Microfinance and COVID-19: A Framework for Regulatory Response

COVID-19 BRIEFING: Insights for Inclusive Finance

|

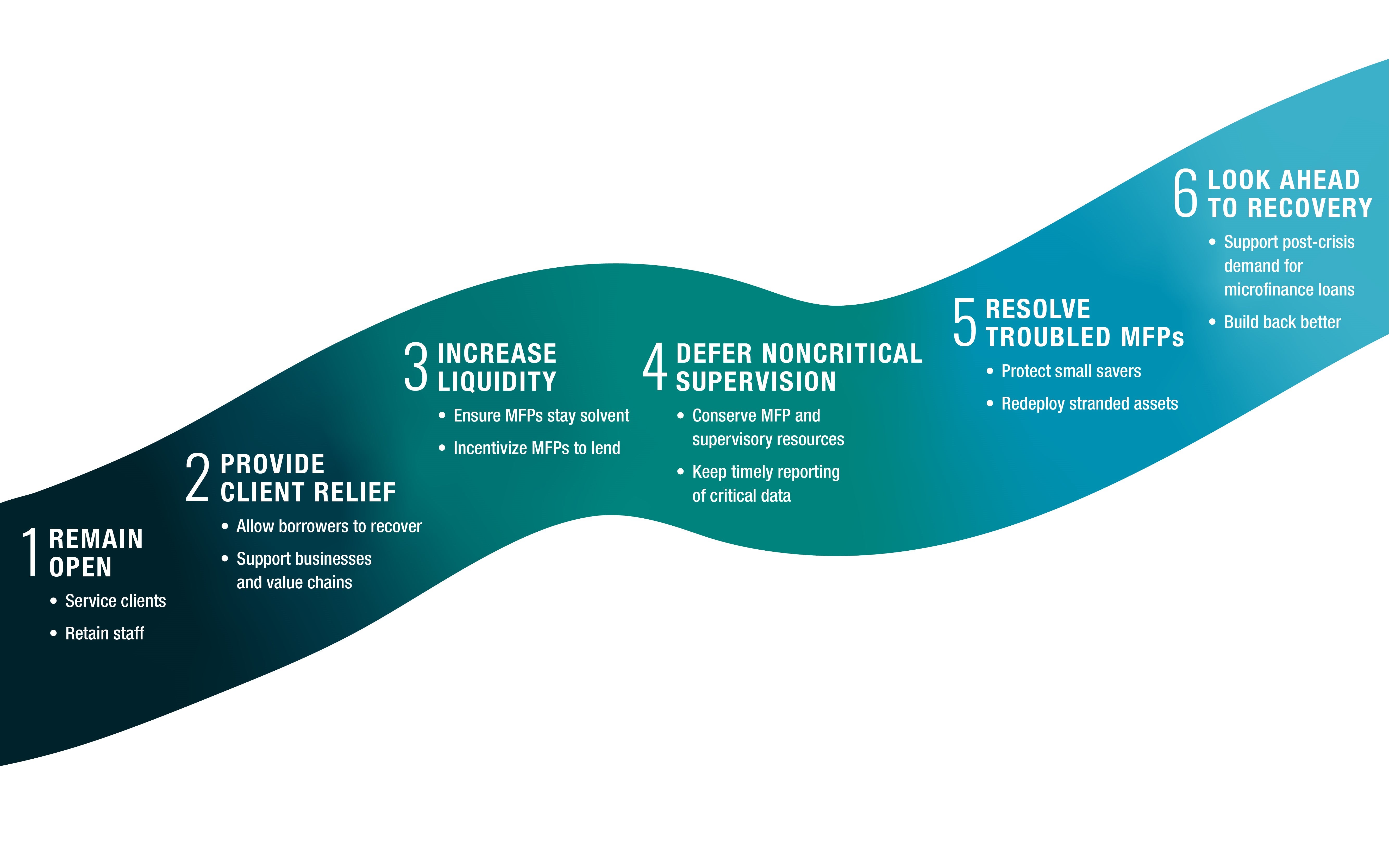

A framework for identifying and assessing crisis responses must take account of the special characteristics of microfinance. This calls for an approach that is empathetic toward vulnerable clients, attuned to the specific risks of microfinance services, and open to communication and consultation with the industry. This leads to the question of how regulators should respond. A review of current practice in a range of countries suggests there are six key steps to be taken at the level of regulation and policy. |

The COVID-19 (coronavirus) crisis endangers health and economic prospects across the globe. The outlook is especially sobering for the most vulnerable populations in developing countries. Informal workers, farmers, and microentrepreneurs are coming under severe financial stress brought on by the social distancing and lockdown measures taken to contain the outbreak. While poor people are resilient, many depend on microfinance services, including basic savings accounts, small loans, and remittances. Microfinance services afford clients a margin of flexibility to cope with emergencies when publicly funded safety nets fall short.

