Recent Blogs

Blog

Wari to Buy Tigo in Senegal: Opportunity for Financial Inclusion?

Wari recently announced plans to acquire Tigo in Senegal, a move that would combine Senegal’s largest over-the-counter agent network with Tigo’s e-money wallet. This acquisition could disrupt the digital finance market in a way that benefits low-income customers.Blog

From Theory to Practice in the Market Facilitation Approach

Market facilitation has become a well-known approach to development, but evidence on how best to apply it in the field remains limited. New case studies from Africa point toward numerous lessons.Blog

Daily Energy Payments Powering Digital Finance in Ghana

New evidence from Ghana suggests that pay-as-you-go solar customers are becoming more active mobile money users.Blog

Market Facilitation: Unpacking New Evidence from Africa

Market facilitation has become a common approach to making financial markets work for the poor. This post kicks off a new series to explore how this approach can be used effectively.Blog

Responsible Digital Credit for Merchants: Insights from Kenya

As digital credit expands rapidly in East Africa and elsewhere, offering credit responsibly is becoming increasingly important. These insights from Kenyan merchants who use Kopo Kopo’s Grow cash advance product point toward some best practices for digital merchant credit.Blog

Why Does M-PESA Lift Kenyans Out of Poverty?

New research shows that access to basic financial services via M-PESA made a difference in Kenya, lifting 2 percent of households out of poverty. Were mobile phones or proximity to agents crucial elements driving the change?Blog

What Does the Future Hold for Youth Savings in Ethiopia?

Over the past five years, PEACE MFI S.CO's Lenege youth savings product has increased access to savings for low-income youth in Ethiopia. What can other financial service providers learn from its experience?Blog

A Public-Private Partnership to Digitize Bus Fares in Rwanda

Digitizing high-frequency or high-volume payment flows–especially to and from government–can support the growth of a national payments ecosystem and progress towards universal financial inclusion. In Rwanda, several initiatives are developing technology-enabled delivery of government services and digitization of corresponding payments.Blog

Liberian Teacher ePayments: Stepping Stones to Inclusion

What if a teacher in rural Liberia could collect her salary instantly and remotely? USAID recently partnered with the Liberian Ministry of Education to roll out the first mobile salary payments, and the preliminary results are extremely promising.Blog

Digital Financial Inclusion Supervision: Tanzania Pilot Program

The world of digital financial inclusion is growing quickly and outpacing capacity and resources to tackle it from a regulatory and supervisory standpoint. In response, CGAP and Toronto Centre piloted the first Digital Financial Inclusion Supervision training program in Tanzania.Blog

Six Tips for Policy on Disruptive Digital Financial Inclusion

Digital technologies are changing the financial inclusion landscape worldwide by revolutionizing access to finance, connecting hundreds of millions to formal financial services for the first time. Financial market regulators, supervisors and overseers are racing to keep pace with these developments.Blog

Digital Finance in WAEMU: What’s New?

CGAP recently interviewed representatives of 100+ organizations in Benin, Côte d’Ivoire, Senegal, Mali and Niger to better understand the market system for digital financial services in the West African Economic and Monetary Union (WAEMU). What have we learned?Blog

Future of Mobile Money for Cocoa Farmers in Côte d’Ivoire, Ghana

New research from the World Cocoa Foundation explores the potential of mobile money to enhance cocoa farmers’ livelihoods in Côte d’Ivoire and Ghana and paints a detailed persona of customers at the frontier of widespread adoption.Blog

Kenya Ends Hidden Costs for Digital Financial Services

In Kenya, many digital financial service providers do not disclose to consumers the costs of products. On October 29, the Competition Authority of Kenya announced an important new standard for pricing in digital financial services.Blog

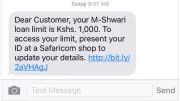

Time to Take Data Privacy Concerns Seriously in Digital Lending

Digital credit is on the rise in Kenya. While digital lenders are expanding access to credit for many Kenyans, they are operating outside regulation by any financial sector authority–and some key consumer protection concerns have started to emerge.Blog

How BOMA Is Using Technology to Reach the Extreme Poor

In 2013, the BOMA Project started moving to a digital data collection system for its programs in Kenya. This system has made data collection less costly, more timely and more reliable, with greater accountability translating into improved results for program participants.Blog

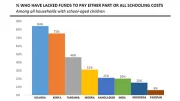

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Digital Credit in Kenya: Time for Celebration or Concern?

There are now more than 20 digital credit offerings in Kenya, with new services launching continually. Hype is building around the potential opportunities these products could bring, but their rapid proliferation is also raising questions about risks.Blog

Delivering on Education for All: The Role of Mobile Money

For many low-income families worldwide, education can be out of reach. Mobile money and digital financial services have the potential to help families by providing them with better tools that can help them save, plan and make education payments.Blog