Recent Blogs

Blog

What Does the Future Hold for Youth Savings in Ethiopia?

Over the past five years, PEACE MFI S.CO's Lenege youth savings product has increased access to savings for low-income youth in Ethiopia. What can other financial service providers learn from its experience?Blog

Microfinance in India Growing Fast Again: Should We Be Concerned?

The rapid growth of microfinance in India today is creating new challenges for a sector hugely impacted by the 2010 crisis. The recently released Inclusive Finance India Report 2016 outlines these challenges and suggests that they should be addressed soon.Blog

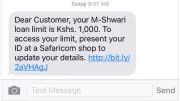

3 Steps Policy-Makers Can Take Now on Digital Credit

In emerging markets, policy-makers have often struggled to keep pace with the rapid growth of digital credit. With the establishment of consumer protection authorities unlikely in the short term, here are three steps policy-makers can take now to protect consumers.Blog

Time to Take Data Privacy Concerns Seriously in Digital Lending

Digital credit is on the rise in Kenya. While digital lenders are expanding access to credit for many Kenyans, they are operating outside regulation by any financial sector authority–and some key consumer protection concerns have started to emerge.Blog

Why We Need to Start Talking about Operational Inefficiencies

To contribute to sustainable development, microfinance itself must be sustainable. Many microlenders–including mature and/or highly profitable ones–still have ample capacity for significant efficiency gains, yet efficiency considerations are usually not among their top concerns. Why?Blog

Digital Credit in Kenya: Time for Celebration or Concern?

There are now more than 20 digital credit offerings in Kenya, with new services launching continually. Hype is building around the potential opportunities these products could bring, but their rapid proliferation is also raising questions about risks.Blog

Those Star-Ratings Do Matter for Financial Inclusion

CGAP recently partnered with MercadoLibre, Latin America’s largest online retailer, to assess the potential of alternative data to boost financial inclusion. This research found that e-commerce data can be a powerful credit risk predictor for underbanked and unbanked people.Blog

Headwinds and Tailwinds in Banking Small Businesses

Rapid “digitization” of business and investment in financial technology have the potential to significantly improve access to finance for millions of micro, small, and medium enterprises worldwide, yet challenges remain. Can FinTech solve the access to finance problem for MSMEs?Blog

The Role of Financial Services in Reducing Hunger

Many of the world's 1.5 billion smallholder farmers lack access to basic financial services, leaving them vulnerable to shocks and prone to low-risk, low-return investments. Improving access to financial services can help farmers increase household income and food security.Blog

Better Understanding the Demand for Islamic Microfinance

CGAP, Yale University and Tamweelcom have taken a novel approach to the study of demand for Islamic and conventional loans in Jordan. This randomized experiment reveals new insights into the real demand for Islamic microloans, and the findings are striking.Blog

Beyond Credit: Risk Management as a Strategy for Economic Growth

Well-functioning financial markets are essential for the growth of firms, including commercial farms. Efforts to improve financial markets in underserved localities must include an understanding of stakeholders’ risk management needs—not just access to credit.Blog

The Unusual Financial Dynamics of Short-Tenor Digital Credit

Digital credit is disbursed and recovered rapidly, often in 30 days or less, and generally with loan amounts smaller than conventional credit or micro-lending. CGAP built a digital credit financial model to investigate the basic financial dynamics of loan portfolios made up of short-term, small loans.Blog

An Indian Start for Digital Credit

In India, loans often require extensive application processes or participation in a joint liability group. A pioneering digital loan provided by Suvidhaa Infoserve and Axis Bank is changing the financial services landscape.Blog

An Introductory Course to Digital Credit

In the growing field of digital credit, CGAP research has found exciting innovations along with fundamental miscalculations. CGAP's self-directed course, "An Introduction to Digital Credit," presents key lessons for practitioners, regulators and others with an interest in digital credit.Blog

User-Centered Financial Services Build Household Resilience

"Resilience" refers to the ability to anticipate, respond to and recover from shocks. Freedom from Hunger used “resilience diaries” with 46 households in Burkina Faso to research whether financial services could play a greater role in building household resilience.Blog

Building a Toolbox for Bundling Services

In an increasingly competitive marketplace, could the bundling of credit with non-credit financial services be a viable solution for FSPs? EA Consultants designed and implemented a study with Crezcamos in Colombia to find out.Blog

How Can Indirect Deposit Insurance Work in Digital Finance?

It is increasingly important to ensure that digitally-stored funds are protected against the failure of institutions offering these products. The indirect (or 'pass-through') approach to deposit insurance is raising questions with big implications for financial inclusion.Blog

Four Common Features of Emerging Digital Credit Offerings

Digital credit has emerged at the digital finance frontier, drawing attention from all players across the DFS ecosystem. A new CGAP brief explores the inner workings and key characteristics of digital credit offerings.Blog

Fierce Competition for India’s Newly Minted Small Finance Banks

The landscape of India’s financial sector is changing rapidly. New small finance bank (SFB) licenses present new possibilities and challenges for financial service providers in the Indian market.Blog