Microfinance providers (MFPs)—microfinance institutions and other regulated providers from banks to nongovernment organizations (NGOs)—face threats to their own existence. The diminished earning capacity of their clients threatens to undermine the strong repayment culture on which microfinance depends. Meanwhile, MFPs are rescheduling loans—voluntarily or by order of the authorities. Many are caught in a bind, with client repayments drying up and ongoing operational expenditure depleting reserves. Their ability to meet their own debt obligations and liquidity needs thus comes into question.

How should regulators respond?

Regulators and policy makers face critical decisions in meeting the challenges to microfinance in the COVID-19 crisis. While CGAP’s ultimate concern lies with low-income households and their livelihoods, this paper focuses on MFPs, specifically regulated MFPs (see Box 1). Although we are not recommending specific measures, we are presenting a framework for identifying and assessing crisis responses. These responses inevitably will be highly specific to diverse contexts. In addition, regulators sometimes do not know the microfinance sector well or are familiar only with the few largest MFPs. These factors argue for dialogue between policy makers and sector representatives such as microfinance associations in crafting responses to the crisis.

BOX 1. Which MFPs are addressed in this paper?This paper addresses regulatory issues around regulated MFPs. This category necessarily leaves out a wide range of organizations in the nonregulated sphere, including NGOs that are not subject to a financial authority and small, informal groups such as rotating savings and credit clubs. Note that such nonregulated MFPs often have been allowed to operate in the absence of a financial regulatory framework as is the case in East Africa and India. In addition, unregulated NGO MFPs have provided a large share of microfinance in some countries, including Lebanon. (Cooperatives and state-owned banks also are not addressed in this paper.)a Nonetheless, our target group of MFPs is heterogeneous. It includes entities operating under different names, including some that might not label themselves as being part of the “microfinance sector.” All of these MFPs focus on providing small-ticket services such as small, mostly short-term loans. Some provide deposits and serve mainly or exclusively low-income clients and micro and small enterprises, mostly in the informal sector. We developed the following typology of MFPs to identify our target group:b Deposit-taking MFPs

Credit-only MFPs

Some of these entities are small nonprofits while others are large commercial businesses backed by international investors. Their services, depending on their licensing status, may include savings, credit, insurance, and money transfers. The MFPs’ market overlaps not only with banks but with payments service providers such as e-money issuers, mobile lenders, and fintechs. Although this paper focuses on regulated MFPs for analytical purposes, this is not to suggest that unregulated providers should be ignored. The latter can play a major role in strengthening the resilience of poor people and in jumpstarting the recovery. They are likely to be affected by policy measures, even if indirectly. a Member-based institutions (credit cooperatives, credit unions, building societies) have special features that are not detailed here. See Nair and Kloeppinger-Todd (2007). State-owned banks often are used by governments as a crisis response vehicle and are not subject to the same liquidity and solvency risks as privately owned MFPs, which makes them a special case.b See CGAP Typology of Microfinance Providers. |

A review of current practice in a range of countries suggests six key steps at the regulation and policy level.1 These should be understood as decision points in the crisis response, not as policy prescriptions (see Figure 1). Specific measures and the sequence followed will differ across countries. The steps are as follows:

- Enable MFPs to operate safely.

- Provide relief to microfinance clients.

- Make additional liquidity available to MFPs.

- Defer noncritical supervisory processes.

- Restructure or liquidate troubled MFPs.

- Think ahead to the challenges of the recovery, balancing urgent rescue against longer-term values such as legal certainty, risk-based regulation, and sustainability.

Crisis responses must consider the special characteristics of microfinance. This calls for an approach that is empathetic toward vulnerable clients, attuned to the specific risks of microfinance services, and open to communication and consultation with the industry. Further, measures aimed at conventional banks are not always appropriate for MFPs. One key difference between banks and MFPs is that most banks rely on asset-based lending, whereas MFPs primarily depend on a close relationship with each borrower and client incentives to repay in order to access future loans.

Most MFPs fall short of being systemically important as defined by central banks (i.e., in balance-sheet terms), but in many cases, they are critically important to a large and vulnerable client base. Thus, MFP failures could have serious consequences. Moreover, microfinance sectors have developed capacities and linkages to nonfinancial areas such as health—that will be essential to recovering from the crisis. Their knowledge of local economies makes them potentially critical channels for relief payments, such as government-to-person (G2P) transfers. Furthermore, their service links to the informal sector are unlikely to be matched by conventional banking institutions.

FIGURE 1. Path from crisis to recovery

Enable MFPs to stay open while operating safely

The first priority in the crisis is containment—reducing as much as possible the harmful effects on clients and MFPs. People need access to their savings, while businesses that remain open seek continued financing. The needs of microfinance clients may intensify during the crisis as income is lost, health emergencies arise, and coping strategies evolve. This suggests that MFPs, especially those that accept deposits, should to the extent possible maintain a minimum level of operations while heeding safety protocols.

