Recent Blogs

Blog

Smartphones and Mobile Money: Is the Conventional Wisdom Wrong?

There is a wide consensus that smartphones will change how financial services reach poor people. However, there are three components of conventional wisdom that call for more critical examination.Blog

Cocoa Producers in Côte d’Ivoire: Cash vs. Digital

Branchless banking presents an enormous opportunity for smallholder cocoa producers in Côte d’Ivoire, a client segment that contributes to up to 10% of the countries GDP.Blog

Savings Groups Fuel Digital Design for Smallholders in Rwanda

Interviews with over 75 farmers, banking officials, traders, co-ops, and savings groups in Rwanda offer key insights to drive the design of new digital financial services and products.Blog

Four Ways Energy Access Can Propel Financial Inclusion

Now that mobile money platforms have become widespread, the private sector is using these services to power the delivery of additional services, such as pay-as-you-go (PAYG) solar energy.Blog

Financial Innovation and Solar Power: Conquering Energy Poverty

Early evidence suggests that more people can get electricity with the help of financial innovation. There are two key ways financial innovation is expanding access to electricity around the world.Blog

Five Things Any Youth Savings Program Needs

Women’s World Banking and Banco ADOPEM present five key lessons about serving youth with financial services.Blog

India’s List of Financial Inclusion Efforts Grows

Since India's Prime Minister announced in February that accounts opened under his national scheme exceeded targets and 41 payments banks applications were submitted, the list of centrally-driven policy interventions has continued to stack up.Blog

Which Markets are Ready for Digital Finance Plus?

Innovative businesses are leveraging Digital Finance Plus to link poor communities with essential services. The success of these businesses is driven by multiple market factors. We explore which factors matter most based on a framework CGAP developed with McKinsey.Blog

Can Technology Push Microinsurance Further? 4 Reasons to Say Yes

There is great potential to better design and market insurance products for poor customers. A recent study by CGAP suggests that despite progress, four key opportunities across the insurance value chain are underexplored.Blog

From More Accounts to More Account Activity in India

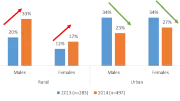

Even as India moves aggressively to close the financial inclusion gap, the picture of financial inclusion in that country as captured in the latest Findex report reminds us that we have a long way to go.Blog

The ‘Ripple’ Effect: Why an Open Payments Infrastructure Matters

As the payment sector contemplates new infrastructure, lessons from open infrastructure approaches give an indication of how to remove barriers in financial services and foster innovation and growth in payments.Blog

Microinsurance: Disrupt, Fail, Repeat?

Many of the most-trumpeted initiatives in the microinsurance industry have failed to survive the past decade. With challenges far outweighing successes, the industry’s soul-searching holds implications for other emerging industries serving the BOP.Blog

Unlocking Access to Critical Services Through Digital Payments

New solutions are emerging that use digital finance to provide essential services for people in places where the traditional models have failed them.Blog

Empower the Customer to Choose and Use Financial Services

A new CGAP Brief reflects on the concept of customer empowerment and its role in increasing uptake and use of digital financial services.Blog

EasyPaisa: Incentivizing Mobile Wallet Usage in Pakistan

The majority of mobile money customers in Pakistan prefer to transact via agents. However, registered mobile money accounts are critical for financial inclusion.Blog

Digital Financial Inclusion in India: Taking Off in 2015

Trends in the Indian financial services landscape are unleashing the potential to fast-track financial inclusion for millions.Blog

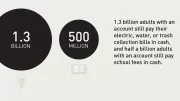

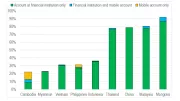

Low Financial Inclusion, High Cash Usage in Myanmar

For the first time, Myanmar was included in the Global Findex survey and analysis. Insights show that although usage of formal services also remains low, cash usage remains high.Blog

Digital Credit: Consumer Protection for M-Shwari and M-Pawa Users

Digital credit products are only going to become a more important element of financial services in emerging markets where expansion of mobile money platforms has created potential borrower segments of millions of consumers that are only an SMS away.Blog

Picking Winners in the Great Remittance Disruption

A convergence of forces offers the opportunity to rethink the traditional remittance model, promising more money, time, and peace of mind for customers.Blog