COVID-19 BRIEFING: Insights for Inclusive Finance

|

How should financial regulators shape their response to the COVID-19 pandemic in overseeing microfinance institutions (MFIs)? What factors should they consider to help poor people and micro- and small enterprises survive the crisis? Building on CGAP’s regulatory framework for MFIs developed earlier in the COVID-19 crisis, this Briefing develops five guiding principles for regulating MFIs in ways that mitigate the impacts of COVID-19 and examines responses in India, Pakistan, Peru, and Uganda. |

While the COVID-19 pandemic has affected nearly every business sector and region of the world, CGAP is particularly concerned with the implications of the crisis for poor people and micro- and small enterprises (MSEs) in developing countries. This Briefing specifically addresses the regulatory response to the pandemic as it affects microfinance providers (MFPs) and their clients. We focus on regulated MFPs as defined in the CGAP Typology of Microfinance Providers.

In a previous COVID-19 Briefing, we proposed five guiding principles for regulators as they balance immediate damage reduction and relief objectives against medium- and long-term goals for the microfinance sector.1 These principles are summarized in Box 1 and are further elaborated throughout this paper. While specific to microfinance, the principles largely are consistent with banking sector guidance issued by standard-setting bodies, the World Bank, the International Monetary Fund (IMF), and the European Banking Authority (EBA). For reference and comparison, the Annex provides a summary of that guidance.

BOX 1. Guiding Principles for RegulatorsCGAP envisioned five principles to guide regulators as they respond to the impacts of the COVID-19 crisis on the microfinance sector. 1. Pro-poor. Poor customers benefit from effective relief and continued access to services, and they are protected. 2. Clear and predictable. Response measures have a clear timeline, scope of application, and exit strategy. 3. Broad coverage. Response measures cover all regulated MFPs. 4. Preserve the safety and soundness of MFPs. Response measures balance the benefits and risks of regulatory changes. 5. Adjust supervision. Response measures reduce supervisory burdens while enhancing risk-based monitoring. |

The paper spells out what the principles mean for regulatory responses to the COVID-19 crisis. It also aims to:

- Illustrate how specific measures may be guided and assessed in light of the five principles.

- Identify trade-offs authorities may face in applying the principles.

- Assess the extent to which these microfinance-specific principles are consistent with general crisis response guidance.

- Draw lessons relevant to the design of responses to COVID-19 and other crises that may arise in the future.

Our analysis centers on India, Pakistan, Peru, and Uganda, whose challenges are further explored in separate country notes.2 We complement the main analysis with examples of measures adopted in additional countries,3 along with broader, non-microfinance-specific guidance in the Annex.

A few caveats are in order. First, although fiscal relief is important in shoring up crisis affected MFPs and their customers, our analysis is confined to the regulatory/supervisory sphere. Second, our research is limited to publicly available information, such as regulatory documents, and insights gathered through exchanges with stakeholders. While we collected as much material as possible on the four countries of focus, we cannot ensure a complete picture in every case. Details on supervisory responses have been particularly difficult to obtain since they are not always made public. Lastly, the crisis is still unfolding. Countries continue to adapt their initial responses—often devised under extreme pressure—to new developments. Information quickly ages, and rapidly moving events must be understood within the broader sweep of a global crisis.

Applying the five principles to country contexts

PRINCIPLE 1: PRO-POOR.

POOR CUSTOMERS BENEFIT FROM EFFECTIVE RELIEF AND CONTINUED ACCESS TO SERVICES, AND THEY ARE PROTECTED.

A pro-poor regulatory response would:

- Directly reach low-income households and MSEs, or reach them through the MFPs that serve them.

- Tailor relief measures to address the distinct challenges of poor people, especially women.

- Protect poor customers against risks arising from or heightened by the pandemic—and from the measures taken to address it.

Reaching poor people

Even when poor households and MSEs are not the specific focus, regulatory responses should be inclusive enough to cover these groups. However, this may prove difficult since poor people face the highest levels of financial exclusion. Moreover, they often depend on nonbank MFPs, which may not automatically benefit from crisis measures. It is important for regulatory relief to cover all types of regulated MFPs that serve or potentially serve poor people. Our discussion of Principle 3 focuses on the scope of MFP coverage.

Where MFPs fail as a result of the pandemic, it is critical to ensure service continuity and protect small depositors. While often not systemically important from the regulator perspective, MFPs are the backbone of the extended financial services network that reaches those unserved or underserved by conventional banking, especially women. Some MFPs serve a large number of poor customers and MSEs and may be the predominant or sole provider in a region. In this regard, they can be considered “systemic.” Without special targeting, systemic MFPs may not receive the level of supervisory attention necessary to protect poor customers—especially depositors—from the worst effects of institutional failure. Principle 5 addresses the issue of early action and orderly resolution.

Regulation and supervision set key conditions for the nonregulatory (e.g., fiscal) crisis response that targets poor people. Where a framework is adverse it may hamper the distribution of fiscal benefits to the poorest individuals or heighten the risk of exposure to the virus. This scenario arises where social benefits are distributed only through bank branches, when agents are not permitted to stay open during the pandemic, or when unbanked beneficiaries cannot remotely open accounts.4 Moreover, providers may be tempted to use government guarantees to lend to large or medium-size businesses rather than MSEs and poor customers—thereby partly defeating the purpose. Avoiding undesired outcomes requires monitoring by financial authorities of how providers are using fiscal support to reach poor people.

Tailoring relief measures to poor people

Ensuring that poor people are reached is not enough. Certain measures need to be tailored to account for the special profiles and circumstances of poor customers. For instance, it is vital to provide MFPs with the flexibility to define business hours or to change operational procedures (e.g., group meetings, loan approvals, savings withdrawals) during the pandemic, especially for those active in rural or peri-urban areas.

Customized debt relief measures may be necessary. Payment moratoria have often been applied equally across customer segments. While poor people may be covered, they likely are more vulnerable than other borrowers. Some specific vulnerable segments may benefit from blanket moratoria with clear opt-outs that ensure borrowers have a choice.5 Regulators should also consider instituting “full payment holidays,” i.e., moratoria with no interest capitalization or accrual. Another aspect to consider is including in relief programs borrowers who were delinquent even before the crisis. Principle 4 addresses this type of scenario.

