Recent Blogs

Blog

Open Banking: 7 Ways Data-Sharing Can Advance Financial Inclusion

When banks and other financial institutions responsibly exchange customer data with other providers, the result is better products for low-income customers.Blog

Kenya’s Expansion of G2P Becomes Lifeline During COVID-19 Crisis

Kenya offers higher fees to providers that facilitate digital government-to-person payments in underserved areas. Today, this makes it easier to reach hundreds of thousands of low-income people with assistance during the COVID-19 crisis.Blog

Customers Want Data Protection: How Can Open API Providers Deliver?

Open APIs can benefit digital financial services providers and low-income customers alike, but they pose data protection and privacy challenges. Here are some tips on how providers can address those challenges.Blog

The Best Laid Plans...CGAP's Response to COVID-19 (Coronavirus)

CGAP spent time thinking about how we can add unique value to a coordinated crisis response. The work we are doing to combat the effects of coronavirus is refocusing those efforts in new and unanticipated ways.Blog

Financial Scams Rise as Coronavirus Hits Developing Countries

As COVID-19 (coronavirus) spreads in developing countries, a surge in financial scams requires action from governments and financial services providers.Blog

India’s Proposed Data Protection Bill Breaks from Notice and Consent

The proposed bill would mark a significant advance in rethinking how to protect digital consumer rights, putting India at the forefront of modern data protection regimes.Blog

How Can Licensing Regimes Keep Up with Financial Innovation in 2020?

Tech giants, digital banks, e-money issuers, fintech startups — as more diverse players enter the financial services space, they are becoming harder for regulators to classify and license. Here are four ways regulators can respond in 2020 and beyond.Blog

Risk-Based Supervision Is Key to Financial Inclusion in 2020 & Beyond

In developing countries around the world, inadequate supervision risks neutralizing regulatory reforms designed to spark innovation and advance financial inclusion. Here’s what the global development community can do about it.Blog

Digital Finance: Cybersecurity Requires Deeper Industry Collaboration

Cybercrime poses a significant threat to financial inclusion. Here are two things mobile financial services providers and industry associations must do to make financial services safer and more trustworthy for low-income customers.Blog

Risk Alert: Development Community Support Needed for Cybersecurity

Here are four things the development community can do to improve cybersecurity as digital financial services expand in developing countries.Blog

Last-Mile Agent Networks: Why Public-Private Partnerships Matter

Building out rural agent networks isn’t just about harnessing digital innovations. Global experience shows that it’s also about the public and private sectors working together.Blog

Digital Finance and the Future of Competition Policy

As tech giants disrupt financial services, they are giving urgency to questions around competition policy. Here are five questions that policy makers in developing countries should be asking about how to ensure fair play.Blog

Deposit Insurance: The Last Line of Defense for E-Money?

Should deposit insurance cover e-money? The answer may not be the same for every country, but here are two lessons that apply across markets.Blog

Open Data and the Future of Banking

Although growing numbers of low-income people are entering the formal financial system, many are not yet leveraging its full value. Emerging regimes for data sharing and payments flexibility have the potential to bypass traditional financial sector development and give poor customers better products and more choices.Blog

Cloud Computing for Financial Inclusion: Lessons from the Philippines

For the first time, the Philippine central bank has allowed a bank to move its core banking operations to the cloud. Its approach, balancing caution with forward thinking, holds lessons for regulators in other countries.Blog

Regulator’s Friend or Foe? Cloud Computing in Financial Inclusion

When regulated and supervised properly, cloud computing can be a boon to financial institutions trying to reach underserved customers. Here are some tips for regulators and supervisors in emerging markets.Blog

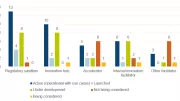

Running a Sandbox May Cost Over $1M, Survey Shows

CGAP and the World Bank surveyed regulators across 30 countries to find out how and why they’re using regulatory sandboxes and what it takes to run one.Blog

It’s Time to Change the Equation on Consumer Protection

For financial inclusion to work for the poor, it’s time to move beyond consumer protection frameworks that are more about protecting providers than customers.Blog

Do Regulatory Sandboxes Impact Financial Inclusion? A Look at the Data

CGAP estimates that less than 25 percent of sandbox-tested solutions address financial inclusion. Here's how to change this.Blog