Regulators and policy makers must decide whether MFPs should stay open and, if so, how continued (perhaps pared down) operations can proceed safely. Governments have designated certain financial services, such as branch banking, payments, and remittances, to be essential. This allows providers to open their doors. The question then is how broad to make the essential services designation: Which types of financial institutions (e.g., MFPs as well as commercial banks) are covered? Which kinds of service points (e.g., individual agents as well as branches) are covered? For example, in Mexico, the exceptions to the lockdown make specific reference to third parties, including agents. Civil authorities and financial regulators may need to work together to arrive at answers to these types of questions.

MFPs are expected to (or may be ordered to) comply with public health measures to protect staff and clients, particularly at locations where in-person meetings are frequent. Public health measures may include use of masks, social distancing, staff rotation (including shortened shifts), and increasing reliance on agent service points and digital channels. Such health precautions pose a challenge for many MFPs because their high-touch models depend on regular personal interaction with clients. Fixed hours also may be an issue. However, emergency measures often allow providers the flexibility to set reduced or differentiated opening hours according to local crisis conditions. Examples can be found in Croatia, Egypt, Jordan, and Rwanda.

Some countries have responded to the crisis by easing access to digital services—in some cases, permanently. These measures include the following:

- Simplifying customer due diligence for certain accounts. For example, Brazil, Egypt, Ukraine, and the United Kingdom have simplified customer due diligence. In Peru, financial institutions now may open accounts, in bulk or individually, for G2P beneficiaries without requiring them to sign a contract.

- Reducing fees. For example, fees in Kenya, Myanmar, Rwanda, and Uganda are waived or reduced. While waiving or reducing fees benefits clients, it squeezes revenue streams for payment providers.

- Raising transaction limits. For example, Egypt, Peru, and Rwanda have increased transaction and/or balance limits for certain accounts. In Nigeria, check clearing initially was halted to push the shift to digital, but this decision was later reversed.

In light of these types of responses, it may be possible to build on a digital ecosystem already in place to expand remote services in the short term. It is much more difficult to launch new systems and frameworks in response to the COVID-19 crisis. To the extent digital mechanisms are in place for remote account opening and other services, these can be promoted to microfinance clients and their use expanded. Some countries have seen increases of 30 percent or more in downloads of mobile finance apps during the crisis (Fu and Mishra 2020). This in turn enables MFPs to distribute crisis relief by opening accounts in bulk, handling G2P transfers, and making greater use of mobile wallets and agents for loan repayments and disbursements. Further, regulators may wish to ease some of the operational constraints imposed on agents or provide incentives for them to operate in rural areas (Hernandez and Kim 2020, McGuinness 2020).

Prioritize relief to microfinance clients

As lockdowns and distancing measures erode livelihoods, the question of relief for the MFP client base becomes pressing. Many households already have exhausted their reserves, with some selling off livestock or other assets for ready cash. Meanwhile, governments face urgent demands for action but must consider which responses fit the context and minimize harmful consequences over the longer term. Effective relief measures are time bound and directed where impacts and risks are highest, such as individuals who have lost jobs or enterprises that have closed because of the lockdown. The options mostly fall into two groups: fiscal and regulatory.

Fiscal measures allocate resources or reduce expenses to enable MFP clients and vulnerable groups in general to manage the crisis. These measures may include emergency food support or cash transfers to low-income households or the unemployed, partial wage payments, tax breaks, direct lending, and grants to micro and small enterprises. For example, tax exemptions and reductions are available in Brazil, Indonesia, and Nigeria, and loans and grants are available in Peru, South Africa, and the Philippines. (Government guarantees also are relevant, but as these target lenders, they are addressed later in this paper.) Fiscal relief normally is decided by high-level policy makers, although it may be coordinated with financial authorities and perhaps also with international investors and donor agencies.

Regulatory measures may take several forms. First, regulation can play a role in facilitating fiscal relief to microfinance clients. For example, a regulation may be in place—or a change may be needed—to permit MFPs to distribute emergency relief funds. The infrastructure would need to be in place to enable disbursement through branches, agents, or mobile wallets. Several potential benefits flow from MFP involvement in such transfers. It may encourage MFPs to open new accounts for G2P recipients, allow MFPs to retain staff and preserve relationships with clients, and help MFPs safeguard their assets pending recovery.

In response to the crisis, several regulators have taken steps that change rules, such as prudential standards and repayment schedules, and the financial position and incentives of the actors. These are considered extraordinary measures—that is, actions that are not within the normal range of the regulator’s discretion—and may require special review due to heightened risk.