Customer choice: Tailored pro-poor approaches present trade-offs. For instance, it may not be possible to offer customers the choice to continue paying off loans under original loan terms and ensure that those who need immediate debt relief receive it. Requiring customers to apply for relief or make such a choice before receiving a benefit may mean that many do not get it, including those most vulnerable such as women who depend on agricultural livelihoods (Koning, Anderson, and Bin-Humam 2020). To ensure respect for customer choice, moratoria can be applied on an opt-in basis, as in India, Pakistan, Uganda, and many other countries.

In contrast, an opt-out approach prioritizes immediate provision of relief. Peru has allowed lenders to reschedule loans in bulk without the borrower’s prior agreement or knowledge. Borrowers may opt out by contacting their lender. Another rapid relief approach allows MFPs to apply moratoria based on an informal agreement with the borrower (such as via a phone call) and obtain their signature only after the loan has been rescheduled. The Uganda Microfinance Regulatory Authority (UMRA) has adopted this type of policy. Another possible approach would simply apply moratoria to poor borrowers without prior notice and adopt a targeted approach for other clients.

Each option has its benefits and drawbacks. No empirical evidence exists to show which works best for poor people. Customization and targeting could introduce delays. The regulator’s decision should take into account factors such as the urgency of providing relief to certain customer segments; the likelihood of poor customers being aware of and having the ability to apply for a moratorium (e.g., given patchy telecom and transport networks); and their capacity to understand and compare options. Regulators may also exercise flexibility in reviewing and adjusting measures based on the results of early implementation.

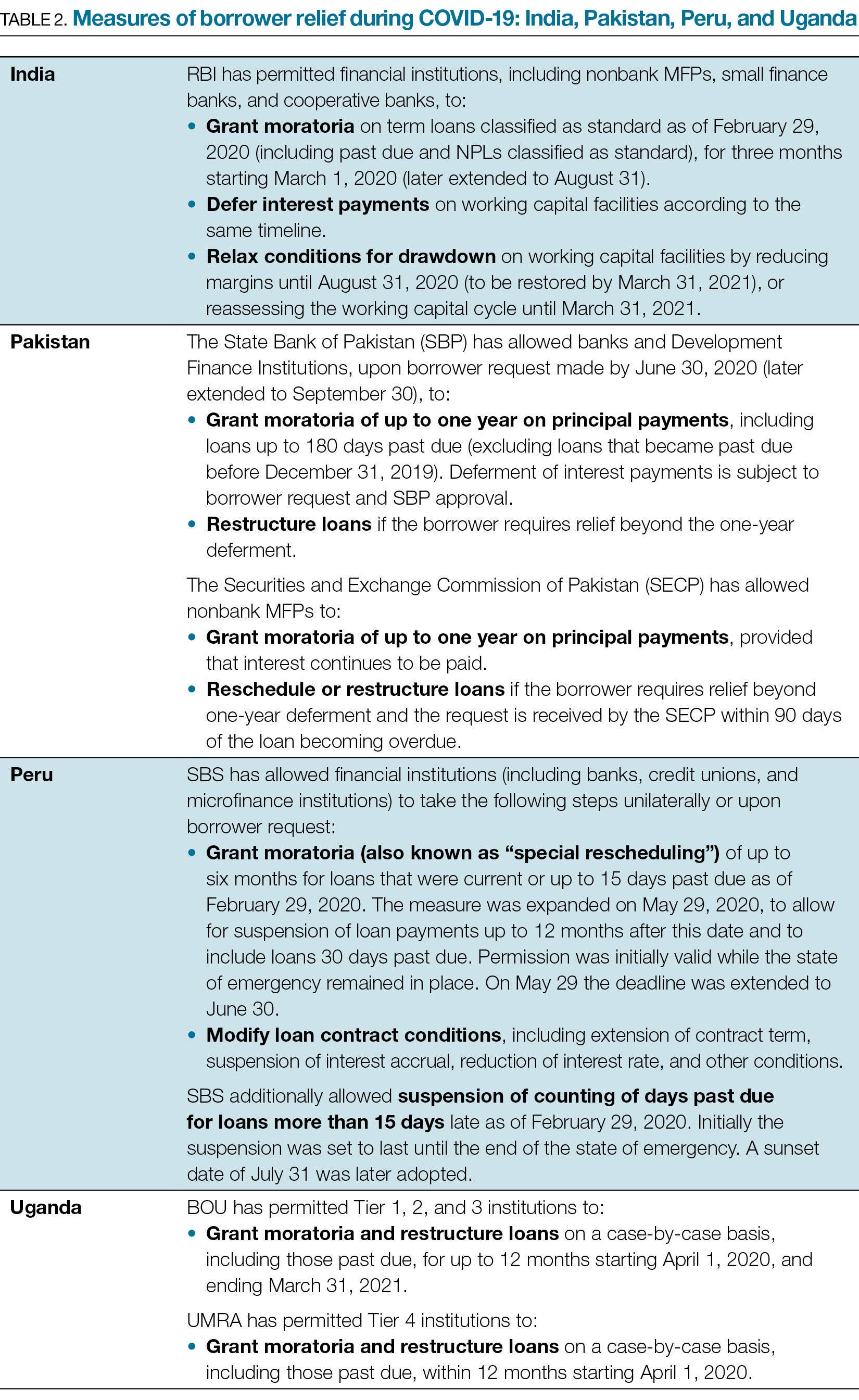

Deferred interest: The regulator’s approach to interest accrual and capitalization is also of deep importance to poor people. Moratoria often suspend principal and interest payments, but interest still accrues. Borrowers gain immediate relief but must later pay back an increased balance. Another option is to suspend interest accrual throughout the moratorium, i.e., provide a payment holiday. Here the borrower gains maximum relief but the cost of the moratorium is increased for MFPs. Table 1 illustrates measures taken in India, Pakistan, Peru, and Uganda.

