Recent Blogs

Blog

How Responsible Is Digital Finance? 10 Global Insights

CGAP conducted a Global Pulse Survey among policy makers, financial service providers, consumer advocates and foundations to gauge perceptions of consumer risks within digital financial services.Blog

Regulating for Inclusive Insurance Markets in Ghana

Tremendous gains have been made in Ghana's microinsurance market in recent years. Here's what the National Insurance Commission of Ghana, along with the German Development Corporation, did to help develop the market - and what challenges lie ahead.Blog

Insurance and Financial Inclusion: IAIS and A2ii

Regulation and supervision of insurance markets are key tools to improve access to finance for poor people.Blog

Merchant Incentives in the Shift to Cashless Food Aid

Shifting social support benefits through electronic payments instead of cash or in-kind contributions offers many benefits, but evidence from existing programs suggests that the link between these payments and financial inclusion is is challenging to make.Blog

Don’t Abandon Youth Financial Services - Innovate

Providing services for small savers is a challenge for financial institutions. With this in mind, Freedom from Hunger is getting a better understanding of the business case behind financial services to youth, who many financial institutions choose not to serve.Blog

How Can Group Loans be Provided more Responsibly?

In order for financial products to help people meet their goals, the products need to fit in with a household's natural cash flows and financial situation.Blog

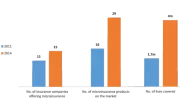

Four Mobile Money Trends from the IMF Financial Access Survey

The expanded IMF Financial Access Survey now includes basic mobile money indicators. The data shed light on four trends that stand out.Blog

Three Ways Financial Service Providers Can Empower Customers

Ensuring that digital financial services are used successfully by poor communities requires a new customer-centric approach. Financial service providers can empower customers to engage with new technology and financial services in several ways.Blog

PHOTOS: The Face of the Working Poor

2014 marked the ninth consecutive CGAP Photo Contest, which highlights standout photography depicting financial inclusion. The contest helps raise awareness about the importance of increased access to financial services, and puts a face on the struggles of low-income entrepreneurs.Blog

From Access to Active Use: The Need for Customer Empowerment

Enabling customers to empower themselves calls for a more interactive and dynamic relationship between provider and customer.Blog

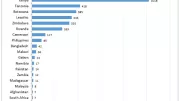

Investing in MENA’s Entrepreneurs: What is Really Needed?

A recent study by Wamda Research Lab highlights challenges preventing startups in the Middle East and North Africa from growing. One of the obstacles is access to appropriate funding.Blog

Mobile Money Users at Center of New GSMA Code of Conduct

The GSMA launched a Code of Conduct for Mobile Money Providers, and already eleven providers have endorsed it. The code is important to ensure that the customer experience is central to the responsible development of mobile money platforms.Blog

Five Bright Ideas for Responsible Digital Finance

Delivering financial services via digital means is growing at a blistering pace, and many are asking how can be accelerated to reach more underserved customers. At the same time, we must ensure that these services are being delivered fairly, transparently, and safely.Blog

Adaptations of the Graduation Approach: Risks and Opportunities

Coaching has proven to be a critical component of the Graduation Approach, but it is also complex to implement. Staffing constraints often cause this building block to be trimmed, sometimes at the expense of program results.Blog

The Seismic Implications of Digital Financial Inclusion

Policy makers, regulators, and supervisors in countries where digital financial inclusion is expanding exponentially see the financial inclusion promise clearly. Yet, they are grappling with the fast-changing risk picture.Blog

What Does it Take to Build Resilient Households in Burkina Faso?

“Resilience” seems to be the mot du jour among development practitioners these days. In the financial inclusion context, resilience refers to a person or family’s ability to weather shocks. But how do households in Burkina Faso define it?Blog

Filling the Smallholder Household Data Gap: A New Learning Agenda

There is a significant data gap when it comes to smallholders' demand for financial services. Filling this gap is going to require new efforts and a shared learning agenda.Blog

Understanding our Smallholder Clients, Serving them Better

Smallholder farmers are among the most financially excluded of all client segments. Understanding their particular needs is an important step in helping financial service providers to develop appropriate and effective products that serve them effectively.Blog

Learning from Smallholder Supply Chains in Côte d’Ivoire

IFC and Ecom, a global commodity trading company, interviewed more than 2,000 cocoa farmers in Côte d’Ivoire about their income levels, food security, and other qualitative aspects of their farming lives. The results highlight some key challenges facing smallholder farmers.Blog