Recent Blogs

Blog

Open APIs in Digital Finance: We Opened Up, Here’s What Happened

Is “going open” worth the risk for payment providers? A money transfer business in India shares how allowing other companies to deliver financial services based on its systems has fueled its recent growth.Blog

India Stack: Major Potential, but Mind the Risks

India’s new financial infrastructure could connect hundreds of millions of people to financial services, but at its core is a biometric ID system that has stirred controversy around data privacy and security. What are the risks, and what can be done to minimize them?Blog

Should Other Countries Build Their Own India Stack?

India’s new financial infrastructure, including its biometric ID system, has been making headlines lately. But what exactly is "India Stack"? Should other countries replicate it?Blog

Is the Unbundling of Payments from Banking Regulation Imminent?

The unbundling of payments from banking is well underway in countries like India. Is the unbundling of payments from banking regulation soon to follow?Blog

Will Universal Basic Income Replace Safety Net Payments in India?

India is currently considering a universal basic income (UBI) scheme in which the government would guarantee a minimum income for all citizens. What are the key points of the UBI debate? What could UBI mean for financial inclusion in India?Blog

India Has Built the Rails — Will Passengers Climb Aboard?

India has put in place virtually all of the supply-side factors that should make low-cost financial services available for all. But the big question right now is the customer. The next year will be telling in how the adoption of digital financial services unfolds.Blog

All’s Well That Repays Well? Not Necessarily.

The rapid growth of microfinance in India has led to concerns about a repayment crisis. Some have tempered these worries by pointing to low delinquency rates. But do low delinquency rates tell the whole story?Blog

Microfinance in India Growing Fast Again: Should We Be Concerned?

The rapid growth of microfinance in India today is creating new challenges for a sector hugely impacted by the 2010 crisis. The recently released Inclusive Finance India Report 2016 outlines these challenges and suggests that they should be addressed soon.Blog

Ending Extreme Poverty: New Evidence on the Graduation Approach

SDG 1 is as exciting as it is daunting: End extreme poverty. The Graduation Approach has resulted in large and cost-effective impacts on ultra-poor households’ standard of living, ultimately enabling a sustainable transition to more secure livelihoods and an exit from poverty.Blog

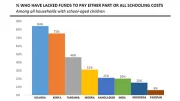

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Digital Social Payments in India: Can the Challenges Be Overcome?

Envisioned as a digital revolution for government transfers, India's Direct Benefit Transfer program transfers government benefits into recipients' bank accounts. Three years in, the government continues to face challenges in digitizing transfers. Is there a way forward?Blog

PMJDY: Commendable Growth, Yet Low-Hanging Barriers Persist

Two years ago, India launched a national financial inclusion program known as Pradhan Mantri Jan Dhan Yojana (PMJDY) which aims for at least one bank account for every household. Has there been any real impact of PMJDY on financial inclusion?Blog

An Indian Start for Digital Credit

In India, loans often require extensive application processes or participation in a joint liability group. A pioneering digital loan provided by Suvidhaa Infoserve and Axis Bank is changing the financial services landscape.Blog

How India’s New Payments Banks Stack Up

India sparked optimism for greater financial inclusion last year when it created a new category of banking service provider—the payments bank. However, three players already chose to surrender their license approvals. What does the remaining line-up of payments banks look like?Blog

Revitalizing the Self-Help Group Movement in India

Growth of the self-help group movement in India has slowed in the past five years. How can challenges be overcome to improve and revitalize these programs?Blog

Want to Improve Customer Experience? Here’s Your Playbook

A delightful customer experience–rooted in a deep understanding of customer needs–is key for any FSP looking to increase use of services among low-income customers. Where to start, and how to do it effectively? A new Customer Experience Playbook offers insights.Blog

Optimizing for the Next Billion Users

Across emerging markets, smartphone adoption is opening up an increasingly clear opportunity for multifaceted financial services. However, a range of technical constraints still hold some users back. Here are three ways to optimize for a more inclusive future.Blog

Can Smartphones Help the Poorest Escape Extreme Poverty?

Trickle Up is piloting a project integrating smartphones into Graduation programs in India, affording a valuable opportunity to explore the potential role of technology in improving and scaling the delivery of the Graduation approach to ultrapoor women in remote areas.Blog

Fierce Competition for India’s Newly Minted Small Finance Banks

The landscape of India’s financial sector is changing rapidly. New small finance bank (SFB) licenses present new possibilities and challenges for financial service providers in the Indian market.Blog