Table 1 illustrates the approaches taken on three points: (i) whether interest is accrued during the moratorium over the unchanged principal; (ii) how accrued interest is paid after loan repayments are resumed; and (iii) whether MFPs capitalize deferred interest payments, thus charging interest on the sum of interest accrued during the moratorium. Poor borrowers and MSEs may not be able to meet the significant increase in their obligations when the moratorium lapses. This in turn may damage their credit history and reduce their future access to finance. Paying deferred amounts in a lump sum immediately after a moratorium ends can be particularly difficult for customers and at the same time heighten MFPs’ credit risk and financial soundness. Borrowers also may not fully understand the consequences of deferment. These issues require regulatory guidance, and none of the four focus countries has fully addressed them. Regulatory guidance ideally would provide maximum relief for the most vulnerable borrowers by limiting sudden additional burdens at the end of a moratorium.

Customer relief is not always consistent with keeping MFPs afloat. The greater the relief extended to borrowers during and after a moratorium, the more MFPs themselves need parallel relief, including repayment moratoria from creditors, liquidity support from the central bank or government, and adjustment of prudential requirements. Principle 4 further discusses the potential risk of debt relief and related measures on the safety and soundness of MFPs.

Digitization: Digital channels enable continuity by allowing access to services when restrictions on movement and branch closures are implemented for health reasons. Authorities in India and Uganda have encouraged the general public to use digital channels. Peru has increased transaction and account balance limits for basic accounts. Pakistan has waived interbank charges, simplified client authentication, increased transaction and balance limits, and enabled digital onboarding of agents. In Uganda, the central bank has allowed the largest mobile money provider to waive customer fees—a practice that in normal times may be considered anti-competitive. In countries such as Rwanda and Kenya, regulators have reduced or eliminated mobile money transaction fees.

Not all MFPs are linked to a country’s digital rails and many low-income customers may not be connected at all. Some countries still lack digital networks. In these contexts, measures that significantly limit in-person or cash transactions can disproportionately hurt poor people and those unable to conduct digital transactions for other reasons.6 Measures to facilitate digital transactions are generally worth considering, as well as measures to address the related risks and problems facing poor customers (e.g., weak connectivity, digital illiteracy, limited privacy), especially poor women and other vulnerable groups.

Protecting poor customers

Regulatory responses and business practices in the context of the pandemic raise a host of consumer protection issues. This section briefly addresses several.7 Protective measures so far adopted include:

- Deferring debt collection.

- Prohibiting lenders from charging fees for crisis-related loan restructuring.

- Protecting the borrower’s credit score from downgrades based on crisis-related restructuring.

- Requiring providers to act in the borrower’s interest when restructuring loans.

- Temporarily prohibiting fees on accounts opened for government-to-person (G2P) payment purposes.

- Forbidding increases in the interest rate or extra collateral for restructured loans.

Each of the four focus countries has adopted one or more of the measures noted above.

Clarifying the rules on deferred principal and interest should ease the repayment burden for poor borrowers and MSEs while helping cushion the impact of deferral on the health of MFPs (see Principle 4). Prohibiting MFPs from discriminating against borrowers who benefit from debt relief (a step Mexico has taken) would offer further protection. If regulators do not issue official guidance, they should at least monitor how MFPs address deferred payments and take action, if warranted. Authorities should watch for signs of stress due to increased loan obligations among low-income borrowers and MSEs. It may be useful to engage civil society and consumer advocates and to require MFPs to communicate proactively and clearly with borrowers (e.g., informing customers of options and likely consequences), as suggested in Rhyne (2020).

The trade-offs between providing urgent relief and upholding consumer protection rules are reflected in a number of adopted measures. In Peru, to facilitate COVID-19-related G2P transfers, financial institutions are temporarily permitted to open accounts in bulk without customer choice or consent. E-money issuers are also temporarily exempt from fund safeguarding rules—a measure aimed at easing account openings and digital transactions during the pandemic.

It is important to mitigate the consumer risks introduced by crisis measures. The Peruvian regulator has prohibited financial institutions from imposing fees (for one year after G2P disbursements) on accounts opened without prior customer consent. A further safeguard may be to place the burden on MFPs to confirm the client’s intention to keep the account open immediately upon complete fund withdrawal or perhaps within the year following. Increased monitoring could help regulators decide on additional measures to mitigate the risk of relaxing fund safeguarding rules for e-money accounts.

During the course of the pandemic, poor customers may be more vulnerable to the heightened risk of abuse and scams linked to transaction accounts and digital transactions, for example, charges improperly deducted from G2P payments (Boeddu et al. 2020). They may not be aware of or have access to complaint procedures. Protective measures could include prohibiting deductions from G2P payments, requiring immediate reimbursement of unauthorized transactions up to a certain value, enhanced monitoring of bulk account openings, warning people how to identify and act on scams, and participating in crossborder enforcement actions (Medine 2020).

Ensuring a pro-poor crisis response means upholding existing consumer protection regulations, except in limited cases. It includes continued enforcement of rules against unauthorized fees, discrimination, overly aggressive lending, insurance sales, and debt collection practices. It also requires MFPs to effectively address consumer complaints.8

PRINCIPLE 2: CLEAR AND PREDICTABLE.

RESPONSE MEASURES HAVE A CLEAR TIMELINE, SCOPE OF APPLICATION, AND EXIT STRATEGY.

Clarity and predictability mean that response measures should be unambiguous and should state which institutions and services are covered in the scope of application. Predictability requires clear timeframes, end dates or sunset clauses, and rules for reestablishing the precrisis status quo (i.e., an exit strategy). There may be a trade-off between quick crisis response and clarity and detail in the adopted measures. But improvements and clarifications can be made after response measures are first announced.

Response measures in the four focus countries largely have been unambiguous, but gaps do exist. For example, conflicting decisions at the national and state or local levels in India have created confusion about which types of institutions can operate during lockdown. It also has been unclear whether MFPs in India can charge fees or require extra collateral for restructuring, and whether nonbank MFPs are considered beneficiaries of bank debt relief. In Uganda, uncertainty arose on the question of whether UMRA-regulated MFPs were allowed or mandated to apply a moratorium. Levels of detail in regulatory guidance have also varied. For example, not all countries have spelled out prudential and accounting treatment for loans that benefit from moratoria or special restructuring.

Lockdown periods and extensions have been unpredictable as they necessarily shift with the course of the pandemic. In light of this, two main approaches to moratoria have emerged: a relatively short, renewable moratorium (e.g., one month) or a longer-term moratorium that provides a fixed sunset date and is less likely to require multiple renewals (e.g., one year). There is no consensus on which approach is better.

