Recent Blogs

Blog

Microfinance and COVID-19: Is Insolvency on the Horizon?

Global survey data shows a sharp increase in nonperforming and restructured microfinance loans during the early months of the COVID-19 pandemic, but strong capitalization among most MFIs mitigates the risk of insolvency.Blog

Building Back Better: Designing Cash Transfers for Women’s Empowerment

For government-to-person payments to truly benefit the most vulnerable during COVID-19, they must tackle the inequalities that women are facing due to the pandemic.Blog

How Ghana’s New Digital Finance Policy Can Drive Women’s Inclusion

Ghana launched the world's first digital finance policy earlier this year. Here are five ways the new policy can be implemented to help Ghana close its gender gap in financial inclusion.Blog

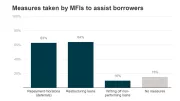

Four Ways Microfinance Institutions Are Responding to COVID-19

How are microfinance institutions responding to COVID-19? To what extent are they offering leniency to clients? Have they been forced to lay off staff or close branches? CGAP's pulse survey of microfinance institutions sheds light on these questions.Blog

Financial Services for Platform Workers: Lessons from Partnerships

Platforms in Kenya are partnering with licensed financial services providers to offer credit, insurance and savings to their workers. Here are some lessons emerging from these partnerships.Blog

COVID-19: Risks for Borrowers as Economies Reopen

With COVID-19 lockdowns putting stress on both consumers and lenders, the stage is set for consumer protection challenges around the provision of credit.Blog

PAYGo Transformed Off-Grid Solar: Is Consumer Financing Next?

By partnering with pay-as-you-go (PAYGo) solar companies, electric utilities in Africa could expand low-income households' access to responsible consumer finance for refrigerators and other electric appliances.Blog

Study Shows Kenyan Borrowers Value Data Privacy, Even During Pandemic

Research in Kenya shows that low-income borrowers value data privacy so much that most are willing to pay higher interest rates for better privacy protections, even during the COVID-19 pandemic.Blog

Is It True that the Big Banks Will Never Offer Financial Inclusion?

In this guest post, Chris Skinner looks at digital banking for the poor from the perspective of big banks.Blog

Women in Rural and Agricultural Livelihoods Facing COVID-19

Women in rural and agricultural livelihoods have been disproportionately impacted by COVID-19. Here is what funders can do to help.Blog

Can JioMart and Facebook Revolutionize Traditional Retail in India?

Facebook and the Indian grocery shopping platform JioMart in April announced a partnership that sent ripples through India's e-commerce and e-grocer sectors. What could this partnership mean for small business owners in India?Blog

Ride-Hailing Drivers in Indonesia Discuss Livelihoods, COVID-19

You can learn a lot from the back of a ride-hailing motorcycle in Jakarta. We rode with several drivers and interviewed them about their platform-based income, use of digital financial services and the impact of COVID-19. Here’s what we learned.Blog

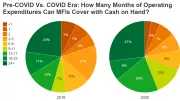

Is There a Liquidity Crisis Among MFIs, and if so, Where?

Are microfinance institutions facing a liquidity crisis as a result of COVID-19? The CGAP Pulse Survey of Microfinance Institutions sheds new light on this question.Blog

Will Facebook Soon Dominate Digital Payments in India, Indonesia?

As Facebook enters the highly regulated space of digital payments in India and Indonesia, it is partnering with local players to connect its virtual ecosystem with the cash economy, gain access to logistics networks and overcome regulatory hurdles.Blog

COVID-19 Highlights Need for Stronger Safety Nets for Gig Workers

COVID-19 has highlighted the volatile nature of platform work and the need for platforms to provide stronger social safety nets to workers.Blog

Regional Centers Can Help Low-Income Countries Build Cyber Resilience

By pooling resources and establishing shared regional cybersecurity centers, low-income countries could better respond to the rising threat of financial cybercrime in developing economies.Blog

Emergency Relief for Small Businesses Requires a Targeted Approach

Here are some useful ways to segment the more than 160 million micro and small businesses in developing countries for more targeted, effective COVID-19 relief.Blog

Financial Consumer Protection: 3 Steps to Better Customer Outcomes

Here are three steps that regulators can take to advance a customer outcomes-based approach to financial consumer protection.Blog

Digital Banks Increasingly Embrace a Platform Business Model

There are a billion mobile money wallets in developing countries that could be made far more relevant for low-income customers by a digital marketplace approach to banking.Blog