Loan repayments may be suspended. This does not always depend on action by the regulator. Many MFPs simply have offered clients a few months’ relief in the form of a repayment moratorium or a “loan holiday” in which repayments are optional. In other cases, regulators have stepped in to allow providers to offer moratoria or to require a moratorium to be granted upon request, or indeed to mandate a moratorium across the board. For example, in Tunisia, MFPs were required to approve requests for loan rescheduling. Nigeria mandated a moratorium on all MFP loans, including MFP credits from the central bank. Vietnam required banks to eliminate, cut, or delay interest payments.

Moratoria often are for 30 to 90 days, sometimes longer, and may involve adjustments in credit reporting and loan classification. Regulators sometimes have specified that willing clients must be allowed to repay during the moratorium. Regulators also have removed or prohibited fees such as bank charges for crisis-driven loan restructuring. Examples of this can be found in Kenya, Mexico, and Uganda.

Each type of relief measure introduces trade-offs. Beneficial as borrower relief measures may be, they risk weakening repayment discipline and masking the true financial position of MFP portfolios. Fiscal measures are perhaps the least distorting overall, but they depend on funding allocations that are outside the control of financial regulators.

In the case of regulatory measures, the risk of harm can to some extent be managed by careful design.2 For example, in Brazil, Mexico, and Peru, moratoria can be applied only to those loan accounts that are current at a stipulated cut-off date, such as the date related to the start of the COVID-19 outbreak. This helps to reduce the risk of sustaining debtors who may never be in a position to repay, leaving the MFP holding nonperforming assets.

A mandatory moratorium may create the opposite problem: preventing clients who can repay from doing so. This could disrupt clients’ financial management, increase their interest costs, and place an unnecessary burden on MFPs. Therefore, some moratorium rules, such as those in Uganda, explicitly allow for voluntary repayments or require borrower consent for any restructuring.

A related design factor is the treatment of loans deferred under a moratorium, in accounting and prudential terms. Many regulators have decided that crisis-related restructuring should not be treated as refinanced or reprogrammed for purposes of credit reporting, classification, and provisioning. The moratorium freezes the loans’ status (days past due)as of the cut-off date for the moratorium,3 which shields clients from short-term repayment pressures and write-downs. Examples of this include measures adopted in Brazil, Mexico, Peru, Russia, and Uganda.

However, a risk arises if special accounting treatment for restructured loans is not disclosed along with any adjustment of prudential standards. This could disguise the true creditworthiness of clients and in turn the financial position of MFPs and their loan portfolios. This may complicate the resumption of normal credit operations during the recovery, weaken safe and sound risk management practices in the industry, and thus compromise supervisor credibility.4 Supervisors as well as MFPs and investors need a clear view of all loans affected by restructuring or moratoria. Some regulators have addressed transparency risk by adopting special tracking measures. For example, Peru created a new off-balance sheet subaccount, “Reprogrammed Credit—State of Sanitary Emergency,” for providers to track loans that benefitted from forbearance, (i.e. nonenforcement). In Mexico and in Uganda, MFPs are required to report regularly to their supervisors on all loans that have been restructured or have benefited from moratoria.

Increase provider access to liquidity

As lockdowns disrupt operations, a liquidity squeeze looms. Many MFPs depend on high-touch customer interaction, which is severely constrained by social distancing and limited hours. Unless they are designated to be essential services, MFPs may be forced to close their doors. Loan collections may be suspended under a moratorium (voluntary or otherwise) while new lending slows down, further constraining income. At the same time, MFPs struggle to retain staff, service debt, and cover savings withdrawals. Commercial banks facing similar pressures may reduce or curtail credit lines to MFPs. Some governments, such as India and Pakistan, have pressured employers not to lay off staff, while others, such as Nigeria, have prohibited them from doing so.

The situation can become volatile, especially where traditional microfinance featuring unsecured group lending is the norm. Signs that a provider might have trouble meeting cash needs for withdrawals could spark a run on deposits, as in past crises. On the other side of the balance sheet, if the crisis threatens the issuance of fresh loans to clients who have paid off earlier loans, a key incentive for repayment—namely, qualifying for subsequent loans—may be undermined, and critically needed income thereby lost.

In short, MFPs quickly can become liquidity constrained. This is the worry most frequently voiced by microfinance stakeholders (including international donors and investors) about the COVID-19 crisis. The downstream effects of liquidity shortage can be severely damaging: micro and small enterprises unable to meet their credit needs, value chains under stress, potential shortages of food and other basics, and resulting setbacks to recovery.

How can more liquidity be made available to MFPs? Here again, the approaches take two main forms: fiscal measures and interventions by the regulator.

Fiscal options can be more or less direct. Direct support—support targeted to the MFPs themselves—may include recapitalization, tax relief, transfers or loans to cover operational costs, and credit guarantees. Several countries, including Argentina, Brazil, India, Pakistan, and South Africa, have mounted guarantee schemes that MFPs may access for lending to micro and small enterprises.