The focus countries diverge on approaches to moratoria. India uses the short, renewable approach. The effective period for moratoria or loan restructuring by MFPs is tied to implementation schedules, including renewals, of virus containment measures at the national level (e.g., lockdowns and restrictions on movement). Pakistan and Uganda take the second approach, with some variations in detail. In Pakistan, loan extensions provided by September 30, 2020 can last up to one year. In Uganda, loan extensions can span the 12 months beginning April 1, 2020, or be granted (and terminated) at any time during that period. Peru takes an intermediate approach: Financial institutions may grant moratoria up to six or 12 months (depending on whether relief is granted before or after May 29, 2020), beginning any time lockdown is in effect.

Cutoff dates for determination of prerelief loan status (e.g., current, delinquent) have been clearly stated in all four focus countries. However, not all have determined an exit strategy or a date by which to reestablish modified regulations.

PRINCIPLE 3: BROAD COVERAGE.

RESPONSE MEASURES COVER ALL REGULATED MFPs.

Broad coverage means inclusion of all regulated MFPs, on equal terms, to the greatest extent possible. This creates a level playing field for MFPs and ensures that microfinance customers continue to be served and to benefit from crisis relief.

A level of customization is important when measures cover a diversity of MFPs. Providers could, for example, be given the flexibility to set crisis-period service hours that differ across regions. Further, some could gain priority in liquidity support allocation according to systemic relevance, scope of activity, and other factors. While central bank liquidity support is usually limited to banks, the Bank of Uganda (BOU) created a specific instrument to support the deposit-taking nonbank MFPs under its purview. Zambia adopted a similar measure. In Uganda and Peru, all MFPs, including cooperatives that serve rural and very low-income customers, have been permitted to operate since the start of the national lockdown. In contrast, millions of nonbank MFP customers in India and Pakistan had zero access to microfinance services during early phases of the crisis.

The case for differentiation in coverage is clearest where risk variation is most significant. Supervisory monitoring and resolution procedures should be adjusted to reflect the risk profile of each MFP and the extent to which poor communities depend on its services. Further, bank supervisors usually have more current and detailed data on the loan portfolio, liquidity, and capital of their MFPs than nonbank MFP supervisors. This may affect the nonbank supervisor’s ability to take timely action and guide the industry through a crisis, including early interventions that would minimize the impact on poor customers.

Broad coverage on the basis of uniform risk-based principles strongly contrasts with haphazard treatment driven by a patchwork of regulatory domains. Where different types of MFPs fall under separate authorities or departments within an authority, unequal treatment may result from a lack of coordination in crisis response. In India and Pakistan, for example, banks were declared essential services while nonbank MFPs were subject to state-level lockdown decisions. As a result, many remain closed. In Pakistan (but not India), nonbanks fall under a different regulator than banks. By contrast, while measures in Uganda were largely the same for MFPs under BOU and UMRA, BOU has provided a greater level of detail, increasing clarity and predictability.

PRINCIPLE 4: PRESERVE THE SAFETY AND SOUNDNESS OF MFPs.

RESPONSE MEASURES BALANCE THE BENEFITS AND RISKS OF REGUL ATORY CHANGES.

Regulators need to strike a balance between urgent relief and core long-term priorities such as preserving the safety and soundness of MFPs, repayment culture among borrowers, and transparency in financial disclosures by MFPs. These priorities apply both before and after relief has been granted. Regulators can achieve a balance by strictly monitoring portfolio quality and requiring MFPs to continuously assess borrower repayment capacity and recovery prospects. Further, while the regulator can offer temporary flexibility in applying prudential standards, this should be balanced by strict limitations on discretionary MFP payments, for example, dividends and bonuses. These steps are justifiable in the context of crisis but must be temporary—and counterbalanced by special risk-management and monitoring measures.9

International financial institutions, standard-setting bodies, and supervisory authorities such as EBA have issued guidance for regulatory response to COVID-19 (the Annex provides a summary). Although the guidance addresses commercial lending, it may be a useful reference for regulatory responses in the microfinance sector as well. We use the World Bank’s guidance as a reference point in analyzing debt relief measures (see Box 2). The guidance emphasizes flexibility in treating crisis-affected borrowers while highlighting the need to uphold prudential fundamentals, for example, definitions of nonperforming loans (NPLs).

The four focus countries do not consistently practice the guidance noted in Box 2. In some cases, the first point in the guidance may be unrealistic. MFP supervisors in developing countries (and in some emerging markets) may not have current, detailed data to estimate the impact of relief measures. This data gap adds to the time pressure. The World Bank urges governments to obtain prior input from financial regulatory authorities. Coordination is key for a common, consistent, clear message, especially to borrowers, about the exceptional nature of the measures.

BOX 2. World Bank guidance on COVID-19- related borrower relief measures• Regulators should have a thorough understanding of the financial impact of relief measures prior to adoption • Relief should be temporary and exceptional, with a clear exit strategy • Regulators should avoid extending the life of “zombie” borrowers and rewarding the moral hazard of willful defaulters • Regulators should uphold fundamental prudential standards and definitions • Lenders should provide supervisors with reliable, frequent, up-to-date, and comparable information on loans that have benefitted from relief measures • Financial statements should provide sufficient information on the quality of the loan portfolio and credit risk control practices Source: Dijkman and Salomão Garcia (2020) |

Zombie borrowers and willful defaulters

According to the World Bank (Dijkman and Salomão Garcia 2020), borrower relief should target those with strong payment records who have been temporarily unable to repay loans exclusively due to the pandemic. The intent is to mitigate the risks related to (i) willful defaulters, i.e., those who have the means to repay but refuse to do so and (ii) “zombie borrowers,” i.e., those who were delinquent prior to the crisis and are unlikely to repay. Thus, special prudential treatment should be limited to loan restructuring that directly results from moratoria. Relief policies need to avoid extending flexibility to most other kinds of restructuring, including of past-due loans. Table 2 summarizes debt relief measures in the four focus countries.

