Recent Blogs

Blog

How Fintechs Could Digitize Store Credit in the Arab World

People in the Arab world rely on store credit almost twice as much as people in other regions. Here are three ways fintechs could digitize this type of credit.Blog

Last-Mile Agent Networks: Why Public-Private Partnerships Matter

Building out rural agent networks isn’t just about harnessing digital innovations. Global experience shows that it’s also about the public and private sectors working together.Blog

Digital Finance and the Future of Competition Policy

As tech giants disrupt financial services, they are giving urgency to questions around competition policy. Here are five questions that policy makers in developing countries should be asking about how to ensure fair play.Blog

Deposit Insurance: The Last Line of Defense for E-Money?

Should deposit insurance cover e-money? The answer may not be the same for every country, but here are two lessons that apply across markets.Blog

Zoona Is Putting APIs at the Core of Its Business: Here’s Why

What began as a side project has become central to Zoona's plans for growth. In this blog post, Zoona executives Brett Magrath and Bridgid Thomson discuss the importance of APIs at the company.Blog

Smart Phones, Smart Partners: Linking Asset Finance and Microfinance

One company offers microcredit. The other offers PAYGo financing for smartphones, tablets and solar home systems. In what may be a template for other microfinance institutions, they are helping each other to reach more low-income customers.Blog

A Vision for Collaborative Customer ID Verification in Africa

Technology has the capacity to improve financial inclusion in Africa, but this value can be unlocked only if African leaders reduce the burden of customer ID checks.Blog

Bringing Digital Finance Agents to the Last Mile in Indonesia

A recent CGAP publication identifies six principles for viable agent networks in rural areas. In this post, we look at how where Indonesia stands against these principles.Blog

BTPN Wow! Using Open APIs to Bring E-Commerce to Its 250,000 Agents

By connecting its agents to e-commerce platforms, BTPN is giving agents and end-customers in Indonesia more reasons to use its mobile banking service.Blog

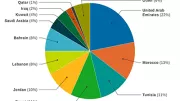

Mapping Fintech Innovations in the Arab World

Where is fintech innovation happening in the Arab world? What types of solutions are emerging? CGAP shares preliminary results from our research on fintech in a region with roughly 140 million financially excluded adults.Blog

Open Data and the Future of Banking

Although growing numbers of low-income people are entering the formal financial system, many are not yet leveraging its full value. Emerging regimes for data sharing and payments flexibility have the potential to bypass traditional financial sector development and give poor customers better products and more choices.Blog

The Path to Financial Health Begins in Adolescence

It is critical that youth financial inclusion programs tailor interventions based on young people's life stage to achieve long-term impact on financial health.Blog

Where Youth Join Trust Groups, Not Insurgency Groups

By providing a combination of financial and nonfinancial services to over 16,000 smallholders, a social enterprise in northern Nigeria is harnessing the power of agriculture to create jobs for youth and improve livelihoods.Blog

4 Keys to a Successful Developer Portal for Digital Finance APIs

Here are some practical tips on how digital financial services providers can build a first-rate developer portal for their APIs.Blog

Former PAYGo CFO: Smart Subsidies Can Scale Energy Financing

Well-designed subsidies could create a stronger foundation for the solar home system industry and enable it to reach more low-income customers, according to entrepreneur and former PAYGo executive Joshua Romisher.Blog

When Youth Entrepreneurship Training Meets Financial Inclusion

By working together to integrate entrepreneurship training and financial inclusion in Africa, youth-serving organizations and financial services providers could help young people build successful businesses and create jobs.Blog

A New Generation of Government-to-Person Payments Is Emerging

Advances in payment infrastructure are enabling governments to channel payments through multiple providers, giving people greater choice over how to receive payments. This is an important shift with implications for financial services providers, recipients of government payments and financial inclusion.Blog

Cloud Computing for Financial Inclusion: Lessons from the Philippines

For the first time, the Philippine central bank has allowed a bank to move its core banking operations to the cloud. Its approach, balancing caution with forward thinking, holds lessons for regulators in other countries.Blog

Inclusive Growth vs. Household Finance: A False Choice

What’s better for inclusive economic growth: expanding access to financial services among individuals or businesses? Emerging evidence suggests they’re both critical.Blog