Recent Blogs

Blog

BTPN Wow! Using Open APIs to Bring E-Commerce to Its 250,000 Agents

By connecting its agents to e-commerce platforms, BTPN is giving agents and end-customers in Indonesia more reasons to use its mobile banking service.Blog

A New Generation of Government-to-Person Payments Is Emerging

Advances in payment infrastructure are enabling governments to channel payments through multiple providers, giving people greater choice over how to receive payments. This is an important shift with implications for financial services providers, recipients of government payments and financial inclusion.Blog

Cheaper Remittances: How Malaysia and the Philippines Paved the Way

Globally, people pay an average fee of 6.9 percent to send money to family and others abroad. In one of Asia’s largest remittance corridors, between Malaysia and the Philippines, the average fee is only 3.7 percent. Smart policies have played an important role in bringing prices down.Blog

$4.9 Trillion Small Business Credit Gap: Digital Models to the Rescue

CGAP estimates that there is a $4.9 trillion credit gap for micro and small businesses in emerging markets.Blog

Digital Payments Matter More for Public Services: 3 Reasons Why

Water utilities and other public service providers can benefit in at least three ways from digital payments.Blog

How Bangladesh Digitized Education Aid for 10 Million Families

In just months, Bangladesh digitized financial aid payments for education to millions of families. What can other countries learn from this rapid transition to digital payments?Blog

Building Rural Digital Ecosystems, One Small Payment at a Time

New research shows that digitizing everyday payments as person-to-person transfers can be a sustainable way for providers to reach customers in rural areas.Blog

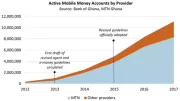

How Ghana Became One of Africa’s Top Mobile Money Markets

Mobile money account ownership tripled in Ghana from 2014 to 2017, making the country one of the fastest growing mobile money markets in Africa. How? Smart regulations played a key role.Blog

Public Clearinghouse Could Shake Up China’s Mobile Payment Market

China will soon require payments providers, including Alipay and WeChat Pay, to connect to a public online payments clearinghouse. Here’s what we know so far about how this institution will work and what it could mean for mobile payments.Blog

Super Platforms in Africa: Not if, but When

Super platforms like Ant Financial are likely to expand into Africa and impact financial services providers, regulators and customers.Blog

QR Codes and Financial Inclusion: Reasons for Optimism

QR codes are gaining traction in China as a way to make digital payments, but will they catch on in other countries?Blog

What Can Mobile Money Make Possible? China Has Many Answers

What's the secret to Alipay and WeChat Pay's success in mobile payments? Creating in-app universes of bundled services has played a big role by making mobile payments more useful to customers.Blog

Financial Inclusion in 2018: BigTech Hits Its Stride

CGAP CEO Greta Bull explores how large platform players like Google, Facebook and Ant Financial are likely to shape financial inclusion in 2018.Blog

Inside QR Codes: How Black & White Dots Simplify Digital Payments

QR codes last year facilitated $2.5 trillion in retail payments in China, and their use is gaining momentum in countries like India. But how do they work? And what is their potential to increase financial inclusion?Blog

Benefits and Burdens of Digital Retail Payments

Payments providers in emerging markets could earn billions if more merchants start accepting digital payments. But what are the opportunities for poor customers?Blog

Merchant Payments: What About the Customers?

Shifting retail payments away from cash to digital instruments will require strong buy-in from end customers, who tend to like cash. How might they be persuaded?Blog

Merchant Acquiring: Why Winning Is the Wrong Approach

Competition is heating up among digital financial services providers looking to stake a dominant position in the $35 trillion global retail payments market. But this could be a market where cooperation will be as important as competition for success.Blog

Will Digital Payments Unlock Financial Access for Small Business?

Bundling digital payments with services that address common challenges for merchants could expand access to finance for small businesses.Blog

A $1.5 Trillion Tip on Cracking Merchant Payments

The card industry once faced a challenge in retail payments familiar to today’s mobile money providers: competitors were building their own acceptance networks, limiting the usefulness of their services. The card industry’s solution could hold a valuable lesson for today.Blog