Recent Blogs

Blog

Winners and Losers on the Road to Financial Inclusion

The Center for Financial Inclusion at Accion has created the Financial Inclusion 2020 Campaign, which aims to build a movement that mobilizes stakeholders around the globe to achieve full inclusion by the year 2020.Blog

Better Than Cash, or Just Better Cash?

Far from replacing cash, mobile money has made cash much more efficient.Blog

More on Why OTC Makes Sense for Kenya

Cashless goals are too focused on designing products that make people want to switch to e-money, even though most still prefer cash.Blog

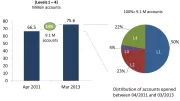

M-Pesa Usage Data: OTC Makes Sense, Even for Kenya

Even though "cash-lite" is a buzzword in financial inclusion, usage data from M-Pesa suggests that the goal of going "cashless" may not be aligned with the needs of people at the base of the income pyramid.Blog

Can Retail Payment Systems be Profitable and Inclusive?

A framework developed by the Bill and Melinda Gates Foundation explains the economics of payment systems and how providers can make a profit while still effectively serving the poor.Blog

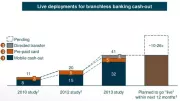

Mobile Money: OTC versus Wallets

A new blog series explores the business choices involved when balancing the extremes of OTC transactions and electronic wallets when it comes to making electronic payments.Blog

Vivid Profiles of Mobile Account Users in Rural Mexico

Nearly 30 million Mexicans live in rural communities and lack basic infrastructure. As Telecomm brings basic mobile banking services to rural communities, we hear how users benefit from using these accounts in their daily lives.Blog

Innovation in Person to Government Payments in the Philippines

Smart Hub Inc., has developed an epayment innovation in the person to government (P2G) space, called BayadLoad (bayad meaning payment in Tagalog), which attempts to empower more users in the Philippines to use digital channels.Blog

Keep Your Insurance Close, and Your Friends and Family Closer

Throughout our research, we are seeing that friends and family are often a preferred source of support when a financial shock strikes. So, what is the role of microinsurance.Blog

What Options do MFIs Have to Leverage M-banking?

There is no evidence that MFIs or their customers are driving the development of m-banking. MFIs that are successfully leveraging m-banking tend to be in countries where an m-banking service is already widely used.Blog

China – The Future Leader in Branchless Banking for the Poor?

A look at the world's biggest market for branchless banking.Blog

Context and Culture: Designing Relevant Financial Services

As a tool to help a mobile financial services provider design a business strategy, how effective is a point-in-time, one-off, research exercise in helping understand customers?Blog

Mobile Payments in Brazil: Ready, Set, Go?

The Central Bank of Brazil has issued the much awaited medida provisoria (MP) for mobile payments.This bill establishes the regulatory framework to allow non-bank eMoney issuance, paving the way for a number of commercial partnerships to go to the market.Blog

Enabling Data Driven Decisions for Expanding Financial Inclusion

The Financial Service for the Poor (FSP) team at the Bill & Melinda Gates Foundation and its partners have developed an interactive web portal that aims to improve the way financial access is measured and tracked.Blog

Indonesia Moves Towards a Cash Light Economy

In mid May 2013, the three leading mobile network operators in Indonesia surprised the financial services industry by announcing they will interoperate their wallets.Blog

Three Thoughts for Financial Inclusion Entrepreneurs

I am one of the founders of Coda Payments, a company that makes it possible for customers in emerging markets to make small-value purchases using their mobile accounts. There are three essential lessons for aspiring entrepreneurs in this space.Blog

International Remittances and Branchless Banking: Emerging Models

The landscape of international remittances through branchless banking continues to evolve, with a variety of new players and models entering the market and driving change.Blog

Latest on Branchless Banking from Indonesia

In early May 2013, Bank Indonesia released long-awaited guidelines for banks and mobile network operators to outsource some banking operations to agents, unleashing the potential for branchless banking across the country.Blog

What Do We Know about the Impact of Microinsurance?

Knowledge is still patchy but key insights are emerging on the impact of microinsurance products including financial protection and better access to health care.Blog