In this sample, Pakistan, Peru, and Uganda have extended the scope of special prudential treatment (e.g., permission not to downgrade a loan) to loan restructuring beyond the application of moratoria. A different example comes from Mexico, where the regulator has encouraged MFPs to consider additional relief such as forgiving interest owed. While regulators should not allow lenders to extend the lives of loans that were unlikely to be repaid from the start of the pandemic,10 an excessively strict interpretation of the World Bank guidance could pose problems. For example, it would not permit restructuring that could provide greater relief to poor borrowers under a moratorium, such as suspension of interest accrual or noncapitalization of interest accrued during the moratorium.

Past due loans in the four focus countries can benefit from moratoria under the following conditions:

- India: Loans past due and NPLs classified as “standard” as of the date of the granting of the moratorium

- Pakistan: Loans past due for up to 180 days as of June 30, 2020

- Peru: Loans past due for up to 15 days as of February 29, 2020, and loans past due for up to 30 days as of May 29, 2020, for the moratorium granted on or after this date

- Uganda: Loans past due as of April 1, 2020

These loosely targeted policies reflect trade-offs in locales where relief must urgently be adopted. Such an approach presents potentially important advantages for microfinance in the crisis context. It enables relief to reach borrowers in outlying areas and those who may not receive notification quickly enough to opt in. This method further can provide immediate support to cash strapped MSEs and informal workers who have suddenly lost income. It can accommodate any borrower whose delinquency is a direct result of their inability to pay due to lockdowns.

There also may be country-specific reasons to include MFP borrowers who were delinquent before the pandemic hit, within limits. First, farmers affected by floods and locust invasions in Uganda prior to the outbreak, for example, may be as likely to recover as those whose loans were current when the COVID-19 crisis hit. Second, microfinance borrowers in a given area may expect equal treatment by the same MFP or even all MFPs that serve a community. Furthermore, low-income borrowers (even those with a perfect repayment record) may decide to hold onto scarce liquidity as a hedge against uncertainty instead of paying off their loans. Some urban MFP customers in Uganda have reportedly taken this approach. Technically these examples would be considered zombie borrowers or willful defaulters, as defined by the World Bank, even though their situation may not lead to default post-crisis.

Upholding prudential and transparency standards

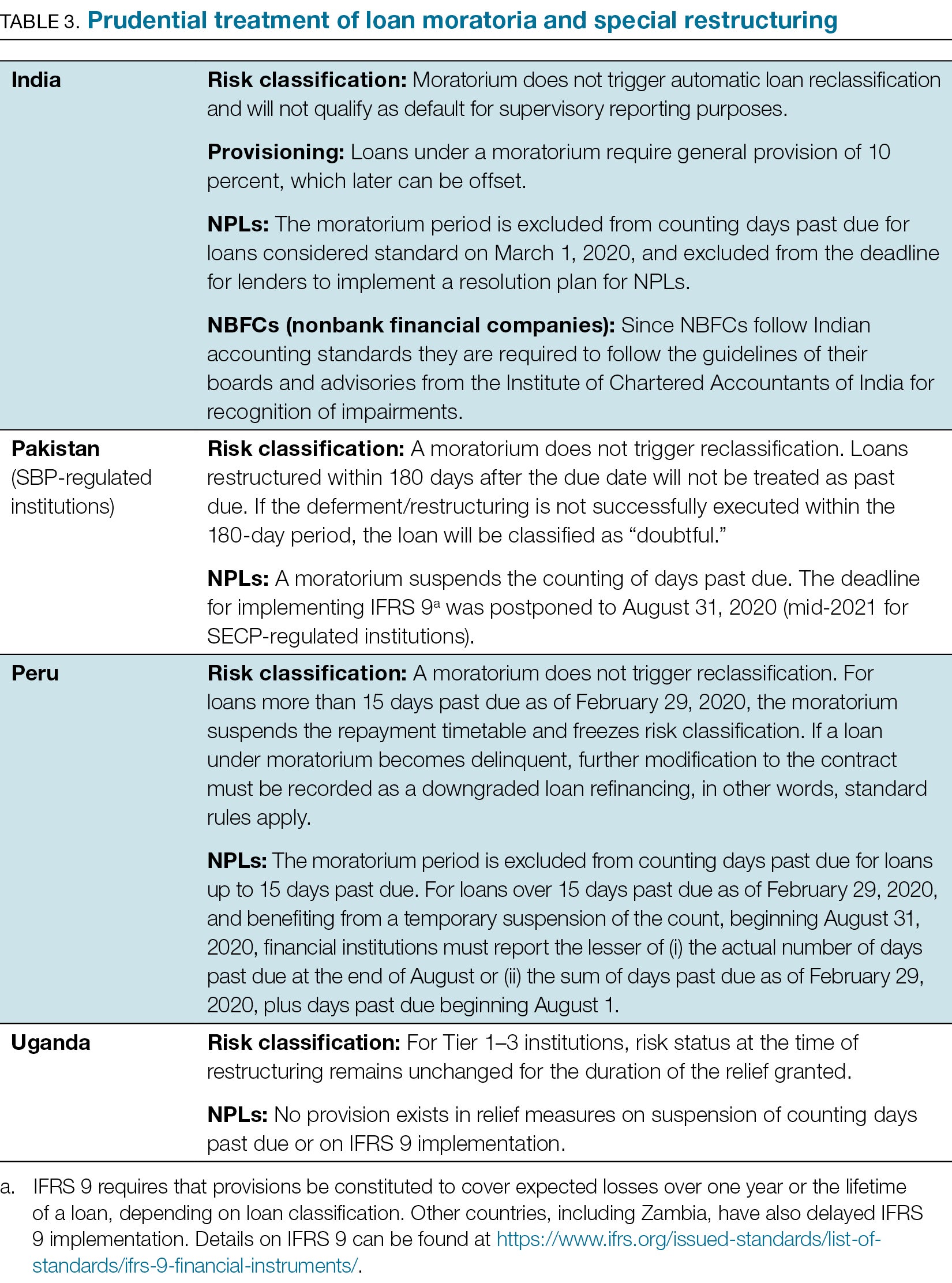

Borrower relief programs may be difficult to reconcile with the normal practices that fully uphold prudential and transparency standards. The four focus countries have kept loan risk classification and provisioning rules largely unchanged while allowing flexibility in the regulatory treatment of moratoria. Flexibility is necessary to shield MFPs from sudden major increases in loan loss provisions and capital requirements, which would further reduce liquidity and undermine their capacity to support recovery among low-income segments.

