Recent Blogs

Blog

It's Time to Slow Digital Credit's Growth in East Africa

New research from Kenya and Tanzania reveals that digital credit is often used for consumption purposes and that delinquency and default rates are high, suggesting funders of digital credit markets should prioritize consumer protection.Blog

A Digital Platform to Manage Out-of-Pocket Health Care Expenses

The M-TIBA mobile health wallet combines savings, remittances and other digital financial services to help low-income customers cover health care expenses.Blog

What Can Traditional Giving Teach Digital Fundraising Platforms?

What can today’s digital fundraising platforms learn from long-held traditions of giving? We spoke with givers in Kenya to find out.Blog

Bringing Health Microinsurance to Kenyans via Mobile Phone

Bundling microinsurance with other mobile financial products is making health insurance more affordable and useful for low-income patients in Kenya.Blog

East African Interoperability: Dispatches from the Home of M-Pesa

Kenyans can now send money between the country's two largest digital wallet services, Airtel and M-Pesa, the latest step toward interoperability in East Africa.Blog

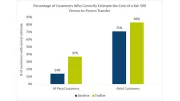

Kenya’s Rules on Mobile Money Price Transparency Are Paying Off

Kenya's pricing transparency rules have made customers more aware of the costs of using certain digital financial services, according to a new CGAP survey.Blog

Kenya’s Digital Credit Revolution Five Years On

It's been five years since Kenya launched its first digital credit solution. A new CGAP survey shows that one in four Kenyans has taken a digital loan, mostly for working capital and day-to-day consumption.Blog

A Digital Finance Prescription for Universal Health Coverage

Digital finance is just beginning to realize its potential in the health care sector. Take a look at some early examples of how digital financial services are contributing to the goal of universal health coverage.Blog

Who Are Kenya’s Financially Excluded?

In Kenya, where nearly everyone knows about mobile money and a majority live within walking distance of an agent, why do nearly 2 in 10 adults lack access to formal financial services? And what can be done to reach them?Blog

Keeping the Lights On: Repayment Challenges in PAYGo Solar

Research in Cote d'Ivoire, Ghana, Kenya and Tanzania reveals some of the top reasons pay-as-you-go solar borrowers stop repaying their loans.Blog

In Kenya, Bank Accounts Again More Popular than M-PESA – Why?

Bank accounts today once again outnumber mobile money accounts in Kenya -- by over 30 percent. Innovations like PesaLink have helped banks achieve this growth, showing that banks can thrive in the face of mobile money.Blog

Mapping Africa’s Latest Innovations in Digital Finance

CGAP received nearly 200 proposals from digital financial services providers across Africa interested in piloting new products. A look at those proposals — from 30 countries — shows that innovations are spreading beyond hot spots like Kenya.Blog

Digital Credit: Data Sharing Can Improve Product Diversity

In a CGAP and M-Kopa pilot in Kenya, customers with greater control over their credit histories took up more credit and were more likely to pay it off in full.Blog

Traders in Refugee Camps: Overlooked Opportunity in Bulk Payments

Lolem Boyo Emilat is a trader in Kenya’s Kalobeyei settlement, where mobile payments have transformed her small business. Could bringing mobile money to more traders like Lolem be an overlooked opportunity to advance financial inclusion?Blog

Do Peer-to-Peer Lenders Understand Risk?

A growing number of novice investors are starting to lend to their peers on digital platforms. New research out of Kenya suggests that providers may need to fundamentally rethink how they inform these lenders about risk.Blog

Market Facilitation Is the Way Ahead, but It Needs to Do More

What does FSD Kenya's experience over the last 10 years reveal about how to make market systems work for the poor? Here are three takeaways.Blog

From Theory to Practice in the Market Facilitation Approach

Market facilitation has become a well-known approach to development, but evidence on how best to apply it in the field remains limited. New case studies from Africa point toward numerous lessons.Blog

Responsible Digital Credit for Merchants: Insights from Kenya

As digital credit expands rapidly in East Africa and elsewhere, offering credit responsibly is becoming increasingly important. These insights from Kenyan merchants who use Kopo Kopo’s Grow cash advance product point toward some best practices for digital merchant credit.Blog

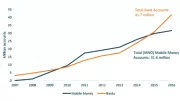

Why Does M-PESA Lift Kenyans Out of Poverty?

New research shows that access to basic financial services via M-PESA made a difference in Kenya, lifting 2 percent of households out of poverty. Were mobile phones or proximity to agents crucial elements driving the change?Blog