This is the first post of a series on the emerging branchless banking data architecture. The series aims to explore the landscape of supply and demand-side data gathering efforts with the related goals of (i) identifying gaps in the data architecture; (ii) moving toward consensus – where it makes sense – on the correct indicators and methodologies to track progress and understand client value; and (iii) developing a common agenda for data collection and measurement as the branchless banking and mobile money industry continues to mature and improve. The series coincides with the recent release of the data by the IMF collected through its Financial Access Survey (FAS) and will include contributions from the Bill and Melinda Gates Foundation, CGAP, GSMA, Intermedia, MIX and UNCDF. We hope to also gather the perspectives of other members of the field through discussion on the blog.

The importance of data

Data is crucial for policy and decision-making, as it provides an analytical base to understand the workings of the markets and systems where policy decisions have their impact. Those of us in the field of financial inclusion are constantly trying to find better ways to improve our understanding of the 2.5 billion people excluded from the formal financial system worldwide, and the various ways they engage with branchless banking and digital financial services. We base all our impressions, hunches, and theories from things we read and interactions in the field but we need data to sort through these impressions and theories and select the ones that will lead to good decisions. During the last couple of years as financial inclusion has become a policy priority for governments and a larger number of branchless banking deployments reach scale, institutions such as CGAP, the Bill and Melinda Gates Foundation, GSMA, IFC, MasterCard Foundation, MIX, UNCDF, and USAID have worked to develop a conceptual understanding of the most meaningful branchless banking and financial inclusion indicators that will assist the industry in tracking and monitoring its development and impact more effectively. That said, the job of defining a measurement and data collection agenda for our field is far from done.

A young entrepreneur analayzes some data

A young entrepreneur analayzes some data

Photo Credit: Jay Bendixen

This first post in this series lays out a conceptual map of the data landscape and takes a closer look at the supply-side data gathering efforts worldwide. It is important to note that while various initiatives have begun to look at the wider financial inclusion data architecture from the

supply and

demand-side, branchless banking and mobile money data is still missing from many datasets or is poorly represented. This is due partly to a lack of common definitions and indicators, but also because branchless banking with all its regulatory nuances and rapidly changing commercial landscape is new and neither easy to define nor measure. This in itself highlights even more the importance of enhancing data collection efforts by using the right indicators and definitions, which will lead to more effective, measurable and scalable interventions.

• This map is just a sampling of data sources – mostly in Branchless Banking and Mobile Money.

Beyond ATMS

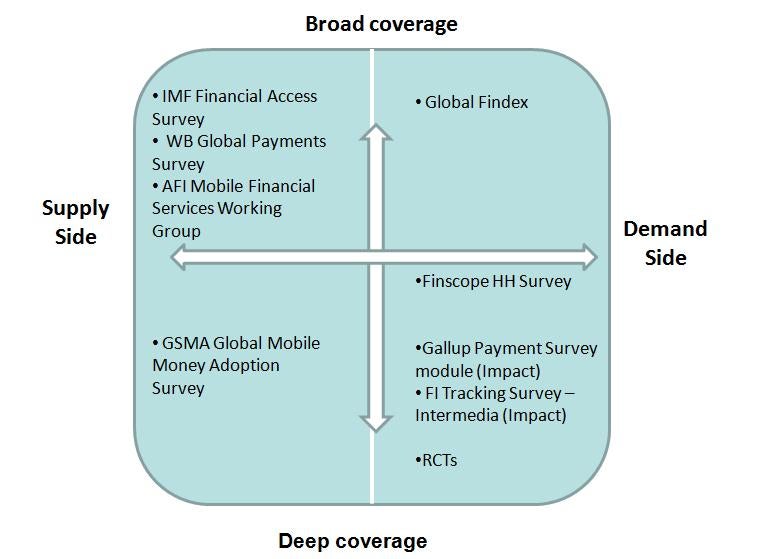

Figure 1 is a representation adapted from

Financial Access 2011 and Bill & Melinda Gates Foundation “

Measurement Challenge” note prepared for the 2010 Global Savings Forum. It orients global and multi-country financial inclusion data initiatives on a conceptual map, which includes sources with data on branchless banking and mobile money. It is organized by data source (demand- or supply-side) and depth/breadth of coverage. Broad coverage initiatives provide data on a basic set of indicators in a large set of countries, while deeper coverage initiatives include a larger number of indicators, usually on one or more specific dimensions of financial inclusion (Mobile Money) in a small set of countries.

Financial service providers, the supply-side, track the services they deliver as part of their everyday business. This provider data can often include total numbers of loans or savings accounts, the types of products, points of service (number of bank branches, number of branchless banking and mobile money agents) and even in some cases aggregated numbers of registered and active mobile money customers or other usage measures.