Under the regulations of our focus countries, the granting of relief does not automatically trigger loan reclassification. In all cases, the moratorium suspends the counting of days past due for purposes of NPL classification for affected loans.11 To balance flexibility with prudential safeguards in India, RBI imposed a uniform provision of 10 percent for all loans benefiting from moratoria. Any excess provisioning can be offset later against actual loan performance. Table 3 summarizes the prudential treatment of moratoria and crisis-related restructuring in the focus countries.

Special prudential treatment of debt relief covers loans that were past due before the COVID-19 outbreak hit. In Uganda, relief measures seem to have frozen risk classifications for the duration of relief granted irrespective of changes in the borrower’s payment capacity. This could mean a freeze in loan classification for up to one year in that country. Credit profiles also have been protected. A combination of these measures unfortunately could put at risk both the repayment culture among microfinance borrowers and the safety and soundness of MFPs. In Pakistan and Uganda, where relief can be granted during a defined timeframe, it is not clear whether the same loan can be restructured more than once within that period. We would normally expect subsequent restructurings to fall within standard forbearance rules, i.e., triggering reclassification and higher provisioning.

Two approaches to credit reporting have emerged (FinRegLab 2020). The first, suppression, has MFPs not reporting the application of relief such as moratoria. In Uganda, for example, credit reporting was suspended for Tier 1–3 institutions during the moratorium period. This could create an information gap that negatively impacts borrowers in the future and reduces the credibility of credit information. The second approach calls for data on relief granted to be reported (e.g., a special standardized flag or code), with the necessary safeguards to neutralize the effect on a good borrower’s credit. This allows the credit information system to reflect a borrower’s true position.12

For Tier 4 institutions, Pakistan, Peru, and Uganda have determined that relief should not negatively affect a borrower’s credit profile. However, these countries have stopped short of detailing how relief reporting—if any—must be carried out. In Peru, information reported to the SBS credit register must include details on loans that benefit from a moratorium but it should not negatively impact a borrower’s credit rating.13 While it may be difficult to ensure that borrowers will not be affected in the future due to reporting, regulators should consider the potential risk of not requiring any reporting at all. (Risk may be difficult to address if the credit information system provides only default information as opposed to both negative and positive information.) Moreover, not reporting or flagging relief granted may be seen as unfair to borrowers who continue repaying loans during a moratorium.

In the area of public disclosure, only India has issued guidance for reporting the impact of debt relief measures in the financial results of regulated entities. Specific disclosures (e.g., criteria applied to moratoria on large loans) are to be included in the notes section of financial statements. By contrast, MFPs in Mexico are required to disclose within financial statements the accounting standards used for granting relief—along with results that would have been achieved had standard prudential rules been applied to affected loans.14 As previously noted, the Peruvian regulator set up an off-balance sheet subaccount to record figures on principal, interest, and accrual, along with write-offs. It has yet to issue rules for public disclosure.

