Recent Blogs

Blog

Smart Policy: Why Islamic Banks Matter in Indonesia

With financing a key need for millions of micro to mid-sized entrepreneurs, empowering Islamic financial service providers to reach more clients is not only good for business. It’s smart policy.Blog

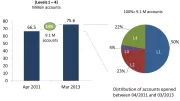

Mexico’s Tiered KYC: An Update on Market Response

In August 2011 Mexico approved a tiered scheme for opening deposit accounts at credit institutions. The innovation is that it incorporates several “levels” of simplified accounts – requirements increase progressively as restrictions on transactions and channels are eased.Blog

A New Wave of E-Money in Latin America

In Latin America, the banking sector is highly rooted in the economy, and to think about non-bank issued electronic money is almost heretic. But things are changing.Blog

Comparing Branchless Banking in Bangladesh and Pakistan

What can be learned from benchmarking Bangladesh to the regional leader Pakistan which had begun two years earlier in 2009? Both have similar populations, mobile penetration and income levels making the comparison even more interesting.Blog

Building An Enabling and Protective Policy Environment

The blog post describes CGAP's approach to building an enabling and protective policy environment for financial inclusion.Blog

Gabriel Davel Proposes Tests for Credit Bubbles

Davel helped create South Africa’s National Credit Regulator, one of the world's most capable financial consumer protection agencies. In a new Focus Note, Davel draws on a number of debt crises and distills his own experience into practical guidance.Blog

Anti-Money Laundering Regulation and Financial Inclusion

The Financial Action Task Force is making significant strides in providing more granular guidance to country regulators on balancing anti-money laundering/combating the financing of terrorism (AML/CFT) regulations with financial inclusion goals. This guidance impacts financial service providers in several ways.Blog

Access to Insurance Through Regulation and Supervision

Adequate regulation and supervision enhance policyholder protection. That is the ultimate objective of insurance supervision and regulation according to the International Association of Insurance Supervisors (IAIS).Blog

Branchless Banking in Pakistan: the Glass Half and Full View

Branchless banking is flourishing in Pakistan, which is on track to become the most competitive mobile money market in the world.Blog

Data: Enabling Country-led Actions to Address Financial Inclusion

Following the endorsement of the G20 Basic Set of Financial Inclusion Indicators, the Global Partnership for Financial Inclusion's Data and Measurement Sub-Group, in collaboration with partners, has developed an online data portal.Blog

Does “Effective Interoperability” Equal Financial Inclusion?

The measurement of “effective interoperability,” depends on the ultimate policy goal, which could be financial inclusion. In the case of Pakistan, “effective interconnection” could facilitate a 100 million Pakistanis with electronic financial access within eight years.Blog

Over-indebtedness: Striking the Right Policy Balance

Debt stress is an inherent phase in the evolution of credit markets and in credit cycles, but it is also a significant source of instability.Blog

Six To-Dos Now for Responsible Investors

At the mid-year Social Investor Roundtable, the Sangam Group (CEOs of the 10 largest MIVs) and annual Development Finance Institutions (DFI) consultation on responsible finance agreed on a “to-do” list of six concrete actions for investors.Blog

Financial Inclusion in Latin America: Looking Back, then Forward

In Latin America, 2012 has seen continued and increased efforts on financial inclusion across the region by providers and policymakers, although it wasn't a year without challenges.Blog

Back To The Future Of Performance Reporting On Financial Services

There are at least four lessons that branchless banking stakeholders can take from the MFI experience when it comes to reporting standards.Blog

10 Priorities For Financial Inclusion In 2013 And Beyond

Because they recognize its importance for economic and social progress, global and national policymakers have made it a priority to advance financial inclusion so people can access and use the appropriate financial services that help them improve their lives. To make real progress, we at CGAP believe the field has 10 priorities over the next 5 years.Blog

A Review of Financial Inclusion 2012: Aligning for Real Progress

Leaders from nearly 40 developing countries and emerging markets with a combined population of 1.7 billion committed to advance financial inclusion domestically because they know that an inclusive, local financial system that reaches all its citizens is an important ingredient for economic and social progress.Blog

Who Is Targeted? Financial Pyramid Schemes and the Poor

In Kenya, where the qualitative research provided input to a policy diagnostic on financial consumer protection issues and approaches, at least one person in each of 14 groups was personally affected by a pyramid investment scheme.Blog

Financial Crime: Risks For New Formal Finance Customers

There are a range of financial crimes that may occur in the financial inclusion space. This post highlights the most relevant risk elements from a financial inclusion perspective.Blog