Recent Blogs

Blog

Four Ways Microfinance Institutions Are Responding to COVID-19

How are microfinance institutions responding to COVID-19? To what extent are they offering leniency to clients? Have they been forced to lay off staff or close branches? CGAP's pulse survey of microfinance institutions sheds light on these questions.Blog

Financial Services for Platform Workers: Lessons from Partnerships

Platforms in Kenya are partnering with licensed financial services providers to offer credit, insurance and savings to their workers. Here are some lessons emerging from these partnerships.Blog

PAYGo Transformed Off-Grid Solar: Is Consumer Financing Next?

By partnering with pay-as-you-go (PAYGo) solar companies, electric utilities in Africa could expand low-income households' access to responsible consumer finance for refrigerators and other electric appliances.Blog

Is It True that the Big Banks Will Never Offer Financial Inclusion?

In this guest post, Chris Skinner looks at digital banking for the poor from the perspective of big banks.Blog

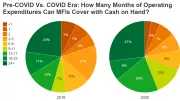

Is There a Liquidity Crisis Among MFIs, and if so, Where?

Are microfinance institutions facing a liquidity crisis as a result of COVID-19? The CGAP Pulse Survey of Microfinance Institutions sheds new light on this question.Blog

Will Facebook Soon Dominate Digital Payments in India, Indonesia?

As Facebook enters the highly regulated space of digital payments in India and Indonesia, it is partnering with local players to connect its virtual ecosystem with the cash economy, gain access to logistics networks and overcome regulatory hurdles.Blog

COVID-19 Highlights Need for Stronger Safety Nets for Gig Workers

COVID-19 has highlighted the volatile nature of platform work and the need for platforms to provide stronger social safety nets to workers.Blog

Digital Banks Increasingly Embrace a Platform Business Model

There are a billion mobile money wallets in developing countries that could be made far more relevant for low-income customers by a digital marketplace approach to banking.Blog

These Digital Banks Help Fintechs to Offer Banking Services

By enabling virtually any type of business to offer banking services cheaply and in record time, “banking-as-a-service” providers can dramatically reduce the barriers to entry into banking and potentially deepen financial inclusion.Blog

The Wrong Kind of Credit: Why Loans to Gig Workers Must Reflect Income

Volatile gig income and inflexible loan repayment schedules can be a dangerous mix, as this ride-hailing driver in Nairobi learned from experience. His story serves as a cautionary tale to lenders and borrowers in the gig economy.Blog

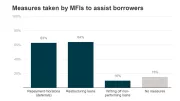

Survey Shows Gathering Clouds, but No Storm (Yet) for Microfinance

How is COVID-19 impacting the portfolios of microfinance institutions (MFIs)? Are MFIs facing a liquidity crisis? Is the solvency of institutions at risk? CGAP's global, monthly survey began two weeks ago, and answers are beginning to emerge.Blog

Beyond Hackathons: Reaching Developers with Your Digital Finance APIs

Hackathons aren't the only way for a digital financial services provider to engage third parties with its open APIs.Blog

How Is the Pandemic Affecting Agents? Here’s What Providers Tell Us

As customers, agents and digital financial services providers adjust to COVID-19, it’s becoming clearer what a resilient agent network looks like. Providers should take note to prepare for future crises.Blog

Financial Services for Gig Workers: An Intersection of Needs in Kenya

Gig workers in Kenya cite savings, loans and medical insurance as top financial services they would like to access via gig platforms. While platforms across Africa increasingly offer credit and insurance, savings appears to be under-supplied.Blog

The Box, Not the Tools: Managing Credit Risk in Asset Finance

Pay-as-you-go solar companies and other asset finance providers are using cutting-edge tools to manage credit risk, but many lack the risk culture, governance structures and processes to use them effectively.Blog

API Technology Jargon: What Business Leaders Need to Know

Here are three design principles that financial services providers should keep in mind when making technology decisions related to their open API products.Blog

Asset Finance Innovations Can Advance SDGs – If They Scale Responsibly

New asset finance business models are breaking down old barriers to putting life-changing assets into the hands of poor households. But to meaningfully advance SDGs, they’ll need to scale responsibly, and this is where funders can play a role.Blog

Kenya’s Expansion of G2P Becomes Lifeline During COVID-19 Crisis

Kenya offers higher fees to providers that facilitate digital government-to-person payments in underserved areas. Today, this makes it easier to reach hundreds of thousands of low-income people with assistance during the COVID-19 crisis.Blog

Agent Networks: Vital to COVID-19 Response, in Need of Support

Digital payments are central to the global COVID-19 response, but the agent networks that distribute these funds are struggling to remain open. Here are three questions policy makers must answer to ensure agents reach as many people as possible.Blog