Other prudential measures

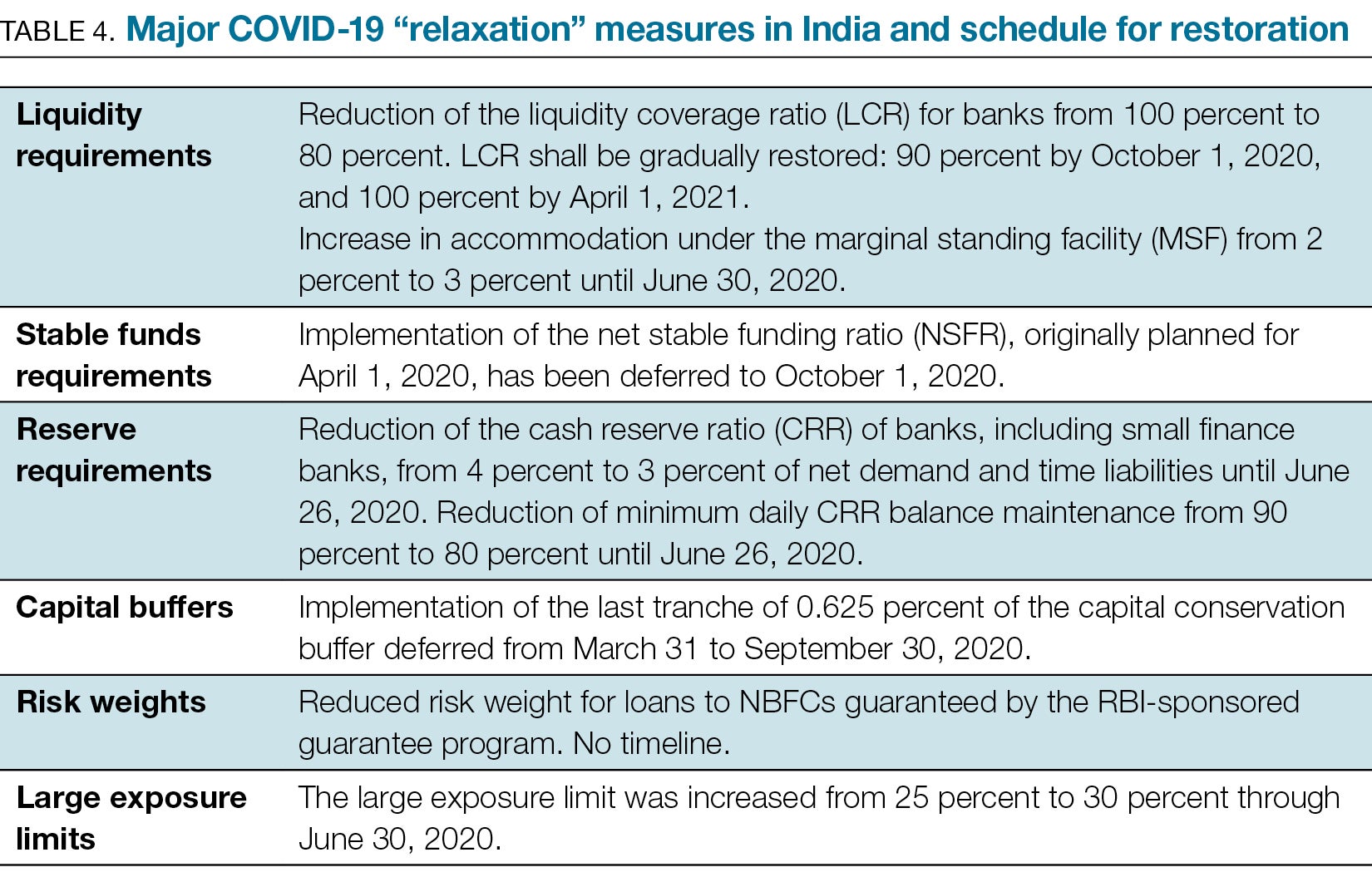

India, Pakistan, and Peru have taken other prudential measures, such as temporary relaxation of liquidity and reserve requirements and release of capital buffers. These countries have also reduced risk weights for loans guaranteed by the government. Pakistan reduced collateral requirements, increased the maximum debt burden ratio, and permanently increased bank exposure limits on SME loans. All four focus countries have coupled prudential relaxation with limits to discretionary distributions such as dividend payments, share buybacks, bonuses, and increases in executive compensation. Only in Peru do these limitations apply to all MFPs. India applies the limitations only to banks, while Pakistan and Uganda apply them to central-bank-regulated banks and nonbanks.

As far as exit strategies, Table 4 shows how India has defined a schedule for restoring prudential ratios to precrisis levels. Brazil has taken a similar approach.

PRINCIPLE 5: ADJUST SUPERVISION.

RESPONSE MEASURES REDUCE SUPERVISORY BURDENS WHILE ENHANCING RISK-BASED MONITORING.

Crisis-hit MFPs have been exposed to potential liquidity shortfalls, sharp drops in loan repayments, and runs on deposits. While response measures are meant to alleviate the pressure, the risk of instability and failure remains high. Supervisors should monitor key safety and soundness indicators, following a risk-based approach. They should be ready to intervene proactively before an institution becomes troubled. Yet the reality is that supervisors themselves are operating on contingency arrangements, with most staff working from home. Many MFP supervisors also lack the reliable data that are crucial for early problem detection. Overall, supervisory processes need to be adjusted to reduce nonessential burdens on authorities as well as MFPs.15

Reduce or defer nonessential supervision activities

Both MFPs and financial authorities are focused on dealing with the immediate crisis. MFPs may be conducting stress tests that trigger actions by senior management or their board, including discussions with the supervisor and creditors. They have activated contingency plans to ensure continuity with fewer on-premises staff while complying with restrictions on in-person client interactions. Many have enhanced physical and digital security protocols. These and other activities beyond the normal scope make MFPs less available to respond to supervisory demands.

All focus countries except Uganda have publicly announced measures to reduce the burden on MFPs—which often lightens the supervisor’s burden as well:

- RBI in India and Peru’s SBS have extended timelines for submitting regulatory returns.

- Pakistan’s Securities and Exchange Commission extended deadlines for nonbank MFPs to hold annual general meetings and may accept delays in submitting regulatory returns upon request.

Tighten monitoring

Supervisory relief should be balanced with enhanced scrutiny in key areas. This is necessary to protect the stability of the microfinance sector, the safety and soundness of MFPs, and the interests of depositors and borrowers. Measures include enhanced monitoring of MFP liquidity and portfolio quality (Peru, Uganda), with specific reporting of deferred and restructured loans (India, Peru), and frequent communication with MFPs (Uganda). In Peru, SBS has requested that institutions submit a “management plan” that classifies loans by risk (i.e., low, medium, high but viable, high unviable), by type (e.g., corporate, consumer), and by moratorium status (i.e., individually granted, in bulk, or nonrescheduled). Institutions must also set a schedule for reviewing and identifying loan quality deterioration.

As Principle 1 notes, it is important to closely monitor consumer protection issues during the pandemic. This enables authorities to address the increased risk of scams and fraud, aggressive sales and debt collection, and other abuses. None of the four focus countries has publicly announced supervisory measures in this regard. However, the Peruvian regulator has relaxed deadlines for providers to respond to consumer complaints while prioritizing resolution of complaints that financially impact consumers. This may come at a cost to consumers, diminishing their input to consumer protection authorities. Heightened risk in this area is highlighted by actions such as Peru’s (SBS) issuance of four consumer warnings on fraudulent schemes, including pyramids.

A special challenge for microfinance supervision is the disparity sometimes noted in the levels of expertise and resources between bank and nonbank supervisors. This difference may exist even when entities are under the same authority. Obtaining timely and accurate data may be more difficult for nonbank supervisors, especially in developing countries. In these contexts supervisors often oversee small MFPs that have low levels of digitization. While larger institutions justifiably attract greater supervisory scrutiny, MFP supervisors may be especially constrained in their ability to monitor MFP loan portfolios affected by the COVID-19 crisis. Here, the issue is not equal treatment but managing expectations and effectively allocating resources.

Lastly, proactive monitoring is critical for anticipating and minimizing the impact of MFP failures. Many MFPs across the globe were weak prior to the pandemic while others have since become troubled. Orderly resolution of MFPs is essential to protect small depositors and ensure service continuity.16 Preparedness requires not only proactive supervisory monitoring but agreed-upon powers, procedures, and coordination mechanisms for resolution. The limitation here is that the implementation of resolution frameworks is often focused on systemic banks, which means that most MFPs would go straight into the liquidation phase. But, as previously noted, MFPs often provide essential services to a certain segment of the population or a particular region and may be critical for financial inclusion. It may be worth considering the application of some elements of resolution regimes, in principle designed for systemic institutions, to the most important of these MFPs to reduce the negative impacts of failure on poor consumers. A special concern is increasing the supervisor’s ability to detect problems that are brewing while they still can be fixed. Where a deposit-taking MFP is not covered by a deposit insurance scheme, there is further reason to consider this step.

The way forward

The five principles discussed in this Briefing are intended not as a blueprint but as a series of guideposts for regulators. They offer decision criteria for the many instances where emergency response potentially clashes with the objectives of financial inclusion and a credibly regulated and supervised microfinance sector. Decisions must be made on tradeoffs and about how to serve long-term goals and values while taking the urgent short-term steps that may contradict them. The principles will prove their value to the extent they aid stakeholder thinking on the adoption of crisis response measures, the adjustment (and eventual phase out) of measures over time, and the potential to incorporate measures into contingency plans.