Access to central bank liquidity might be extended to nonbanks, especially MFPs that are unusually important in terms of number of clients, savings, and presence in poor and outlying communities. For example, Uganda’s central bank offers loans to Tier 2 institutions secured on deposits in commercial banks. Other examples include Nigeria and Pakistan. The Central Bank of Peru eased access to its repurchase window for discounted shortterm credit by reducing the minimum risk rating for participating financial institutions and the minimum size of loans that they can use as collateral.

However, central bank facilities typically are open only to large institutions, mostly commercial banks.5 In addition to size or importance for financial inclusion, other criteria may be used for targeting funds to MFPs. These include providers’ precrisis performance and their access to support from well-resourced shareholders such as international investors.

Monitoring by financial authorities is critical in dealing with liquidity. This is especially so where MFPs are involved in delivering relief payments to customers. There is a risk that beneficiary demand for cash-out transactions could exceed available liquidity. This suggests that careful tracking is needed, at the level of MFPs as well as their branches and agents, for targeting and scheduling relief payments—whether they be cash aid to needy clients or liquidity transfers to providers. In turn, digital systems and connectivity are important for timely monitoring.

In contrast to direct support, indirect methods target liquidity to institutions that lend to MFPs. This includes making emergency credit lines and credit guarantees available to commercial banks. These types of guarantees are indirect since they target not MFPs but their creditors. For example, Argentina, Brazil, India, Pakistan, and South Africa have credit guarantee schemes that may be used for credit to MFPs. However, such indirect relief is sometimes constrained by banks’ lack of incentives to draw on credit lines or guarantees to extend loans to MFPs.6 International donors and investors also play an important role in providing funds or guarantees in these situations.

Regulatory measures likewise may either apply directly to MFPs (especially deposit-takers) or reach them indirectly by targeting commercial banks and other lenders to MFPs. The choices overlap with those discussed earlier. Measures adopted during the crisis include the following:

- Allow MFPs to continue collecting loans when this is possible under lockdown conditions.

- Temporarily prohibit MFPs from making dividend payments, share buybacks, and bonus payments—except, as appropriate— to front-line staff. This has been done, for example, in Brazil, Mexico, Sri Lanka, and Uganda.

- Reduce collateral (e.g., security deposit) requirements and provisioning for microcredits, and reduce risk-weighted assets for micro, small, and medium enterprise (MSME) loans. For example, the Philippines allows provisioning to be spread over five years, on a case-by-case basis. Pakistan has reduced collateral requirements for larger loans and encouraged collateral-free loans up to Rs 5 million. Brazil’s Central Bank reduced risk-weighted assets relative to MSME credit exposures from 100 percent to 85 percent.

- Relax selected prudential norms, such as capital adequacy ratios, reserve requirements, liquidity ratios, leverage ratios, and minimum paid-up capital. Less stringent leverage ratios are used, for example, in Brazil, India, Kenya, Philippines, and Sri Lanka. In terms of paid-up capital, Nigeria’s central bank delayed by one year the deadline for microfinance banks to comply with higher minimum capital requirements. The Central Bank of Brazil reduced the minimum required capital for small, nonsystemic regulated institutions (deposit-taking and credit-only institutions).

- Ease restrictions on foreign investment; allow MFPs to expand funding sources. For example, the Central Bank of Brazil has liberalized issuance of term deposits.7

As for measures targeting lenders to MFPs, a key issue is whether banks are allowed—and willing—to restructure their loans to MFPs.8 In parallel to moratoria/restructuring provided by MFPs to their clients, the lender in this case may be required to apply special classification, reporting, and provisioning rules under the emergency regulation. Loans to MFPs that qualify as small and medium enterprises also may benefit from lower risk-weighting for regulatory capital purposes. Also, measures generally taken to ease bank liquidity, such as release of capital buffers and reduction of reserve requirements, may cover microfinance banks or may enable commercial banks to provide credit to MFPs. For example, Brazil has introduced several of these measures, targeting banks and nonbanks.

Weighing the right approach

Emergency measures entail trade-offs. Where a regulator requires or enables commercial banks to restructure loans to MFPs, the regulator is positioned to promote the development of the microfinance sector—which is not a traditional regulatory/supervisory function. Such forbearance or promotion normally would be considered a function not of regulation but of general policy making (and covered by the state budget).

But these are not normal times. Central banks and regulators in developing countries are taking extraordinary steps to deal with the crisis. This includes declaring or allowing moratoria and restructuring under special rules, expanding access to liquidity, and temporarily adjusting selected prudential rules to ease the pressure on MFPs as well as on their lenders and clients. Some regulators acknowledge that MFPs have an important role in supporting vulnerable clients and assisting their recovery from this crisis—and see it as part of their mission to ensure that the microfinance sector is able to carry out this role. For example, Pakistan’s central bank has warned banks that it will check how they are dealing with their loans to MFPs.

