Recent Blogs

Blog

Is the Hunger Season Really the Sick Season?

For many smallholders, "the hunger season," when little can be harvested, is the worst time of the year. What financial and other tools might help farmers to better endure the rainy, sick, and hungry months?Blog

Digitizing Agricultural Value Chains: How Buyers Drive Uptake

Most companies don’t want to be the first in a sector to try something new and potentially unpopular. Dominant buyers must lead the way to drive large-scale mobile money uptake by smallholder farmers.Blog

Helping Smallholders Buy Inputs, One Scratch Card at a Time

What if there was a way to construct a digital finance product that was based on habits and behaviors that are already part of smallholders’ lives? There is: Meet the myAgro scratch card model.Blog

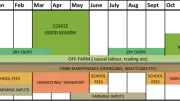

Digitizing Agriculture Value Chains: Seasonal Cash Flows

Examining the cash flows of coffee and sugar farmers in Uganda for a CGAP-commissioned project revealed a seasonal cycle that is unsuited to monthly accounting practices. There are many ways that financial services could be designed to assist these farmers.Blog

Lessons from Aggregator-Enabled Digital Payments in Uganda

To understand factors impacting aggregator profitability regarding digital bulk disbursements, we took a close look at a pilot in Uganda, where six USAID funded organizations tested digital payments to end recipients via payment aggregators.Blog

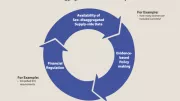

Catalyzing Women’s Financial Inclusion: The Role of Data

For governments, the collection of sex-disaggregated data begins a virtuous cycle, where its availability informs stronger, evidence-based policymaking and helps regulators evaluate the effectiveness of policies intended to promote financial inclusion.Blog

What Information Do Customers Need to Make Informed Decisions?

We know more today than every before about how customers use financial services. But we still don’t know enough about what information customers access about products they are considering, and how this informs their financial decisions.Blog

Policy into Practice: Zambia Advances Women’s Financial Inclusion

What can stakeholders do to facilitate women’s access to finance? How can they ensure that women can participate in the economy without facing constraints and barriers limiting their success?Blog

India's Regulator to do More on Inclusion and Innovation

Following a year of well-documented progress toward financial inclusion, the Reserve Bank of India took more steps in December 2015 that appear innovation-friendly.Blog

Regional Trends in International Funding for Financial Inclusion

International funding for financial inclusion varies greatly across regions.Blog

The Business of Aggregators: A Changing Market

Aggregators work in the background to help businesses, governments and donors easily connect with a variety of payment services. But how do aggregators get off the ground, what is their size and reach, and how does the business model work?Blog

Instant, Automated, Remote: The Key Attributes of Digital Credit

Three attributes - instant, automated, and remote - underscore the power of digital credit and its ability to scale quickly.Blog

The Graduation Approach Works: Now how do we Reach Scale?

Over half of 40 new Graduation projects are being implemented by governments. Some are adjusting the approach or integrating technology to make it more efficient and easier to scale.Blog

Competition & Mobile Financial Services: Move Past "Test & Learn"

A country’s approach to policymaking in mobile financial services can have a big impact on the competitive landscape. A flexible, "test and learn" approach has helped foster innovation, but may begin to have adverse consequences for competition and consumer protection.Blog

Aggregators: The Secret Sauce to Digital Financial Expansion

Aggregators are key players in the digital financial services ecosystem, but primarily operate in the background. What exactly is their role and why are they important?Blog

Salam: Both a Greeting & Innovative Agricultural Financing Option

For over 6 million smallholder farmers in Pakistan, financing options are extremely limited. The Wasil Foundation, winner of the 2013 Islamic Microfinance Challenge, offers an alternative to traditional financing that enables farmers to build assets and sustainable livelihoods.Blog

Digitizing Agriculture Value Chains: Building Value for Farmers

While there are clear benefits for buyers in digitized agricultural value chains, but the value proposition is less certain for farmers.Blog

Towards a More Enabling Legal Framework for Microfinance in Iraq

Four Iraqi MFIs, representing 15% of the market closed their doors in recent years due to conflict in the country. This left 20,000 clients with few other options, as Iraq's financial system remains underdeveloped.Blog

20 Years of Financial Inclusion in the Arab World

According to the Findex, the Arab World has the highest percentage of financially excluded adults. What are the regional obstacles? How has the field changed in the past 2 decades?Blog