Recent Blogs

Blog

Mobile Money in Pakistan: From OTC to Accounts, Part 2

Despite the continued dominance of agent-assisted OTC transactions in Pakistan, it is not all doom and gloom. We note four recent developments that just might trigger a rapid expansion in mobile account usage in 2015.Blog

Five Lessons about Agent Networks in Peru

CGAP recently completed a study of five agent networks in Peru comprising more than 26,000 agents and 24 million monthly transactions to identify key success factors in reaching poor and rural areas.Blog

When Digital Meets Traditional Banking: A New Concept in Senegal

With the launch of Manko in 2013, Société Générale de Banques au Sénégal (SGBS) is one of the few commercial banks that could potentially disrupt the market and redefine the role of banks in Senegal and WAEMU more broadly.Blog

When Clients Inspire Product Design

Grameen Foundation India shares key steps that organizations implementing HCD should incorporate into their projects to optimize chances of success.Blog

Mobile Money in Pakistan: From OTC to Accounts, Part 1

The latest data from the Intermedia Financial Inclusion Insights survey suggests that providers continue to focus on basic over-the-counter (OTC) services. Kabir Kumar and Dan Radcliffe discuss lessons learned from the survey and Pakistan’s potential for digital financial inclusion.Blog

So…What Does HCD Mean for Financial Inclusion?

Human-centered design can help managers understand their customers creatively, iteratively and effectively.Blog

Top 5 Customer Insights from CGAP’s work in Human-Centered Design

CGAP has tried using human-centered design (HCD) to learn from and design better products and services for customers.Blog

Building Big Backbones for Innovation

Building a network of agents across a broad geography has proved to be a huge barrier to entering the digital finance space for small or medium-sized companies. In Bangaldesh and Nigeria, industry giants are building the channels necessary to allow smaller players to get in the game.Blog

Boon for the Base: Crowdfunding for the Base of the Pyramid

Crowdfuding is growing fast. Combined with the continued permeation of internet connectivity - especially via smartphones - and mobile connectivity, crowdfunding holds tremendous potential for entrepreneurs at the base of the pyramid who need access to capital.Blog

Regulation and Innovation: Hand in Hand?

The United Kingdom's Financial Conduct Authority just launched a new approach to dealing with the natural tension between consumer protection, innovation, and ensuring financial inclusion. Project Innovate is the UK's answer to supporting innovation where it could genuinely improve the lives of consumers.Blog

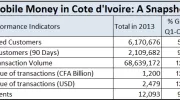

Digital Finance in Cote d’Ivoire: Ready, Set, Go!

On the surface, Cote d’Ivoire may seem like an unlikely contender to challenge the digital financial success in East Africa. However, the country has great potential to be the next digital finance success story.Blog

Can Agents Improve Conditional Cash Transfers in Peru?

Innovations for Poverty Action is working with the Peruvian Government to test conditional cash transfer programs that help poor people save more and receive their payments in more convenient ways.Blog

Apple Pay in Afghanistan: Could US M-Payments Work Abroad?

Mobile payments are a prime example of "reverse innovation," where Western companies draw inspiration from hundreds of mobile money deployments overseas in developing markets.Blog

Digital Currencies and Financial Inclusion: 5 Questions

CGAP's recent experience with BitPesa offers new perspective on some of the key concerns about Bitcoin being used in emerging markets.Blog

Is Digital Finance Hitting its Stride in WAEMU?

Digital finance is advancing in WAEMU, but within the region there are eight countries all with unique markets facing disparate challenges. When it comes to mobile money and financial inclusion, the question for some is "where do you start?"Blog

Digital Currencies and Financial Inclusion: Revisited

Digital currencies are evolving fast, and so is their link with financial inclusion.Blog

Talking Avocados, Spinach & Catfish with a Tanzanian Rice Farmer

Although Gideon, a participant in CGAP's financial diaries of smallholder families research, is technically a rice farmer, much of his income is comprised of income from other crops and and non-agricultural activities.Blog

Does Information Overload Affect Uptake of Financial Services?

When clients receive too much information about new financial services at once, they may avoid making a decision about it, or make a decision without fully understanding a product.Blog

Consumer Protection at the Crux of Takaful Islamic Insurance

A growing need exists to design insurance products that meet the needs of the world's 2 billion Muslims. Takaful insurance is one possible solution, but consumer protection is a challenge.Blog