Recent Blogs

Blog

Digital Financial Inclusion Supervision: Tanzania Pilot Program

The world of digital financial inclusion is growing quickly and outpacing capacity and resources to tackle it from a regulatory and supervisory standpoint. In response, CGAP and Toronto Centre piloted the first Digital Financial Inclusion Supervision training program in Tanzania.Blog

Six Tips for Policy on Disruptive Digital Financial Inclusion

Digital technologies are changing the financial inclusion landscape worldwide by revolutionizing access to finance, connecting hundreds of millions to formal financial services for the first time. Financial market regulators, supervisors and overseers are racing to keep pace with these developments.Blog

Making the Case for Privacy for the Poor

Poor people in emerging economies are rightfully concerned about whether their families are safe, sheltered and adequately nourished. Where does privacy fit into that mix?Blog

Digital Finance in WAEMU: What’s New?

CGAP recently interviewed representatives of 100+ organizations in Benin, Côte d’Ivoire, Senegal, Mali and Niger to better understand the market system for digital financial services in the West African Economic and Monetary Union (WAEMU). What have we learned?Blog

503.2 Million Reasons to Tackle Data Protection Now

Conducting financial affairs digitally does not come without risks, evidenced by recent privacy breaches around the world. CGAP is exploring relevant issues in data protection, along with potential solutions that could build trust and improve value for customers, providers and societies.Blog

Future of Mobile Money for Cocoa Farmers in Côte d’Ivoire, Ghana

New research from the World Cocoa Foundation explores the potential of mobile money to enhance cocoa farmers’ livelihoods in Côte d’Ivoire and Ghana and paints a detailed persona of customers at the frontier of widespread adoption.Blog

Kenya Ends Hidden Costs for Digital Financial Services

In Kenya, many digital financial service providers do not disclose to consumers the costs of products. On October 29, the Competition Authority of Kenya announced an important new standard for pricing in digital financial services.Blog

Advancing Financial Inclusion Through P2G Payment Digitization

Karandaaz Pakistan recently undertook the first-ever systematic review of digital person-to-government (P2G) payment efforts from across the globe. What did they find, and what are the implications for future P2G digitization efforts?Blog

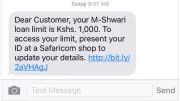

Time to Take Data Privacy Concerns Seriously in Digital Lending

Digital credit is on the rise in Kenya. While digital lenders are expanding access to credit for many Kenyans, they are operating outside regulation by any financial sector authority–and some key consumer protection concerns have started to emerge.Blog

How BOMA Is Using Technology to Reach the Extreme Poor

In 2013, the BOMA Project started moving to a digital data collection system for its programs in Kenya. This system has made data collection less costly, more timely and more reliable, with greater accountability translating into improved results for program participants.Blog

Wave Money Myanmar: The Power of Smartphone Design

Myanmar has experienced remarkable growth in smartphone penetration compared to other frontier markets. A partnership between Wave Money, CGAP and Small Surfaces is leveraging human-centered design to build a digital finance app, seeking to capitalize on this opportunity to reach the unbanked.Blog

Emerging Opportunities for Digital Finance in Indonesia

The recent visit to Indonesia by the UN Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA)–H.M. Queen Máxima of the Netherlands–provided a unique opportunity to better understand key accomplishments, challenges and opportunities for financial inclusion in the country.Blog

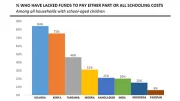

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Why We Need to Start Talking about Operational Inefficiencies

To contribute to sustainable development, microfinance itself must be sustainable. Many microlenders–including mature and/or highly profitable ones–still have ample capacity for significant efficiency gains, yet efficiency considerations are usually not among their top concerns. Why?Blog

The Power of Smartphone Interfaces for Mobile Money

An initial set of 21 principles for the design of smartphone interfaces and mobile money has been released. This powerful new area of research can harness the power of smartphones to better serve the poor.Blog

How Financial Inclusion Can Boost a Nation’s Health & Well-Being

Low-income households often struggle with health expenses, and inadequate access to quality health care can drive families into poverty. To achieve good health and well-being, UN Sustainable Development Goal 3, financial inclusion can and should play a critical role.Blog

Digital Credit in Kenya: Time for Celebration or Concern?

There are now more than 20 digital credit offerings in Kenya, with new services launching continually. Hype is building around the potential opportunities these products could bring, but their rapid proliferation is also raising questions about risks.Blog

Delivering on Education for All: The Role of Mobile Money

For many low-income families worldwide, education can be out of reach. Mobile money and digital financial services have the potential to help families by providing them with better tools that can help them save, plan and make education payments.Blog

Digital Social Payments in India: Can the Challenges Be Overcome?

Envisioned as a digital revolution for government transfers, India's Direct Benefit Transfer program transfers government benefits into recipients' bank accounts. Three years in, the government continues to face challenges in digitizing transfers. Is there a way forward?Blog