, from the point of view of the merchants.

Incentives structure

Most loyalty programs function by allowing users to accumulate points that they can redeem for rewards under certain conditions once a threshold has been met or at the end of a billing period. Rewards typically include free merchandise, like a cup of coffee, or a service upgrade, like a better seat on a plane.

Some programs have additional features such as tiers or leagues to reward users as they accumulate more points in a limited period of time. A tiered system awards customers with different levels of status as their spending or other engagement reaches specific milestones, with higher status tiers unlocking additional benefits. The most prevalent example is airlines that allow higher-tier customers to book better seats, board first, bring additional luggage, use free lounge services, and so forth. These programs can create effective “lock-in” effects by requiring customers to keep accumulating points to retain their status, thus rewarding continuous engagement. A league system doesn’t have set tiers, instead it rewards users based on their relative position compared to others at certain intervals: a given user or group of users may hold the top spot at a certain point in time only to be surpassed by others later on. Rather than setting a specific target for transaction volume required to qualify for rewards, such a scheme might, for example, reward the top 10 percent of customers based on transaction volume.

Beyond points, many loyalty programs have evolving additional features and ways of working. These include cash-back schemes, where customers get a small percentage (typically 1–3 percent) of their spending back in the form of a credit toward future purchases. For such programs, the choices made around broad versus narrow earning and redemption, as discussed above, tend to be essential. They also include fee-based loyalty programs, such as Amazon Prime, where customers pay a fee to join but are given enough perks in return that it feels more like a loyalty program than a simple subscription. Some MNOs are also experimenting with closed user-group discounts in which the discount rate increases as more users are added to the group.

There are also loyalty programs that offer variable rewards, like those offered by Google in India, where users earn a virtual scratch card for making merchant transactions. These scratch cards work like a lottery, with instances of high rewards interspersed between low or no rewards. This model is at once cheaper for providers than a cash-back scheme and more exciting for customers, who enjoy the anticipation of getting and scratching their virtual cards. AliPay used a similar scheme in China and credits it with driving uptake and use of their QR-code-based retail payments, especially in the early years of the business.

Loyalty programs for MNOs

MNOs are well placed to operate loyalty programs, especially in markets with few existing schemes. In such markets, there are typically only a handful of candidates that can operate a large-scale loyalty program. Notably these include large consumer brands, which can have nationwide recognition and distribution but typically lack a digital transactions platform that can capture the requisite data. They also include banks, which are financially capable of running loyalty programs and can promote them across multiple businesses to create industrywide coalition models. However, they tend to have a modest customer penetration into the mass market, poor geographical rural reach and low user activity in certain segments.

MNOs, on the other hand, tend to have a strong national brand with high customer penetration, wide geographical reach, and extensive physical distribution touch points. Furthermore, many MNOs already have loyalty schemes in place for their voice business. By creating integrated loyalty schemes across GSM, data, and financial services and across their retail, agent, and merchant networks, MNOs are well placed to create compelling loyalty schemes at several levels.

Bottom line

When making these decisions and designing their programs, DFS providers should remember that successful programs have four key qualities:

- Simplicity. It is essential that users easily understand how loyalty rewards are earned and redeemed, or the program will fall apart.

- Relevance. If the rewards being offered are not genuinely appealing to customers, the program will inevitably fail. Conversely, the program must target specific behaviors that are important to the business. This could be simply spending more money, but it could also be other things like spending something every day or sharing on social media.

- Strategic use of data. Putting the data generated to good use in understanding what customers want and respond to will help the business offer better services and improve its marketing.

- Evolution. The program must evolve to keep up with evolving user needs and trends.

Even established providers with loyal customers can improve the effectiveness of their reward schemes by abiding by these four principles. For example, when reward points were based on number of beverages purchased rather than money spent, Starbucks found that customers were buying more of its smaller beverages to accumulate points, which drove the number of cups sold but not necessarily total revenue. Starbucks quickly moved to a spend-based model to align rewards with the goals of the program.

For a more detailed review on how loyalty models have been used in retail payments, see “Building a Successful Loyalty Model.” For examples of how DFS providers can integrate loyalty programs into a merchant payments implementation, see “Loyalty Playbook.”