Recent Blogs

Blog

Introducing the Graduation Approach in India’s Jharkhand State

An interview with Bishnu C Parida, on how the government of India is integrating the Graduation Approach into its work with the extreme poor.Blog

The Graduation Approach: What’s Next on the Research Agenda?

Results from an in-depth impact study on the Graduation Approach were strong. As Graduation programs are scaled up in India, Ethiopia, Pakistan, and elsewhere, what should researchers study next?Blog

5 Ways to Improve Customer Experience for the Poor

CGAP offers five insights on improving customer experience for the poor, in ways that are game-changing, yet profitable.Blog

Can a Good Customer Experience for the Poor Benefit Business?

Is it important that financial service providers (FSPs) provide a good customer experience when serving poor, underbanked customers? Evidence says "yes," but this is often overlooked by FSPs.Blog

Why Women Self-Help Group Members Make for Good Bank Agents

Pilot projects that train women self-help group members as bank agents in rural areas in India are proving to be promising.Blog

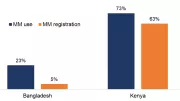

How Hard Is It to Use Mobile Money as a Rural Bangladeshi Woman?

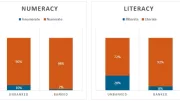

Women in Bangladesh have one of the lowest rates of mobile money usage in the world. Does the dearth of usage indicate a lack of appropriate products and services? Just how hard is it to use mobile money if you are a rural Bangladeshi woman?Blog

Making Mobile Money Accessible in Pakistan

Mobile wallets could have a revolutionary impact on financial inclusion in Pakistan. However, success of this channel hinges on matching the abilities of the end users with appropriately designed products.Blog

Pakistan: Is Mobile Money a Viable Alternative to Banking?

There is more to financial inclusion than convenience. In Pakistan, for mobile financial services to maximize their financial inclusion benefits, providers need to offer a wider variety of services.Blog

The Promise of Mobile Money in Pakistan

Mobile money - through over the counter services and mobile wallets - is helping to drive financial inclusion in Pakistan.Blog

Interpreting the Financial Inclusion Numbers in Pakistan

Financial inclusion in Pakistan has improved slowly but steadily since 2008 according to most sources. However, depending on the source of data, the topline financial inclusion figure for Pakistan varies from 7% to 23%. Why?Blog

Did India’s Central Bank get Payments Bank Approvals Right?

India's Central Bank got many things right when it comes to the 11 new approvals for payments bank licenses. These approvals are big catch-up step for digital finance in India, but it may be challenging for the country to continue being innovation-friendly.Blog

Lessons on Leadership: Reflections from Two Decades in Banking

What can leaders do to embed a culture of customer-centricity? Anil Kumar SG, who has 25 years of experience in banking, shares his ideas. Watch the video to learn more.Blog

Lessons on Leadership: The Power of Micro-Segmentation

Anil Gupta, of Aircel Limited, discusses how telecom companies like his use micro-segmentation to better serve customers and how financial service providers could, too.Blog

Lessons on Leadership: Check Your Assumptions

Maya Vengurlekar shares a story that changed the way CRISIL Foundation approaches its programming.Blog

Lessons on Leadership: Customer-Centric Measures Matter

“If you start early, it gets into the DNA of the institution," says Radhakrishnan, the CEO of Janalakshmi, on an organization's journey to customer centricity. Watch the video interview for insights on how financial service providers can become more customer-centric.Blog

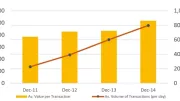

Mobile Money in Bangladesh: Still a Long Way to Go

Bangladesh is one of the fastest growing mobile money markets in the world. Yet, mobile financial services in Bangladesh have a lot of room to grow before they can claim any wide national impact.Blog

Fine Tuning Kaleido: A Key Step for Customer-Centricity

Janalakshmi Financial Services, Jana Foundation, CGAP and Innovation Labs partnered to develop a tool called Kaleido that provides the foundation for building a customer-centric organization. An initial survey of the tool offers several key findings.Blog

What’s Undermining India’s Financial Inclusion Progress?

The success of India's financial inclusion efforts hinges on one factor above all: the quality of the last-mile banking agent networks that will disburse payments and enable customers to access their bank accounts.Blog

India’s List of Financial Inclusion Efforts Grows

Since India's Prime Minister announced in February that accounts opened under his national scheme exceeded targets and 41 payments banks applications were submitted, the list of centrally-driven policy interventions has continued to stack up.Blog