Recent Blogs

Blog

Can a G2P Payment Connection Trigger Tax and Energy Reforms?

Governments are increasingly using payments and identity technology to shift cash-based transfer payments into digital channels. A new Centre for Global Development paper argues that exploiting the full range of policy levers enabled by these technologies can improve public service delivery and reduce poverty.Blog

Accessible, Robust, Integrated: Identifying Good Payment Programs

An estimated 718 million recipients in developing economies are enrolled in cash transfer programs, more of which are going digital. This has not necessarily equaled greater financial inclusion. ISPA's Social Protection Payment Delivery Tool looks to make digital transfer programs more inclusive.Blog

Microfinance in India Growing Fast Again: Should We Be Concerned?

The rapid growth of microfinance in India today is creating new challenges for a sector hugely impacted by the 2010 crisis. The recently released Inclusive Finance India Report 2016 outlines these challenges and suggests that they should be addressed soon.Blog

Riding the “Rails”: Unlocking Innovation with Open APIs

What are "Open APIs" and why do they matter for financial inclusion? CGAP is looking at open APIs as an enabler of increased innovation in digital financial services. Here's what digital payments providers need to know.Blog

3 Steps Policy-Makers Can Take Now on Digital Credit

In emerging markets, policy-makers have often struggled to keep pace with the rapid growth of digital credit. With the establishment of consumer protection authorities unlikely in the short term, here are three steps policy-makers can take now to protect consumers.Blog

Financial Inclusion Can Reduce Inequality and Bring Peace

Global inequality is on the rise, and it is contributing to growing disenchantment and conflict. There is an opportunity for financial inclusion to address these challenges and to make a difference in fragile and conflict-affected states.Blog

Liberian Teacher ePayments: Stepping Stones to Inclusion

What if a teacher in rural Liberia could collect her salary instantly and remotely? USAID recently partnered with the Liberian Ministry of Education to roll out the first mobile salary payments, and the preliminary results are extremely promising.Blog

Swiping Right: Ideo.org Prototypes Mobile Money on Smartphones

IDEO.org believes new smartphone technology and human-centered interaction design of mobile-money apps can go a long way to solve problems and open up new doors, especially for low-income people. Here are key lessons from their recent financial health work in design-led prototyping.Blog

Ending Extreme Poverty: New Evidence on the Graduation Approach

SDG 1 is as exciting as it is daunting: End extreme poverty. The Graduation Approach has resulted in large and cost-effective impacts on ultra-poor households’ standard of living, ultimately enabling a sustainable transition to more secure livelihoods and an exit from poverty.Blog

Digital Finance in WAEMU: What’s New?

CGAP recently interviewed representatives of 100+ organizations in Benin, Côte d’Ivoire, Senegal, Mali and Niger to better understand the market system for digital financial services in the West African Economic and Monetary Union (WAEMU). What have we learned?Blog

Future of Mobile Money for Cocoa Farmers in Côte d’Ivoire, Ghana

New research from the World Cocoa Foundation explores the potential of mobile money to enhance cocoa farmers’ livelihoods in Côte d’Ivoire and Ghana and paints a detailed persona of customers at the frontier of widespread adoption.Blog

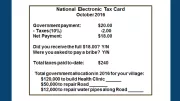

Kenya Ends Hidden Costs for Digital Financial Services

In Kenya, many digital financial service providers do not disclose to consumers the costs of products. On October 29, the Competition Authority of Kenya announced an important new standard for pricing in digital financial services.Blog

Advancing Financial Inclusion Through P2G Payment Digitization

Karandaaz Pakistan recently undertook the first-ever systematic review of digital person-to-government (P2G) payment efforts from across the globe. What did they find, and what are the implications for future P2G digitization efforts?Blog

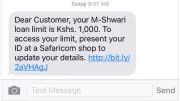

Time to Take Data Privacy Concerns Seriously in Digital Lending

Digital credit is on the rise in Kenya. While digital lenders are expanding access to credit for many Kenyans, they are operating outside regulation by any financial sector authority–and some key consumer protection concerns have started to emerge.Blog

Wave Money Myanmar: The Power of Smartphone Design

Myanmar has experienced remarkable growth in smartphone penetration compared to other frontier markets. A partnership between Wave Money, CGAP and Small Surfaces is leveraging human-centered design to build a digital finance app, seeking to capitalize on this opportunity to reach the unbanked.Blog

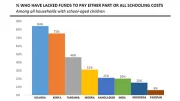

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Why We Need to Start Talking about Operational Inefficiencies

To contribute to sustainable development, microfinance itself must be sustainable. Many microlenders–including mature and/or highly profitable ones–still have ample capacity for significant efficiency gains, yet efficiency considerations are usually not among their top concerns. Why?Blog

The Power of Smartphone Interfaces for Mobile Money

An initial set of 21 principles for the design of smartphone interfaces and mobile money has been released. This powerful new area of research can harness the power of smartphones to better serve the poor.Blog

How Financial Inclusion Can Boost a Nation’s Health & Well-Being

Low-income households often struggle with health expenses, and inadequate access to quality health care can drive families into poverty. To achieve good health and well-being, UN Sustainable Development Goal 3, financial inclusion can and should play a critical role.Blog