Market conduct supervisors (MCSs) charged with protecting consumers of financial products and services place great value on identifying, understanding, and tracking industry developments and market-level consumer risks and consumer behavior—the activities collectively known as market monitoring.

Market monitoring shifts the focus of supervisory activities from individual financial services providers (FSPs) to broader—or narrower—markets and their financial consumers. The shift enables market conduct supervisors to gather deep insights into consumer experiences with FSPs and the risks and consequences of that engagement. Market monitoring is a core component of consumer protection approaches focused on customer outcomes and financial health. It is also important to risk-based conduct supervision as it enables supervisors to identify consumer risks across individual FSPs and products, and better prioritize supervisory efforts. Market monitoring is especially valuable in evolving digital finance markets where vulnerable consumers often face heightened risks.

This toolkit has been created to help financial supervisors, supervisory managers, and division head supervisors understand the range of market monitoring tools available to meet their supervisory objectives. It also includes practical guidance for selecting and implementing individual tools. The terms “market conduct supervisor” and “supervisor” are used throughout to represent the authorities, units, and teams that carry out financial consumer protection-focused supervisory activities. The toolkit may also be of value to stakeholders such as consumer associations and funders interested in market monitoring.

H.M. Queen Máxima of the Netherlands

The United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development

Benefits of market monitoring

Gather early insights on consumer experiences and risks

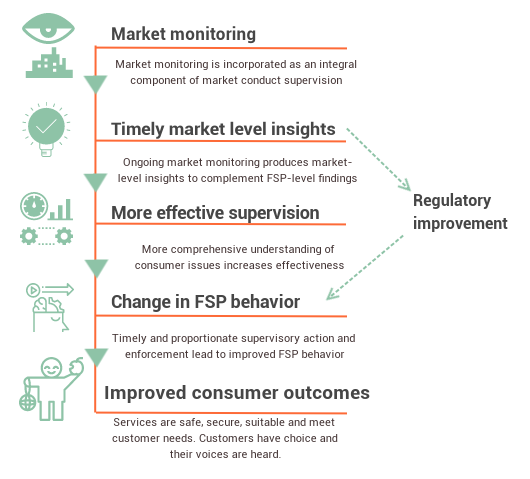

As an MCS, you have a unique opportunity to protect financial consumers and improve FSP conduct to ensure better consumer outcomes and stronger financial health. Market monitoring is a fundamental approach that enables you to gather early insights to better understand, identify, and assess persisting, increasing, or emerging consumer experiences and risks in the market and to take evidence-based actions. Supervisory activities typically include periodic collection and analysis of financial, business, and other FSP-reported data. A range of enforcement powers and tools can be preemptively (before risks materialize) and reactively (after risks have materialized and consumer harm has occurred) used with individual FSPs. Market monitoring can also generate feedback to improve regulations. To be more proactive, preemptive, and forward-looking in your supervisory work, look beyond individual FSPs toward a comprehensive view of what’s happening with consumers in an entire market or sector. For instance, market monitoring may reveal that women’s loan applications are rejected more often than men’s, that women pay higher interest rates than men, and that these differences are greater in the digital credit market. These types of emerging risks and cross-industry findings are the result of market monitoring activities rather than institution-focused supervision.

Figure 1. Theory of change: The role of market monitoring in producing positive consumer outcomes

Increase your efficiency and effectiveness

Market monitoring enables you to proactively and continuously identify consumer risks and other issues that deserve greater attention. This information allows you to prioritize scarce supervisory resources, follow a risk-based supervisory approach, and increase supervisory efficiency and effectiveness. Market monitoring encourages you to take prompt action on rapidly evolving issues that could generate significant consumer distrust or harm at the market level, which may in turn affect your own institutional reputation.

Stay on top of the latest developments

Market monitoring can help you stay abreast of overall market developments, including the use of new technologies (e.g., artificial intelligence for lending and insurance decisions), changes in consumer behavior and preferences (e.g., use of digital payments and channels by vulnerable consumer segments), and consumer satisfaction and sentiment toward FSPs (e.g., negative/positive tweets). Market monitoring is especially useful in contexts where rapid change can affect vulnerable consumers, for example, when digital financial services (DFS) embrace previously excluded and underserved people such as low-income rural and urban women, or where innovative actors bring about new types of consumer issues in DFS. Market monitoring tools like social media monitoring and consumer surveys can produce important insights about rapidly evolving unregulated markets, which may generate significant consumer risks that eventually affect consumers in regulated markets as well.

