Recent Blogs

Blog

Financial Consumer Protection: 5 Lessons from Behavioral Research

The boom in behavioral research methods means that gaining a deeper, more evidence-based understanding of how actors in a financial market behave, what incentives drive them, and what new policies or products can lead to responsible and inclusive financial systems.Blog

What Next for Remittances and Money Transfers in the Pacific?

There is a risk that recent progress in the Pacific region to drive down the cost of remittances will be undone, as money transfer operators are facing increased regulatory pressures.Blog

Postal Savings Bank of China: Inclusive Finance in Rural China

The Postal Savings Bank of China has five advantages over the "big 4" commercial banks when it comes to serving the rural population.Blog

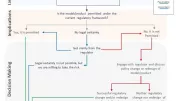

Balancing Regulatory Uncertainty in Branchless Banking Design

For providers of mobile money services looking to navigate complex regulatory environments, there are valuable lessons that can be extracted from failed experiences - which can sometimes be traced back to challenging legal environments.Blog

Branchless Banking in China: Will Regulation Support Innovation?

China's pilot of 500,000 banking agents show significant promise for financial inclusion. Allowing these agents to offer a greater variety of services, such as taking deposits and opening new accounts, could lead to faster growth and more usage.Blog

Passing the Baton, but to Whom? Considerations for Investors

The number of exits from microfinance equity investments is anticipated to accelerate in the next few years because equity funds are maturing, MFIs are maturing, and social investors are moving on to new frontiers.Blog

Savers Deserve More Attention and Protection

Access to finance in the West African Economic Monetary Union and Economic and Monetary Community of Central Africa grew significantly from 2001 to 2011. However, more attention must be paid to savings and savers.Blog

E-Payments in Low-Income Settings: Cutting-Edge or High Risk?

Seen as having great potential for advancing the effectiveness of social and foreign assistance, e-payments can increase efficiency in a variety of ways. Four case studies take a closer look at programs in Haiti, Kenya, The Philippines and Uganda.Blog

Graduation Model: Ready to Scale Up?

The benefits of the Graduation Approach are clear. Optimism around this approach was reinforced in Paris last week when about 100 experts and policymakers discussed how to integrate it into other policies and programs.Blog

Graduation Programs as Part of Targeted Social Policy

After more than 15 years, conditional cash transfer programs have become the backbone of targeted social policies in Latin America. But we must create programs that maintain progress while continuing to move people out of poverty and into sustainable livelihoods.Blog

Private Sector Stepping Up Leadership in Financial Inclusion

On the sidelines of the World Economic Forum in Davos, some 60+ private and public sector leaders expressed their commitment to put the puzzle pieces for greater financial inclusion together for real impact.Blog

Prioritizing Complaints Handling with Third Party Ombudsmen

More and more countries are realizing the importance of establishing proper mechanisms for handling complaints within financial institutions and establishing proper external or third party recourse systems through ombudsman schemes.Blog

Nicaragua’s System for Resolving Financial Complaints

Nicaragua has made significant strides in consumer protection and financial inclusion since 2005, especially regarding its formalized complaints channel for credit card disputes.Blog

The Next Financial Inclusion Challenge: Private Sector Leadership

World leaders are embracing financial inclusion at an accelerating pace because they know it is an important ingredient for social and economic progress in developing countries. But despite the political tailwind, 2.5 billion people remain excluded from formal financial services. What needs to happen to meaningfully advance financial inclusion for the poor?Blog

Financial Inclusion, Stability, Integrity, and Consumer Protection

An inclusive financial system that reaches all citizens will have a more stable retail deposit base, which should increase systematic stability.Blog

Innovation in Person to Government Payments in the Philippines

Smart Hub Inc., has developed an epayment innovation in the person to government (P2G) space, called BayadLoad (bayad meaning payment in Tagalog), which attempts to empower more users in the Philippines to use digital channels.Blog

Understanding Microcredit Interest Rates in East Asia

While interest rates from MFIs are higher than state banks in EAP, with hundreds of millions of poor people without formal access, there is room for MFIs to expand as their services are often superior to other alternatives.Blog

Mobile Payments in Brazil: Ready, Set, Go?

The Central Bank of Brazil has issued the much awaited medida provisoria (MP) for mobile payments.This bill establishes the regulatory framework to allow non-bank eMoney issuance, paving the way for a number of commercial partnerships to go to the market.Blog

Measuring Financial Sales Staff Behavior: Evidence from Mexico

A recently completed study in Mexico sought to determine how the perceptions sales staff have of different types of consumers and their knowledge impacted the quality and quantity of information consumers receive when shopping for an individual credit or savings product.Blog