Recent Blogs

Blog

Beyond Numbers: How One Gaza MFI Emerged from the Rubble

With unemployment rates in Gaza reaching the double digits and the UN estimating that more than three-quarters of the population depends on aid to survive, it’s little wonder that the services of microfinance institution, FATEN, are in such high demand.Blog

PMJDY: Improved Financial Inclusion, But Roadblocks Remain

MicroSave has conducted a study on the progress of the Pradhan Mantri Jan Dhan Yojana (PMJDY), arguably the largest financial inclusion drive in the world.Blog

International Funding for Financial Inclusion: What's New?

CGAP estimates that in 2013 international funders committed at least $31 billion to support financial inclusion, representing an average growth rate of 7 percent per year between 2011 and 2013.Blog

The ‘Uberification’ of Financial Inclusion: What’s Possible?

At CGAP, we want to understand what Uber and other socially interactive business models could mean for financial inclusion.Blog

"It's About Life," Not Just Agriculture

Agriculture is just one of many sources of income for smallholder farmer households. This post focuses on how one family that has dealt with multiple unexpected financial demands and diverse sources of income.Blog

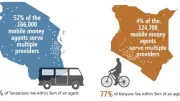

Tanzania: Africa’s Other Mobile Money Juggernaut

Tanzania has seen a rapid spread of mobile money and is hot on the heels of Kenya in terms of uptake and use of digital financial services.Blog

Econet Embraces HCD to Develop Digital Ecosystem for Smallholders

Recognizing the importance of serving smallholder families, Econet Wireless Ltd is investing in financial products and services that overcome the numerous challenges that they face.Blog

Agent Network Expansion: What Can We Learn from Cote d’Ivoire?

The mobile money market in Cote d’Ivoire has boasted impressive acceleration in terms of registered customers, but the number of transaction points in the distribution networks has also seen tremendous growth.Blog

Telenor’s Shared Agents: Digital Finance Catalyst for Bangladesh?

New business models for agent networks, such as shared agent networks, are emerging and may offer more sustainable, competitive and efficient mobile financial services.Blog

Fraud in Uganda: How Millions Were Lost to Internal Collusion

Kampala’s Anti-Corruption Court is at the epicenter of a major mobile money fraud. The very public nature of this case will hopefully lead to some positive outcomes among industry actors in mobile money markets around the world.Blog

What is Digital Financial Inclusion and Why Does it Matter?

A new Brief from CGAP aims to provide national and global policy makers with a clear picture of the rapid development of digital financial services for the poor and the need for their attention and informed understanding.Blog

Mobile Money Moves Forward in Uganda Despite Legal Hurdles

Despite unfavorable financial sector laws, Uganda is among the most successful countries in Africa with regards to mobile financial services (MFS).Blog

Lessons on Customer Empowerment from Women in Rural India

CGAP is seeking to answer questions and test ideas that explore the concept of empowerment and the role it can play in building customer trust and confidence.Blog

How to Measure Results of Financial Sector Development Programs

No single methodology is likely to respond to all the measurement challenges that exist. However, a combination of methods and mindsets may collectively help provide a credible narrative for how a financial market changed and why.Blog

How Tanzania Established Mobile Money Interoperability

Tanzania’s mobile money industry is flourishing. With a new set of standards governing person-to-person payments across multiple networks, it’s now evident that interoperability is here to stay.Blog

What Could Digital Finance Look Like in 10 Years?

CGAP imagines what a digitally-powered, financially-inclusive world could look like in the future.Blog

New Funding Approaches Call for a New Way of Measuring Impact

Marcus Jenal presents guiding principles for changing the fact that monitoring frameworks are still predominantly designed for accountability towards funders rather than as a management and learning tool for the programs themselves.Blog

Sharia-Compliant Microfinance: 5 Takeaways from CGAP's Research

We take a look at five takeaways from CGAP's most recent research on the subject of sharia-compliant products.Blog

Cashless & Cashy: The Yin-Yang of Digital Delivery in Peru

When it comes to delivering financial services to lower income segments in Peru, innovators have struck an interesting balance between cashless and cashy transactions.Blog