Recent Blogs

Blog

Time to Take Data Privacy Concerns Seriously in Digital Lending

Digital credit is on the rise in Kenya. While digital lenders are expanding access to credit for many Kenyans, they are operating outside regulation by any financial sector authority–and some key consumer protection concerns have started to emerge.Blog

How BOMA Is Using Technology to Reach the Extreme Poor

In 2013, the BOMA Project started moving to a digital data collection system for its programs in Kenya. This system has made data collection less costly, more timely and more reliable, with greater accountability translating into improved results for program participants.Blog

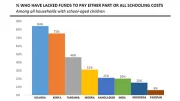

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Digital Credit in Kenya: Time for Celebration or Concern?

There are now more than 20 digital credit offerings in Kenya, with new services launching continually. Hype is building around the potential opportunities these products could bring, but their rapid proliferation is also raising questions about risks.Blog

Delivering on Education for All: The Role of Mobile Money

For many low-income families worldwide, education can be out of reach. Mobile money and digital financial services have the potential to help families by providing them with better tools that can help them save, plan and make education payments.Blog

A Tale of Two Markets

For people in sub-Saharan Africa getting by on $2-$5/day, on the cusp of poverty but not yet secured in Africa’s middle class, are economic challenges more easily weathered in formal or informal markets?Blog

Agents for Everyone: Removing Agent Exclusivity in Kenya & Uganda

Mobile money and banking agents blend seamlessly into the daily economic lives of consumers in countries like Kenya and Uganda, offering convenience and expanding access points to financial services. But agent exclusivity clauses can limit customers' choices.Blog

Understanding Customer Inactivity with Customer Data from Kenya

Account dormancy among mobile money users is an industry-wide problem. WSBI is working to understand the driving forces behind customer inactivity in Kenya.Blog

Achieving Financial Access through Village Banking and Data

In its work towards Universal Financial Access (UFA) by 2020, WSBI is using data to improve understanding of customer behaviors and needs.Blog

Digitizing Agricultural Value Chains: How Buyers Drive Uptake

Most companies don’t want to be the first in a sector to try something new and potentially unpopular. Dominant buyers must lead the way to drive large-scale mobile money uptake by smallholder farmers.Blog

New Data Finds Mobile Money "On the Cusp" in Rwanda and Ghana

New data provides the most comprehensive picture yet of digital financial services (DFS) access and usage in Ghana and Rwanda.Blog

Safaricom Launches Feature to Stop Erroneous Transfers: Hakikisha

Safaricom recently launched an additional functionality “Hakikisha” on the M-Pesa Menu in Kenya, which will enable subscribers to confirm a recipient’s name before completing an M-Pesa transaction. Hakikisha has been under pilot for the last month.Blog

Fixing the Hidden Charges in Lipa na M-Pesa

Kenyan regulators took action to disclose Lipa na M-Pesa’s pricing structure. The move highlights a growing problem as digital financial services expand: Existing financial consumer protection rules are not being enforced consistently on these delivery channels.Blog

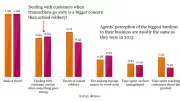

Consumer Risks and Rewards Amid Increased Competition in Kenya

In Kenya, product development and the growth of agent networks are moving in the right direction to provide customers with more options, but we must also remain mindful of the risks these developments pose to customers.Blog

Four Ways Energy Access Can Propel Financial Inclusion

Now that mobile money platforms have become widespread, the private sector is using these services to power the delivery of additional services, such as pay-as-you-go (PAYG) solar energy.Blog

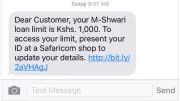

Digital Credit: Consumer Protection for M-Shwari and M-Pawa Users

Digital credit products are only going to become a more important element of financial services in emerging markets where expansion of mobile money platforms has created potential borrower segments of millions of consumers that are only an SMS away.Blog

The Second Coming of M-Shwari: Beyond Early Adopters

InterMedia conducted a study of M-Shwari users and found that in just over a year after launch, M-Shwari achieved the highest level of awareness and use compared with other beyond-basic mobile wallet products in Kenya.Blog

Why M-Shwari Works

With the rapid uptake of M-Shwari, Commercial Bank of Africa (CBA) is the envy of the digital financial services industry. Many factors led to M-Shwari's success, including that it solves a real problem faced by Kenyans: on demand liquidity.Blog

Top 10 Things to Know About M-Shwari

CGAP’s latest Forum publication explores M-Shwari and examines what a critical gap it fills for Kenyan households. We highlight 10 facts about M-Shwari that mobile money watchers should know.Blog