Recent Blogs

Blog

Has Fintech Closed the Credit Gap? Not by a Long Shot

If funders want to spur job creation and economic growth, they’ll need to close the credit gap for small businesses in emerging markets. But to do this, they can’t depend solely on fintech.Blog

Cheaper Remittances: How Malaysia and the Philippines Paved the Way

Globally, people pay an average fee of 6.9 percent to send money to family and others abroad. In one of Asia’s largest remittance corridors, between Malaysia and the Philippines, the average fee is only 3.7 percent. Smart policies have played an important role in bringing prices down.Blog

Algorithm Bias in Credit Scoring: What’s Inside the Black Box?

Computers can make faster, better, and less biased lending decisions than humans, but only if human bias hasn’t crept into their algorithms.Blog

Sports Betting: Highway to Hell or On-Ramp to Digital Finance?

Sports betting is pervasive in Africa. What impact is it having on how youth use digital financial services?Blog

3 Principles for Funders of Youth Financial Inclusion

How can donors promote financial inclusion in a way that creates jobs for youth? Here are three guiding principles, based on the Mastercard Foundation's experience in Africa.Blog

Reaching the Next Generation of Financial Services Customers in Africa

A growing body of evidence shows young people's potential as users of financial services in Africa.Blog

Mapping a Pathway to Improved Well-Being for Young People

What are the links between financial services and young people's educational and job opportunities? Here are three insights.Blog

How Do Kenyans Really Use M-PESA?

Transaction data shows mobile money agents are more like petrol stations than barber shops, with few customers showing loyalty to particular agents.Blog

6 Strategies to Promote Digital Financial Product Adoption Among Youth

Here are six insights about how to make financial services appeal to young people, coming out of a digital savings pilot in Tanzania.Blog

Running a Sandbox May Cost Over $1M, Survey Shows

CGAP and the World Bank surveyed regulators across 30 countries to find out how and why they’re using regulatory sandboxes and what it takes to run one.Blog

The Role of Cash In/Cash Out in Digital Financial Inclusion

Getting cash into and out of the digital system remains one of the main barriers to financial inclusion in emerging markets — even in markets where digital financial services are on the rise.Blog

Social Norms and Women’s Financial Inclusion: The Role of Providers

Financial services providers are a part of the societies in which they operate, and their decisions can bolster gender norms that restrict or expand women’s access to financial services.Blog

Turning Remittances into Savings for Nepal’s Migrant Families

Remittances amount to 28 percent of Nepal’s GDP. Digital financial services that better meet young women’s needs could help migrant families put away more in savings.Blog

Youth in Agriculture: A New Generation Leverages Technology

Digital financial services can help young people see a future in agriculture.Blog

Beyond Regulations: What’s Driving Mobile Money in Côte d’Ivoire?

Regulations helped spur the recent growth of mobile money in Côte d'Ivoire, but there's more to the story.Blog

Expanding the Horizons of Pay-as-You-Go Solar

As PAYGo solar companies seek to expand into new and challenging markets, they will need to lower their costs and improve repayment rates.Blog

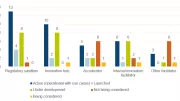

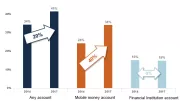

Regulations Drive Success of Digital Finance in Côte d’Ivoire

The year 2015 marked a turning point for financial inclusion in Côte d'Ivoire, as nonbanks were allowed to issue e-money. Since then, mobile money has driven big increases in account ownership.Blog

3 Ways to Deepen Our Understanding of Women’s Financial Inclusion

Researchers can shed new light on the impact of financial inclusion on women by applying three principles in their work.Blog

4 Next-Gen Fintech Models Bridging the Small Business Credit Gap

There is a staggering $4.9 trillion financing gap for micro and small businesses in emerging markets. These fintech models stand out for their ability to solve small businesses' credit needs at scale.Blog