Recent Blogs

Blog

Will Universal Basic Income Replace Safety Net Payments in India?

India is currently considering a universal basic income (UBI) scheme in which the government would guarantee a minimum income for all citizens. What are the key points of the UBI debate? What could UBI mean for financial inclusion in India?Blog

India Has Built the Rails — Will Passengers Climb Aboard?

India has put in place virtually all of the supply-side factors that should make low-cost financial services available for all. But the big question right now is the customer. The next year will be telling in how the adoption of digital financial services unfolds.Blog

All’s Well That Repays Well? Not Necessarily.

The rapid growth of microfinance in India has led to concerns about a repayment crisis. Some have tempered these worries by pointing to low delinquency rates. But do low delinquency rates tell the whole story?Blog

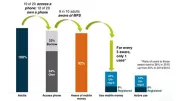

3 Customer Insights for Better Mobile Money UI/UX in Pakistan

Smartphone use in Pakistan has grown steadily, but low-income, less educated, and female customers lag in smartphone adoption and ownership. GRID Impact's user research lends insights into how to better serve and design for these population segments.Blog

Microfinance in India Growing Fast Again: Should We Be Concerned?

The rapid growth of microfinance in India today is creating new challenges for a sector hugely impacted by the 2010 crisis. The recently released Inclusive Finance India Report 2016 outlines these challenges and suggests that they should be addressed soon.Blog

Ending Extreme Poverty: New Evidence on the Graduation Approach

SDG 1 is as exciting as it is daunting: End extreme poverty. The Graduation Approach has resulted in large and cost-effective impacts on ultra-poor households’ standard of living, ultimately enabling a sustainable transition to more secure livelihoods and an exit from poverty.Blog

Advancing Financial Inclusion Through P2G Payment Digitization

Karandaaz Pakistan recently undertook the first-ever systematic review of digital person-to-government (P2G) payment efforts from across the globe. What did they find, and what are the implications for future P2G digitization efforts?Blog

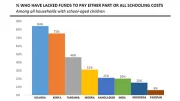

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Digital Social Payments in India: Can the Challenges Be Overcome?

Envisioned as a digital revolution for government transfers, India's Direct Benefit Transfer program transfers government benefits into recipients' bank accounts. Three years in, the government continues to face challenges in digitizing transfers. Is there a way forward?Blog

Pakistan’s Gender Gap in Financial Inclusion

Pakistan has the second worst gender gap in the world, an imbalance reflected in the country’s financial inclusion numbers. What are the specific causes of women's financial exclusion, and what are potential solutions?Blog

PMJDY: Commendable Growth, Yet Low-Hanging Barriers Persist

Two years ago, India launched a national financial inclusion program known as Pradhan Mantri Jan Dhan Yojana (PMJDY) which aims for at least one bank account for every household. Has there been any real impact of PMJDY on financial inclusion?Blog

Mobile Money in Bangladesh Plateaus after Fast Start

Mobile money in Bangladesh had a fast start. However, recent data show that while use is still increasing, the rate of growth in transaction value and volume is tapering off. Researchers analyzed a number of possible explanations for this trend.Blog

An Indian Start for Digital Credit

In India, loans often require extensive application processes or participation in a joint liability group. A pioneering digital loan provided by Suvidhaa Infoserve and Axis Bank is changing the financial services landscape.Blog

Reducing Malnutrition through the Graduation Approach

BRAC’s Targeting the Ultra Poor (TUP) program employs the Graduation Approach, through which participant households receive income-generating assets and training on business development, nutrition and social development. Researchers examined the effects of TUP on nutritional outcomes in Bangladesh, and results have been promising.Blog

Want to Improve Customer Experience? Here’s Your Playbook

A delightful customer experience–rooted in a deep understanding of customer needs–is key for any FSP looking to increase use of services among low-income customers. Where to start, and how to do it effectively? A new Customer Experience Playbook offers insights.Blog

Fierce Competition for India’s Newly Minted Small Finance Banks

The landscape of India’s financial sector is changing rapidly. New small finance bank (SFB) licenses present new possibilities and challenges for financial service providers in the Indian market.Blog

Five Fresh Facts from the Smallholder Diaries

How are smallholder families managing their money? What challenges do they face? What financial solutions can help? CGAP’s Financial Diaries with Smallholder Households ("Smallholder Diaries”) spent a year with 270 farming families in Mozambique, Tanzania, and Pakistan to find out.Blog

India's Regulator to do More on Inclusion and Innovation

Following a year of well-documented progress toward financial inclusion, the Reserve Bank of India took more steps in December 2015 that appear innovation-friendly.Blog

Salam: Both a Greeting & Innovative Agricultural Financing Option

For over 6 million smallholder farmers in Pakistan, financing options are extremely limited. The Wasil Foundation, winner of the 2013 Islamic Microfinance Challenge, offers an alternative to traditional financing that enables farmers to build assets and sustainable livelihoods.Blog