There are three main supply-side financial inclusion data sets which contain data relevant to branchless banking and mobile money. These include the IMF Financial Access Survey and the World Bank Global Payments Survey which has broad coverage (global) and the GSMA Global Mobile Money Adoption Survey which has deeper coverage on around 40% of mobile money implementations worldwide.

- GSMA Global Mobile Money Adoption Survey: While the number of mobile money worldwide is hovering around 140, the number of customers who are actually using these services has been notoriously difficult for anyone to measure. In 2011, MMU initiated a global survey to give managers of mobile money deployments better insights into the performance of their service relative to others. Fifty-two service providers from 35 countries participated in the first iteration which included data such as number of registered and active customers, and agents’ transaction volumes across different types. While this database is not public, MMU has published an analysis of the aggregated results and will be releasing the results of the second survey in February.

- Financial Access Survey: The FAS is one of the main sources of global supply-side data on financial inclusion, encompassing internationally-comparable basic indicators of financial access and usage. It provides policy makers and researchers with annual geographic and demographic data on access to basic consumer financial services worldwide. Its database currently contains annual data for 187 jurisdictions, including all G20 economies, covering an eight-year period (2004-2011), and totaling more than 40,000 time series.

- World Bank Global Payments Survey: Now in its second iteration, the Global Payments survey is a comprehensive survey carried out by the World Bank’s Payment Systems Development Group in 139 countries. The outcomes are expected to guide reform efforts in the payment system arena both nationally and globally. The survey is increasingly adding a retail payments focus, capturing number of POS devices, ATMs and type of transactions.

While each of these sources brings needed data and insight, they all have their own shortcomings and draw backs as well. In particular, supply side data often has trouble identifying clients and thus provides little information on who is served, and can even result in double counting when one individual opens accounts with multiple institutions. Further, even though some branchless banking data is already captured in these supply-side surveys, a large gap still exists. The GSMA Global Mobile Money Adoption Survey covers mobile money implementations (the majority of them MNO-led) but does not capture card-based deployments that serve the poor through agents. Moreover, the data is only publicly -available at the market-level and not at the deployment-level as there is currently little incentive for deployments to make their figures public. Likewise, the nuanced regulatory environment in many countries makes it challenging for a survey like FAS to capture the full spectrum of branchless banking providers. FA surveys regulators who collect data on financial service providers such as banks and MFIs, but excludes other providers such as MNOs and third-party providers, including data from their respective agent networks. Most regulators do not collect geo-spatial referenced data on supply points either, a concept which has shown much potential for financial inclusion tracking (

see this post.) Also, even within FAS, the collection of “financial inclusion” indicators can be challenging given a large number of regulators do not collect these types of indicators.

In the arena of supply side data collection, financial regulators are key players as they are already collecting data from the market. Going forward we expect to see better collection of financial inclusion data from regulators, including a focus on mobile and branchless banking as a result of initiatives supported by organizations such as the

Alliance for Financial Inclusion (AFI) and the

G20’s Basic Set of Financial Inclusion Indicators.

One thing is certain, regardless of the type of service or product launched, it is evident there is a need for improving data sharing to take advantage of the synergies between various providers or organizations involved in the branchless banking space. This includes the sharing of questionnaires, benchmarks and definitions across industry.

Next week, we will examine the role of demand-side data sets in this emerging data architecture taking a closer look at the three main demand-side financial inclusion data sets with a significant degree of branchless banking and mobile money information.

A young entrepreneur analayzes some data

A young entrepreneur analayzes some data

Comments

In order to move from the

In order to move from the current antiquated system to an environment in which the information necessary for policy makers and managers to make informed decisions is being produced and is easily accessible, the Governor and the Legislature should work together and with others to establish a State Data Initiative that would: (a) develop an overall vision for data collection, analysis, and dissemination in the state of Indiana; (b) develop a plan for implementing the Initiative; (c) confirm and prioritize the data needs of the state; (d) improve the quality, quantity, and usability of data being produced by and for state government and other stakeholders; (e) provide for the interpretation and analysis of that data; and (f) facilitate the dissemination of the data and analysis.

The Governor and Legislature should seek the involvement of the state’s universities, business and non-profit sectors, and the public to help shape and implement the Initiative.

Such an initiative would be composed of three primary phases: (1) the planning phase; (2) the implementation phase (parts of which could begin while other aspects are still in development) that will require relatively modest investments by the public sector with perhaps some private sector contributions as well; and (3) a continuing phase that would require regular budgets for the data/research units of state agencies and other data producers to support expanded and improved data collection, analysis, and dissemination activities,

gr. - traprenovatie

Add new comment