Recent Blogs

Blog

An Innovator’s Dilemma: Teaching Mobile Payments

The hard work of educating customers about mobile payments is increasingly falling to start ups offering services like water and solar. In Ghana, Safe Water Network is showing how this can be done in partnership with providers.Blog

Pay-as-You-Drink: Digital Finance and Smart Water Service

A pilot in Ghana is showing that the pay-as-you-go solar model can be adapted to change how water is delivered to poor customers.Blog

Can Uganda Reduce Financial Exclusion to 5% in 5 Years?

Here's what you need to know about Uganda's new financial inclusion strategy, which aims to cut financial exclusion from 15 to 5 percent by 2022.Blog

A Digital Finance Prescription for Universal Health Coverage

Digital finance is just beginning to realize its potential in the health care sector. Take a look at some early examples of how digital financial services are contributing to the goal of universal health coverage.Blog

Water, Water Everywhere, Costs More Than You Might Think

Digitized water credit can help poor families overcome the often high upfront costs of connecting to safe water and sanitation systems, helping them to lead healthier lives.Blog

How Can Pay-as-You-Go Solar Work for Poor People?

Averaging $0.40 a day, pay-as-you-go solar energy is affordable for many people — but not everyone. We looked at the costs and benefits of several tactics providers have used to make solar affordable for low-income households.Blog

Who Are Kenya’s Financially Excluded?

In Kenya, where nearly everyone knows about mobile money and a majority live within walking distance of an agent, why do nearly 2 in 10 adults lack access to formal financial services? And what can be done to reach them?Blog

Keeping the Lights On: Repayment Challenges in PAYGo Solar

Research in Cote d'Ivoire, Ghana, Kenya and Tanzania reveals some of the top reasons pay-as-you-go solar borrowers stop repaying their loans.Blog

Flexible Finance: What Can We Learn from PAYGo Lenders?

Pay-as-you-go solar lenders have developed a uniquely flexible financial product that benefits low-income customers with erratic incomes.Blog

Stuff Matters: Rethinking Value in Asset Finance

What's the value of lighting a home? For many low-income pay-as-you-go solar customers, it is not necessarily about saving money or generating income.Blog

Are PAYGo Solar Companies a New Type of Microfinance Institution?

Are PAYgo solar companies a new breed of microfinance institution (MFI)? Many are engaged in a number of MFI-like activities and could benefit from lessons learned in the more mature MFI sector.Blog

Schools in Africa Aren’t Taking Advantage of Mobile Money – Why?

Mobile money can make paying school fees easier and cheaper, so why aren't more schools adopting it? Part of the solution could involve a simple app for inexpensive smartphones and tablets.Blog

Bridging the Humanitarian and Development Divide

Building financial inclusion goals into humanitarian programs could have long-term benefits for aid recipients.Blog

Meeting Education Finance Needs in Rural Uganda

In Uganda, CGAP partnered with a solar company to better understand the education finance needs of rural customers and explore how pay-as-you-go solar companies can get into education financing.Blog

4 Ways Digital Finance Can Help Bring Clean Water to All

Over 3 billion people lack access to piped water in their homes. There are a number of ways digital financial services can help achieve access to clean water and sanitation for all.Blog

Solar Energy: A New Frontier for Microfinance

What if the institution that financed your business could also light up your house? Microfinance institutions are getting into pay-as-you-go solar, bringing microfinance into consumer lending.Blog

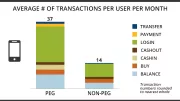

Daily Energy Payments Powering Digital Finance in Ghana

New evidence from Ghana suggests that pay-as-you-go solar customers are becoming more active mobile money users.Blog

The SDGs and CGAP’s Future Direction

The approval of the SDGs in September 2015 coincided with CGAP’s organizational strategy refresh. While this strategic thinking process is still ongoing, here are three clear directions for CGAP's future work that build on the themes in the SDGs.Blog

Women’s Financial Inclusion: A Down Payment on Achieving the SDGs

Ensuring that women have access to formal financial services can help to address many of the economic gaps between men and women worldwide. World Bank Group's Gender Strategy puts women’s economic empowerment—and the financial services necessary to achieve it—high on the agenda.Blog