Broaden your supervisory role

Market monitoring can provide critical input to supervisory dissemination activities, especially those targeting FSPs that do not consistently receive dedicated supervisory attention through inspections or other activities. An FSP’s awareness that it is systematically monitored by a supervisor from a consumer protection standpoint may have a significant positive impact on its conduct toward customers and compliance with consumer protection regulation. Supervisors can communicate key messages, for example, by reassuring an individual FSP that all FSPs are monitored, sharing findings from monitoring activities, illustrating how monitoring has led to supervisory or enforcement actions, clarifying supervisory expectations from FSPs, and clarifying regulatory provisions.

Back to top ↑

How to use this toolkit

This toolkit covers an array of tools for a variety of monitoring purposes. The tools are not mutually exclusive, and an effective market monitoring strategy mixes several different types of tools. The toolkit includes the traditional tools familiar to most supervisors (e.g., analysis of aggregated indicators reported by FSPs through regulatory reports). It also includes tools more commonly used in fields other than financial supervision (e.g., technologies to gather direct consumer insights), as well as tools based on suptech [see suptech Q&A].

The materials in this toolkit can be adapted to your own particular context, including the availability of quality data, staff capacity and skills, supervisory powers and responsibilities, and concurrent priorities. Although CGAP’s goal in creating the toolkit is to provide high-level general guidance, not all guidance fits every context. The inclusion of certain tools, such as those based on suptech, does not imply that CGAP advocates for MCSs to invest in those tools. The one tool we consider to be the most fundamental is the analysis of regulatory reporting data periodically reported by FSPs. Bringing CGAP’s guidance to your own reality is particularly important when using the supporting materials—which are far from definitive recipes. The country cases do not necessarily reflect best practices, rather, they are practical examples of how several types of tools have been implemented in specific contexts. For instance, when using the table of aggregated indicators provided as supporting material under regulatory reporting, it is important to note that not every MCS wants or has the ability to use all indicators. In fact, some use indicators not included in the table.

To the extent possible, this toolkit will be updated with new tools and country cases.

Navigating the tabs of the toolkit

In addition to this introduction page, the toolkit contains a wealth of information spread across four tabs. Hyperlinks displayed at both the top and bottom of pages will enable you to click through to each tab.

This section of the toolkit is based on the experience of market conduct supervisors across the globe. It houses 8 market monitoring tools, including guidance for each tool that describes its characteristics and benefits, the opportunities it may create, how to use it, and its limitations. Each tool is also available for download.

This section includes country cases illustrating how and why a market monitoring tool has been implemented, as well as reflections on implementation benefits and challenges and more. Countries studied are: Ireland, Kenya, Mexico, Portugal, Russia, and Tanzania.

Market conduct supervisors and other stakeholders can adapt the materials in this toolkit based on their individual contexts, the availability of quality data, staff capacity and skills, supervisory powers and responsibilities, and concurrent priorities. This section proposes actions for different actors to strengthen market monitoring for financial consumer protection.

This section includes FAQs on market monitoring and Suptech, content on what standard-setting bodies say about market monitoring and a list of key resources on market monitoring.

Back to top ↑

Acknowledgments

The Toolkit was developed by CGAP’s Juan Carlos Izaguirre, Denise Dias, Eric Duflos, Laura Brix Newbury, Olga Tomilova, and Myra Valenzuela, under the guidance of Gerhard Coetzee and with support from Majorie Chalwe-Mulenga and Antonique Koning. Invaluable editorial contributions were provided by Natalie Greenberg, Eileen Salzig, and Jahda Swanborough.

The case studies would not be possible without contributions from Banco de Portugal, Central Bank of Ireland, Comisión Nacional del Sistema de Ahorro para el Retiro (Consar), Financial Sector Deepening Kenya (FSD Kenya), and International Confederation of Consumer Societies (KonfOp).

The early feedback on the toolkit from Banco Central do Brasil, Bangko Sentral ng Pilipinas, Bank Negara Malaysia, Bank of Zambia, National Bank of Cambodia, Superintendencia de Banca, Seguros y AFPs del Perú; Superintendencia Financiera de Colombia, and OECD Task Force on Financial Consumer Protection was key in shaping the toolkit. Special thanks to peer reviewers Silvia Baur-Yazbeck, Ivo Jenik, and Alice Negre from CGAP and Aute Kasdorp from the World Bank.

Rights and Permissions

Attribution—Cite the work as follows: Izaguirre, Juan Carlos, Denise Dias, Eric Duflos, Laura Brix Newbury, Olga Tomilova, and Myra Valenzuela. 2022. “Market Monitoring for Financial Consumer Protection.” CGAP toolkit. Washington, D.C.:CGAP. https://www.cgap.org/marketmonitoring.