Recent Blogs

Blog

Headwinds and Tailwinds in Banking Small Businesses

Rapid “digitization” of business and investment in financial technology have the potential to significantly improve access to finance for millions of micro, small, and medium enterprises worldwide, yet challenges remain. Can FinTech solve the access to finance problem for MSMEs?Blog

The Role of Financial Services in Reducing Hunger

Many of the world's 1.5 billion smallholder farmers lack access to basic financial services, leaving them vulnerable to shocks and prone to low-risk, low-return investments. Improving access to financial services can help farmers increase household income and food security.Blog

Better Understanding the Demand for Islamic Microfinance

CGAP, Yale University and Tamweelcom have taken a novel approach to the study of demand for Islamic and conventional loans in Jordan. This randomized experiment reveals new insights into the real demand for Islamic microloans, and the findings are striking.Blog

Pakistan’s Gender Gap in Financial Inclusion

Pakistan has the second worst gender gap in the world, an imbalance reflected in the country’s financial inclusion numbers. What are the specific causes of women's financial exclusion, and what are potential solutions?Blog

Beyond Credit: Risk Management as a Strategy for Economic Growth

Well-functioning financial markets are essential for the growth of firms, including commercial farms. Efforts to improve financial markets in underserved localities must include an understanding of stakeholders’ risk management needs—not just access to credit.Blog

Advancing Financial Inclusion to Improve Access to Education

Worldwide, 124 million children between the ages of 6 and 15 are not in school. While financial inclusion cannot solve the many complex reasons all children are not in school, better financial tools can help families manage educational expenses.Blog

Protecting Digital Financial Data: What Standard-Setters Can Do

A 2016 GPFI white paper highlighted privacy and data security risks in digital financial services, asking international financial Standard-Setting Bodies (SSBs) to pay attention. Why are they concerned, and what steps can SSBs take to improve data security?Blog

A Tale of Two Markets

For people in sub-Saharan Africa getting by on $2-$5/day, on the cusp of poverty but not yet secured in Africa’s middle class, are economic challenges more easily weathered in formal or informal markets?Blog

Energy and Water for All: The Last Mile Is the Longest Mile

New models for financing household connections to energy, water and sanitation are enabling more low-income households to access these essential services. Financial solutions are necessary for achieving access targets under the Sustainable Development Goals (SDGs).Blog

Daily Diaries Reveal Bangladesh’s Shifting Financial Landscape

In Bangladesh, 50 respondents are providing full daily details of all transactions in an ongoing financial diaries project. This project aims to provide insights into the money management behavior of low-income rural Bangladeshis. What have the diaries revealed so far?Blog

What’s the Most Cost-Effective Way to Reduce Extreme Poverty?

Over the past year, CGAP and Innovations for Poverty Action have compared the cost-effectiveness of three strands of anti-poverty interventions. Our central question: Which program type generates the greatest and most sustainable impact for the extreme poor, given a limited budget?Blog

PMJDY: Commendable Growth, Yet Low-Hanging Barriers Persist

Two years ago, India launched a national financial inclusion program known as Pradhan Mantri Jan Dhan Yojana (PMJDY) which aims for at least one bank account for every household. Has there been any real impact of PMJDY on financial inclusion?Blog

The Graduation Approach: Building Partnerships with Governments

In Rwanda, the government is an active and engaged partner and strong buy-in from political leadership has helped ensure the success of some development interventions. Concern Worldwide’s adaptation of the Graduation Approach targeting vulnerable households is one such example.Blog

Leading – by Learning – on Customer Centricity

Pioneer, a Philippines-based company, participated in a May 2016 learning visit to South Africa and Zambia to learn from other CGAP partners working on customer centricity: Zoona, PEP, and Hollard. What did they learn?Blog

Mobile Money in Bangladesh Plateaus after Fast Start

Mobile money in Bangladesh had a fast start. However, recent data show that while use is still increasing, the rate of growth in transaction value and volume is tapering off. Researchers analyzed a number of possible explanations for this trend.Blog

Digital Financial Services for Cocoa Farmers in Côte d’Ivoire

Smallholder farmers are largely unable to access formal financial institutions. Over the past 22 months, a pilot project implemented by Advans Côte d’Ivoire strove to link cocoa farmers to financial institutions by transitioning from cash to digital payments, with promising results.Blog

Financial Inclusion Has a Big Role to Play in Reaching the SDGs

The United Nations’ 17 Sustainable Development Goals (SDGs) include greater equality and access to clean water, among other objectives, but not access to savings accounts, loans, insurance and other financial services. Financial inclusion can play an important role in achieving many of the SDGs.Blog

Interactive SMS Drives Digital Savings and Borrowing in Tanzania

Financial education is often delinked from customer actions–they may learn about interest rates now, but won’t need to borrow for months or even years. In rural Tanzania, an interactive SMS project brought information to farmers' phones, enabling customized learning in real time.Blog

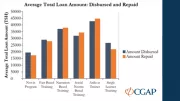

The Unusual Financial Dynamics of Short-Tenor Digital Credit

Digital credit is disbursed and recovered rapidly, often in 30 days or less, and generally with loan amounts smaller than conventional credit or micro-lending. CGAP built a digital credit financial model to investigate the basic financial dynamics of loan portfolios made up of short-term, small loans.Blog