Recent Blogs

Blog

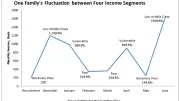

Seasonal, Unsteady Income Drives Economic Vulnerability in Brazil

Although nearly 30 million Brazilians have moved out of poverty and into the middle class in the last decade, millions remain vulnerable due to seasonal and unpredictable income patterns.Blog

Preventing the Digital Trail from Going Cold: Lessons from Mexico

In recent years, digitizing and delivering Government to Person social payments into individual recipients’ bank accounts has been considered a potential gateway to financially include significant numbers of poor people. A five-year project in Mexico is analyzed to help answer key questions.Blog

Transitions from OTC to Wallets: Evidence from Bangladesh

Despite being a relative newcomer in the mobile financial services arena, Bangladesh is already making its mark.Blog

Do Mobile Money Clients Need More Protection?

On this year’s World Consumer Rights Day, Consumers International has chosen a timely target: mobile phones. We take a look at some critical questions that must be asked to ensure the poor are being adequately protected.Blog

E-Payments in Low-Income Settings: Cutting-Edge or High Risk?

Seen as having great potential for advancing the effectiveness of social and foreign assistance, e-payments can increase efficiency in a variety of ways. Four case studies take a closer look at programs in Haiti, Kenya, The Philippines and Uganda.Blog

Postal Networks: a Physical Link to the Digital Economy

The latest White Paper from the U.S. Postal Service exploring the potential to build its existing financial services products to help the poor is getting a lot of ink in the press, and rightfully so.Blog

India’s Unique ID Could Generate Big Boost in Financial Access

Aadhaar, the effort to give every Indian resident a unique identification number for the purpose of accessing services and social benefits, is at the center of India's progress towards financial inclusion.Blog

The Case for Branchless Banking in Thousand Islands, Indonesia

In Thousand Islands, Indonesia, financial access is virtually nonexistent. Since most residents have mobile phones, the introduction of branchless banking could bridge the access gap and help improve the lives of the islands' residents.Blog

Can Voice Corridors be Used to Predict Mobile Money Hotspots?

Voice corridors aren't direct predictors of mobile money hotspots. But, this information can be valuable to mobile providers launching new services, since voice and mobile money corridors often overlap in new markets.Blog

10 Things You May Not Know about Postal Networks

Postal networks have undertaken major transformations. They are increasingly leveraging their branch networks to play a role in financial services, and many are emerging as important gateways for financial inclusion of the world's poor.Blog

Mobile Money: 10 Things You Need to Know

Mobile money is a fast moving space and 2013 was a busy year. Read our list of 10 trends in the mobile money arena in 2013.Blog

Electronic Delivery of Cash Transfers in India: The Agent Story

The G2P ecosystem in Andhra Pradesh offers an opportunity to advance financial inclusion, and also offers many lessons as direct benefit transfers are rolled out across India.Blog

Technology is not Actually a Barrier for Very Poor G2P Recipients

For recipients of social cash transfers in the Indian state of Andhra Pradesh, technology - whether a smart card or mobile phone - is rarely a barrier to use for recipients.Blog

Mobile Wallets: Is a Transition Underway in Bangladesh?

E-wallet use is becoming more common in Bangladesh. However, OTC transactions are still very popular and will likely remain so until the process of opening an e-wallet account and using it regularly become easier for and more attractive to the poor.Blog

Microfinance, E-Commerce, Big Data and China: The Alibaba Story

China's Alibaba Group is not only the world's largest e-commerce company, but it is also an innovator in microfinance. Alibaba leverages big data to link rural villages with the goods, sales channels and financial services they need to grow their businesses.Blog

The “EasyPaisa” Journey from OTC to Wallets in Pakistan

While the founders of EasyPaisa guessed that they would reach a reasonable volume of customers through OTC services, they did not guess that OTC remittances would be the dominant activity by far for EasyPaisa's customers.Blog

Better Than Cash, or Just Better Cash?

Far from replacing cash, mobile money has made cash much more efficient.Blog

More on Why OTC Makes Sense for Kenya

Cashless goals are too focused on designing products that make people want to switch to e-money, even though most still prefer cash.Blog

M-Pesa Usage Data: OTC Makes Sense, Even for Kenya

Even though "cash-lite" is a buzzword in financial inclusion, usage data from M-Pesa suggests that the goal of going "cashless" may not be aligned with the needs of people at the base of the income pyramid.Blog