As mentioned, emergency rules on loan restructuring can clash with the need for transparency, sound risk management, and effective monitoring of portfolios. The risks may increase where loan restructuring and a freeze on reclassification and provisioning combine with a loosening of prudential requirements in areas such as capital, liquidity, and reporting. In this situation, an MFP may continue incurring losses, which would then put pressure on its capital. If several MFPs are affected at the same time, which is the case in many countries, it might be hard for supervisors to know which institutions can withstand a continued downturn and which are headed to insolvency. Supervisors and lenders need to track forborne loans to counteract this effect and maintain an accurate picture of the financial status.

The tension between relief and transparency affects investors as well. As a crisis measure, several countries have deferred the implementation of financial reporting standards that apply to certain MFPs and are relevant to the investor community. The most important of these is IFRS 9 on the recognition of expected credit losses (Toronto Centre 2020, 6–7).

A few key design factors help to determine whether crisis response measures will balance risk appropriately and have the intended benefits. Again, it is critical for the steps to be time bound and carefully targeted, while building in close tracking and monitoring by supervisors and MFPs themselves. Simple stress testing could help supervisors understand which firms are most exposed to credit deterioration tied to the crisis—and could provide ready criteria for benchmarking MFPs. Frequent stress testing is also a key financial management tool for MFPs. It enables decisions about implementing liquidity contingency plans or seeking new capital injections.

The COVID-19 crisis calls for prompt action, and some types of relief, such as direct fiscal measures, may have a quicker impact than others like easing capital ratios. Increased access to funding may become less effective if it takes too long to put in place, thus turning a shortterm liquidity crunch into a longer-term threat to solvency. But a liquidity measure may not be appropriate or effective where the threat to solvency is structural and not solely due to crisis.

Consistency also appears to be important. If a moratorium on loan repayments by MFP clients is adopted or special rules for restructuring are issued, authorities should consider matching this with similar measures applicable to MFP creditors. Otherwise, MFPs likely will be caught in a cash flow squeeze. Consistent treatment of MFPs and of their creditors has not always been the rule during the COVID-19 crisis. For example, MFPs in India, many of which had weak precrisis finances, have been struggling to get their bank loans suspended. In Uganda, although no moratorium was declared, the microfinance regulator recommended that MFPs contact their creditor banks to secure extensions (Moses 2020).

The criteria for access to certain forms of liquidity relief, such as central bank credits, need careful attention. They should be drawn narrowly enough to (i) exclude entities with doubtful precrisis solvency or post-intervention viability,9 while (ii) they channel resources to MFPs that have solid financials and a large low-income client base. Not all MFPs should expect to qualify.

Another key consideration is whether a response measure can be designed to incentivize or “crowd in” private capital. A basic step here might be to ensure that a new funding tranche, such as that from an international investor, is accorded high priority in light of prior debts, in terms of security against default or insolvency. Whether this is sufficient to shore up even the strongest MFPs or those with the largest impact from an inclusion perspective, depends heavily on the context. In some cases, the crisis response would rely more heavily on public guarantees.

Governments in developing countries can play a productive role in discussions involving MFPs and international investors. In addition to ensuring that measures apply equitably to domestic and foreign funders, government could advocate for liquidity injections by the investors while addressing related issues such as foreign exchange risk and investment regulations. In some countries, this dynamic may be inverted, with investors who are close to the microfinance sector intervening to support the MFPs in discussions with government.

Reduce or defer noncritical supervisory processes

Seeking additional ways to ease pressure on providers, authorities have shortened or deferred certain supervisory processes. This means identifying steps that are burdensome but not essential—or at least not time critical—for MFPs or supervisors. For example, some supervisors have postponed nonurgent planned activities such as routine inspections or the slated publication and implementation of new rules. Nonessential reporting, such as reporting on corporate governance, also has been temporarily reduced or deferred. In some cases, deadlines have been extended or fines are waived for late submission.10

Regulators must strike a balance and distinguish what is essential from what is not. Timely reporting of data on loan performance and portfolio quality, including data for tracking restructured loans, is essential. The information and processes involved in licensing also may be essential in that the integrity of the sector depends on them; however, deferring application reviews might be a way to conserve supervisory resources during the crisis.

Plan to restructure or close troubled MFPs

The COVID-19 crisis will sweep away some MFPs and push others to the brink of failure. Policy makers and regulators need to work with other stakeholders to prepare plans and procedures for stabilizing the sector.

The initial priority is to ensure that the necessary monitoring and reporting mechanisms are in place to detect threats early. Procedures for prompt restructuring or liquidation also are important, particularly in light of the potential for rapid unspooling of microfinance portfolios and runs on deposits (Bull and Ogden 2020). Supervisors need to be able to perform stress tests to assess the resilience of major MFPs that have a large customer base and to identify the potential impact of failures. Coordination with the deposit insurance fund and/or resolution authority would be important for crisis-related planning. (It should be noted, however, that deposit insurance and resolution funds are not available to many MFPs in developing countries.)

