Research & Analysis

Publication

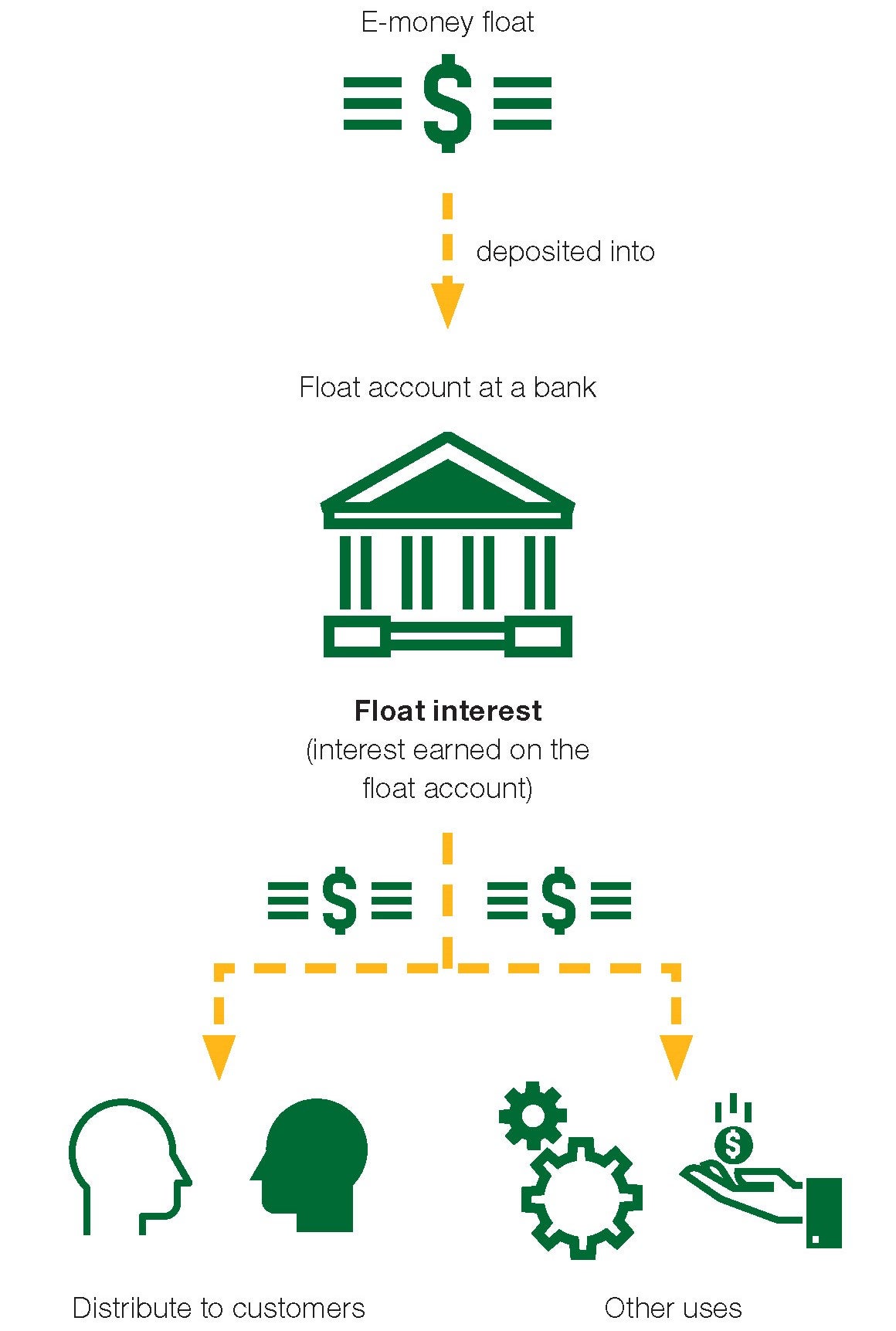

Regulatory Approaches to the Interest Earned on E-Money Float Accounts

Electronic money issuers are usually required by regulation to set aside an amount equivalent to the total e-money issued in one or more separate accounts in banks, called “float accounts”, and most often these accounts earn interest called “float interest”. As digital financial services take center stage in the post-pandemic world, issues around what happens to this interest will become ever more important. CGAP’s new Technical Note outlines five approaches to the regulatory treatment of making use of float interest. In CGAP’s preferred approach, EMIs are allowed to distribute the float interest, but not required to do so.

Sub-topics: Regulation