Recent Blogs

Blog

Landscaping Microinsurance In Africa And Latin America

Two recent landscape studies provide much needed data to assist a variety of stakeholders – including insurers, distribution channels, policy-makers, donors and consultants – to understand the microinsurance markets more effectively, leading to better development and expansion of microinsurance.Blog

Islamic Microfinance And Clients: See What I Do, Not What I Say

Muslim microfinance clients often insist on Sharia-compliant products. However, when offered, many clients try the products and then go back to conventional products. Others shun the Islamic offerings altogether. Why this disconnect between what people say and what they do?Blog

Why People Don’t Buy Microinsurance

Several factors influence a household's decision to buy microinsurance. A review of over 30 studies shows that trust and liquidity constraints are amongst the most important determinants while understanding demand of microinsurance products.Blog

Building Resilience through Access to Insurance

There is increasing recognition that poor people need access to a suite of varied financial services. In this context, there is increasing talk about insurance as an important financial service to help people mitigate, manage risks and protect assets.Blog

Mobile Payment Systems:What Can India Adopt From Kenya’s Success?

Despite some initiatives in India, the adoption of mobile payment technology, especially among the low-income population, has been cautious. What can India learn about mobile money services in Kenya?Blog

How Much do Financial Inclusion Indicators Say about Russia?

Despite significant progress, access to financial services is still a huge challenge in remote areas of Russia.Blog

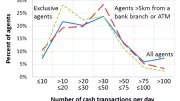

Mobile Money Agents in Tanzania: How Busy, How Exclusive?

The Financial Sector Deepening Trust of Tanzania (FSDT) undertook a census of cash outlets in the country, and discovered that half of all agents do more than 30 transactions per month and nearly two-thirds of agents are exclusive to M-PESA.Blog

A New Framework For Digital Money Innovation

A new "Digital Money Innovation Framework" helps us organize our research and ideas in accordance with some of the biggest barriers we see in digitizing financial services for low-income populations.Blog

Freemium: Spawning An Insurance Market In Ghana

The experience of Tigo Family Care Insurance in Ghana makes the case for freemium services. In underdeveloped markets, offering initial services for free can encourage uptake of paid services in the long run.Blog

Can Phones Drive Insurance Markets? Initial Results From Ghana

Burials in Ghana often put a strain on household budgets of the poor. The insurance market offers very few products, especially to poor customers.Tigo's new mobile insurance product called "Freemium" hopes to change that.Blog

Finding Real World Relevance for Microinsurance Research

Without mechanisms like insurance in place to manage the enormous amount of risk in the lives of the poor, hard fought gains against poverty may be wiped out when the inevitable shocks of everyday life occur, be they the death or disability of a breadwinner, sickness, a failed harvest, or the loss of property due to a natural disaster or fire or theft.Blog

A Digital Pathway To Financial Inclusion

A growing body of evidence suggests that connecting poor people to a digital financial system will generate sizable welfare benefits. But countries cannot bridge the cash-digital divide in one leap. Instead, they pass through several stages of market development.Blog

Innovations in Islamic Microfinance for Small Farmers in Sudan

To enable financial inclusion for small farmers, the entire value chain needs to be understood and supported, and financial products have to be designed keeping in mind their unique needs. We at Bank of Khartoum believe that Islamic microfinance products can effectively reach small farmers in Sudan when customized to their needs.Blog

Re-Banking the De-Banked in Mexico

Earlier this year CGAP, in partnership with Bancomer, commissioned IDEO.org, the non-profit arm of the California firm known for its human-centered design methodology, to create a savings product that would meet the needs of low income Mexicans.Blog

Is M-PESA Replacing Cash in Kenya?

How far away is Kenya from the goal of cash-lite? Between July and August 2011, Bankable Frontier Associates (BFA) conducted an intensive field study within an urban and a rural pilot area to study the mode and size of intra-day cash flows at the customer-to-merchant interface and the merchant-to-supplier interface. This research finds that despite Kenya’s reputation for being a leader in mobile money, cash is still king.Blog

Savings and Credit on Mobile: The Jipange KuSave Experiment

The results of an experiment with a lend-to-save model in Kenya, Jipange KuSave, showed that there is demand for financial services which are quite different from those currently offered by mainstream providers.Blog

Lessons from India on Weather Insurance for Small Farmers

With 22 million farms covered by a yield based index, 3 million by a weather index insurance and 340,000 farms covered by an insurance combining the two indices, India is probably today the most innovative and experienced country in agricultural index insurance in the world.Blog

Creative Partnerships Promote Rural Credit in the Andes

The competitiveness and sizable growth of microlending in the Andean Region can be largely attributed to the favorable regulatory framework, but the creativity of the stakeholders in the industry has been an important factor as well. The supervisory authorities in the region’s financial sector have recognized the importance of microlending in the promotion of financial inclusion and have gradually created an environment that has been open to creativity and has enabled the different players to come up with financial services for previously underserved populations in rural areas.Blog

The Growth of Mobile Financial Services in Bangladesh

In early 2010, we blogged about the steps identified for mobile financial services to take off in Bangladesh. Bangladesh has moved partly down this path. A newly released overview report on Mobile Financial Services by Bangladesh’s Central Bank highlights the progress achieved two years on.Blog