Once an MFP is in trouble, supervisors can play a constructive role in pursuing market solutions. This might include identifying and negotiating with potential buyers of failing MFPs or of loan portfolios. Where deposit insurance coverage is lacking, alternatives need to be found for protecting small depositors. Consolidation may be inevitable in the microfinance sectors of some countries. International investors and funders should be part of the solution and share equitably the costs of resolution.

Where recapitalization or merger is not possible or desired, a troubled MFP should move into a resolution process that allocates stranded assets to efficient users and avoids unjustified bailouts. Regimes for insolvency and restructuring of financial institutions typically are designed with banks and large companies in mind. In addition, many MFPs are chartered as NGOs, which complicates share ownership and therefore insolvency proceedings.11 However, the subsequent market pressure may interfere with the social mission of the MFPs and their investors.

In past crises, such as the financial crisis of 2008, voluntary workout rather than formal insolvency proceedings was the primary method for dealing with failing MFPs. In a voluntary workout, stakeholders, including those with ownership stakes such as investment funds and development finance institutions, agree on the process (Lieberman and DiLeo 2020, 1). Successful workouts depend on quick action and incentive structures that maximize peer pressure for cooperation and against free-riding (Lieberman and DiLeo (2020, 4).12

Think ahead to recovery and rebuilding

Immediate steps to alleviate the crisis must be tempered with some forward vision. This is a balancing act. First, emergency measures should ensure that microfinance services continue to be available and that assistance is targeted effectively to vulnerable clients. Second, the crisis response must enable the microfinance sector to play its central role in medium-term economic recovery. This means helping viable, responsible MFPs survive and retain the confidence of their clients. It also means reinforcing MFPs’ incentive to begin lending again as the lockdown ends, thereby encouraging the repayment of loans outstanding (many of them having been restructured). MFPs are well placed to do this, because their micro and small enterprise clients tend to be highly resilient—and quick to reopen and seek fresh capital. This was the experience, for example, of the BRAC network in the Ebola crisis (Chakma et al. 2017). Third is the need to facilitate the orderly consolidation or exit of institutions that cannot sustain themselves, including those that entered the crisis already compromised.

Balance is needed to make relief measures effective as well as consistent with a well-governed sector and credible regulation over the long term. This means targeting emergency support so that MFPs emerging from the crisis are able to quickly comply with the rules normally in force (pre/post-crisis). Rescue packages go awry when policy makers lose sight of the need for discipline in responding to chronic weakness in financial institutions. This often is due to populist appeals overriding sound policy. The result is costly, distortionary subsidies that prolong the life of “zombie” institutions unable either to survive without external support or to find a sustainable way forward. Avoiding this trap while providing sound, targeted relief calls for an approach that embodies the following principles:13

- Pro-poor. Focus on protecting small deposits and borrowers

- Clear and predictable. Time bound, established in law, clear scope and application, exit strategy

- Broad coverage. Cover all regulated MFPs, allow for customized application

- Preserve risk management culture. Assess risk of regulatory forbearance including “race to the bottom”

- Supervision and resolution. Active monitoring and communication, orderly restructuring, consolidation, or liquidation of unviable/insolvent MFPs

Looking ahead, the sector needs to go beyond perfecting the relief package. Stakeholders can and should seize the opportunity to build back better. This is a matter not only of addressing weaknesses revealed by the crisis but also of exploiting the potential to leapfrog to a higher level of effectiveness. The failures and opportunities to be addressed are those not only of the microfinance sector but of the financial system in general, such as regulatory fragmentation, missing or inadequate deposit guarantee schemes, and gaps in payment systems.

One of the ways forward is to crisis-proof the system. For MFPs, this might involve strengthening business continuity frameworks and perhaps establishing a sectorwide fund for disaster relief or emergency liquidity. Providing a framework to protect small depositors affected by future institutional failures also is important, as is an appropriate bankruptcy regime.

The COVID-19 crisis shows that enhancing remote operations should be on the agenda. This might include speeding up the shift toward digitizing front-end services and back-end operations, with MFPs making greater use of mobile services and exploring tie-ups to digital platforms. Expanding the role of agents also will be important. The MFPs themselves could serve as agents to banks, digital finance providers, and social transfer programs. These transitions already are underway globally, with the scope and pace differing across countries. In many cases, there will need to be greater emphasis on encouraging remote operations, improving digital interoperability, and expanding access to remittances.