The principles offer a way forward, but it must be acknowledged that the COVID-19 crisis poses serious challenges. Indeed, especially in developing countries, longstanding unresolved issues have often exacerbated the impact of the crisis and make it difficult to follow the principles. Preexisting issues include:

- Regulatory and supervisory fragmentation without sufficient collaboration among different regulatory authorities or departments within the same authority.

- Lack of depositor protection mechanisms for MFP depositors.

- Shortfalls in supervisory capacity and data.

- Low levels of digitization in the microfinance sector.

- Weak linkages between MFPs and other financial and payment services providers.

- Inadequate contingency plans and business continuity arrangements for MFPs and microfinance supervisors.

These points of vulnerability need to be understood in order to fairly assess the results of current crisis measures and to plan for the next phases.

It is clear that certain vulnerabilities are inherent to emergency regulatory measures. First and most obviously, regulation by itself can solve only a limited set of problems. Fiscal measures such as government loan guarantees and liquidity facilities are equally important—perhaps even more so in the short term. In addition, the nonregulated microfinance sector is largely beyond the reach of regulatory measures, which raises the question of whether some large unregulated institutions should become regulated. Second, regulatory relief—particularly that directed to borrowers—poses significant risk in terms of abetting the deterioration of portfolio quality, reducing the transparency of financial disclosures, and weakening incentives for borrowers to repay loans.

Looking forward, there are also prospects for positive change. The COVID-19 crisis has exposed numerous constraints and vulnerabilities. Microfinance stakeholders across the globe now have tremendous opportunities for improvement and for learning. Seizing these opportunities should strengthen responses not only in the current crisis, but in emergencies that arise, inevitably, later on.

Successfully navigating the hazardous landscape of the pandemic, as we have argued, requires guideposts. These include such principles as ensuring that emergency measures are clear and predictable, provide broad coverage, and are consistent with safety, soundness, and consumer protection objectives.

Adhering to the pro-poor principle may pose the stiffest challenges. These range from the difficulty of targeting poor people, to the relatively low levels of connectivity among poor people and service providers, and the weakness of consumer protections in crisis measures. To address these challenges it will be important to gather insights from MFP customer databases, collecting data on the difficulties consumers face and on the effects of crisis measures. Client views can then be brought into the ongoing process of adjusting emergency response and forward-looking policy, regulatory, and supervisory development. Regulators should also consider a more customer-centric approach to consumer protection, where their focus shifts from reactive enforcement of provider compliance with prescriptive rules to proactive assessment of customer results or outcomes generated by providers (Izaguirre 2020).

Finally, heightened vigilance is critical for containing the crisis and ensuring recovery. This means slimming down nonessential supervisory processes while concentrating on monitoring key indicators, especially leading indicators of MFP financial health and consumer protection indicators. One challenge we find is that the nonbank supervisors who oversee most MFPs appear less equipped than their banking counterparts to exercise the necessary vigilance. To the extent that robust data collection and close monitoring are possible, trouble could be detected and treated early. The resultant understanding of the crisis and its outcomes can then be shared at the policy level, helping drive the effort to “build back better” toward a more resilient microfinance sector.

View Annex >>

--

1 We use the terms “regulator” and “supervisor” interchangeably in this paper to refer to financial regulatory and supervisory authorities.

2 Our selection of countries is purely illustrative. They may not necessarily exhibit best practices, but they do cover a wide range of responses that have impacted the microfinance sector.

3 See https://www.cgap.org/research/data/microfinance-covid-19-examples-regulatory-responses-affecting-microfinance-providers.

4 Jenik, Kerse, and de Koker (2020) discusses regulatory tools for rapid account opening during the pandemic.

5 This has also been described as a moratorium “by default” in “Consumer Protection and COVID-19: Borrower Risks as Economies Re-Open” (Rhyne, forthcoming).

6 This concern has led the UK’s Financial Conduct Authority (FCA) to closely monitor access to cash by underserved communities since the start of the pandemic.

7 CGAP is conducting further research on consumer protection issues facing borrowers as a result of the pandemic.

8 There is evidence from the Philippines that complaints have increased significantly during the crisis. More generally, complaint channels appear to have taken relatively low priority in the crisis response, and they may have become less accessible.

9 In addition to allocating zero risk weight to loans backed by government credit guarantee schemes, the only other permanent prudential measure we have documented among the four focus countries is Pakistan’s decision to raise the exposure limit for banks on loans to SMEs from $800,000 to $1.1 million.

10 Avoiding what is known as “window dressing” or “evergreening.”

11 In Peru, suspended counting of days past due for a limited period was also granted to loans that did not receive a moratorium.

12 This is to uphold the General Principles on Credit Reporting (World Bank 2011). The International Committee on Credit Reporting (ICCR) has made specific recommendations for the treatment of debt relief extended in the context of the COVID-19 pandemic (ICCR 2020).

13 In the United States, loans deferred under the COVID-19 relief (CARES) Act are not to be reported as past due (FinRegLab 2020).

14 Most financial authorities worldwide have yet to issue specific rules for public disclosure on borrower relief measures in the context of the COVID-19 pandemic. Some recently have done so, such as EBA, which on June 2, 2020, imposed temporary additional reporting and disclosure templates for payment moratoria and forbearance measures (EBA 2020c), in addition to preexisting rules for disclosure of nonperforming and forborne exposures (EBA 2018).

15 See Toronto Centre (2020) guidance on business continuity for supervisors during the COVID-19 pandemic.

16 “Resolution,” as employed here, includes (i) recovery by action of the troubled institution (as required by the supervisory authority); (ii) the intervention of a resolution authority to ensure continuity of critical functions, secure funds to reimburse depositors, and wind up the entity; and (iii) liquidation. For MFPs, it is particularly important for the supervisor to be authorized to take early action to intervene and conduct the resolution as an administrative matter (i.e., not as a formal legal proceeding).

To view full list of references, please see PDF.

|

This Briefing was prepared by a CGAP team that included Denise Dias, Juan Carlos Izaguirre, Patrick Meagher, and Stefan Staschen, under the overall guidance of Stephen Rasmussen. |