Another next step is for MFPs to broaden their service offerings and revenue streams. The crisis demonstrates just how fragile the resource base is for many such institutions. Government and the microfinance community could push for more and closer MFP partnerships with banks and fintechs, tie-ups with mobile money and remittance providers, and alternative financing instruments such as wholesale credit and subordinated debt. In this regard, stronger policy emphasis on savings also is warranted because it augments resiliency in a crisis.

Finally, the regulatory structure needs to be strengthened in several areas. Consumer protection has arisen as a major concern during the crisis. Scams and lender abuses highlight the need for stricter norms as well as systems for complaint resolution and client support, especially by remote means. Policy makers and regulators sometimes have failed to communicate adequately with customers about crisis measures. This can lead to lack of awareness, misunderstanding, and skewed implementation.

The crisis has exposed fragmentation in regulatory frameworks: (i) inconsistency across separate regulatory domains for banks and nonbanks and (ii) limited reach of regulatory authority. The latter can create situations where a few large MFPs meet regulatory criteria while many unlicensed, unsupervised MFPs accept deposits. Moving toward a functional, graduated framework of tiered regulation may be part of the solution. Tiered regulation may be needed to meet the overarching need for a proportionate, risk-based regulatory and supervisory framework for MFPs, in accord with well-established guidance.14 Other components include regular communication and consultation with the industry and well-tailored tools and high-quality data that enable proactive monitoring of providers.

--

1This paper focuses on regulatory responses and touches on broader policy measures. It is based on desk research and interviews with country experts primarily focused on Côte d’Ivoire, Egypt, Ghana, India, Jordan, Kenya, Kyrgyzstan, Lebanon, Mexico, Pakistan, Peru, Russia, Senegal, Tunisia, and Uganda.

2Dijkman and Salomão Garcia (2020) propose guiding principles for the design of borrower relief measures in order to mitigate their risks.

3According to the Bank for International Settlements, crisis-related payment moratorium periods (regulatory or voluntary) can be excluded by banks from the counting of days past due. Whether the borrower is unlikely to pay its credit obligations should be assessed in relation to the rescheduled payments. Acceptance of a moratorium or similar relief should not automatically lead to the loan being categorized as forborne. See Borio and Restoy (2020).

4Dijkman and Salomão Garcia (2020) recommend against changes in asset classification as a crisis measure.

5Moreover, access to this liquidity source is not purely “fiscal” as it depends on central banks’ independent authority over macroprudential policy.

6India’s new repo operation (TLTRO 2.0) requires banks to channel half of new funds to Nonbank Financial Companies including MFPs that serve millions of people (Dasgupta 2020). The banks, however, showed little interest (Palepu 2020).

7See “Preserving the Regular Operation of the Financial System and the Brazilian Economy,” Banco Central do Brasil, https://www.bcb.gov.br/en/about/covid-19-measures.

8Moratorium provisions applicable to banks, such as those in India, Malawi, and Vietnam, may apply to MFPs as borrowers. Inconsistency arises—and may cause a liquidity problem—if MFPs are not within the terms of the moratorium or if the bank chooses not to provide a discretionary moratorium.

9See Rozas and Mendelson (2020) for a discussion about liquidity and solvency measures.

10E.g., the European Banking Authority extended reporting deadlines, except for “data deemed priority,” and Indonesia’s financial regulators relaxed certain reporting requirements and deadlines. Peru extended deadlines to submit certain reports. The Philippines refrained from penalizing banks, including rural banks, that delayed submission of supervisory reports or legal reserve deficiencies, subject to central bank approval.

11See Lauer (2008). Even after transformation of an NGO into a company, ownership by the original NGO may continue to pose problems.

12A Memorandum of Understanding adopted by microfinance investors provides a framework to facilitate these workouts, but without adequately factoring in the social importance of the MFP.

13These draft principles were developed by CGAP. By way of comparison, the Bank of International Settlements has issued the following core principles: support economic activity, preserve the health of the financial system, and avoid undermining the long-run credibility of financial policies (Borio and Restoy 2020).

14See Christen, Lauer, Lyman, and Rosenberg (2012) and the Basel Committee’s two guidance documents on application of the Core Principles for Effective Banking Supervision to MFPs, BIS (2010) and BIS (2016).

To view full list of references, please see PDF.

|

The lead author for this Briefing is Patrick Meagher. Background research was conducted by a CGAP team that included Denise Dias, Juan Carlos Izaguirre, Stephen Rasmussen, Matthew Soursourian, and Stefan Staschen. We thank readers of earlier drafts who provided helpful comments and suggestions, in particular Valeria Salomão Garcia of the World Bank. The views expressed are solely those of the CGAP team. |

Website photo by Hiba Zeeshan, 2016 CGAP Photo Contest

Related Resources

A set of CGAP background documents examine the impact of the COVID-19 crisis at the country level. These documents provide a snapshot of the policy and regulatory responses adopted by financial authorities in four countries: Peru, India, Pakistan, and Uganda.