Recent Blogs

Blog

The Best Laid Plans...CGAP's Response to COVID-19 (Coronavirus)

CGAP spent time thinking about how we can add unique value to a coordinated crisis response. The work we are doing to combat the effects of coronavirus is refocusing those efforts in new and unanticipated ways.Blog

COVID-19: How Does Microfinance Weather the Coming Storm?

If the microfinance sector is going to survive the pandemic, we need to treat COVID-19 as the fundamental threat to the industry that it likely is. The millions who rely on inclusive finance to borrow, save and spend money are counting on us.Blog

What Do Low-Income Customers Want from Asset Finance?

Here are six lessons for offering asset finance to low-income customers, based on in-depth interviews with dozens of asset finance providers and their customers in developing countries.Blog

Hiding in Plain Site: Informal E-Commerce Among Women in Asia

Millions of women are buying and selling goods online across Asia — but, at least in Bangladesh, Myanmar and Pakistan, they’re not transacting on e-commerce platforms. They’re using social platforms instead, often without digital payments.Blog

Digital Finance APIs Come with Risks – Here’s One Way to Manage Them

Digital financial services providers can manage risks associated with open APIs by adopting standardized legal contracts with partners and third parties. Here are six key issues that a contract should clarify, along with a contract template.Blog

How Paystack’s APIs Are Enabling Entrepreneurs in Nigeria

Paystack's open APIs for digital payments are helping thousands of African companies to launch new business models and deepen customer relationships.Blog

E-Commerce Is Taking Off in Rural China: 3 Lessons for Other Countries

China's e-commerce market has $2 trillion in annual sales and is growing as digital services reach rural areas. CGAP visited several villages and spoke with farmers and manufacturers about e-commerce. Here's what we learned.Blog

African Digital Credit Goes West

Digital credit is emerging in West Africa. Despite early reports of low default rates, consumer protection policies will be key to avoiding problems witnessed in East Africa.Blog

How Fintechs Could Digitize Store Credit in the Arab World

People in the Arab world rely on store credit almost twice as much as people in other regions. Here are three ways fintechs could digitize this type of credit.Blog

Last-Mile Agent Networks: Why Public-Private Partnerships Matter

Building out rural agent networks isn’t just about harnessing digital innovations. Global experience shows that it’s also about the public and private sectors working together.Blog

Zoona Is Putting APIs at the Core of Its Business: Here’s Why

What began as a side project has become central to Zoona's plans for growth. In this blog post, Zoona executives Brett Magrath and Bridgid Thomson discuss the importance of APIs at the company.Blog

Smart Phones, Smart Partners: Linking Asset Finance and Microfinance

One company offers microcredit. The other offers PAYGo financing for smartphones, tablets and solar home systems. In what may be a template for other microfinance institutions, they are helping each other to reach more low-income customers.Blog

A Vision for Collaborative Customer ID Verification in Africa

Technology has the capacity to improve financial inclusion in Africa, but this value can be unlocked only if African leaders reduce the burden of customer ID checks.Blog

Bringing Digital Finance Agents to the Last Mile in Indonesia

A recent CGAP publication identifies six principles for viable agent networks in rural areas. In this post, we look at how where Indonesia stands against these principles.Blog

BTPN Wow! Using Open APIs to Bring E-Commerce to Its 250,000 Agents

By connecting its agents to e-commerce platforms, BTPN is giving agents and end-customers in Indonesia more reasons to use its mobile banking service.Blog

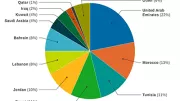

Mapping Fintech Innovations in the Arab World

Where is fintech innovation happening in the Arab world? What types of solutions are emerging? CGAP shares preliminary results from our research on fintech in a region with roughly 140 million financially excluded adults.Blog

Open Data and the Future of Banking

Although growing numbers of low-income people are entering the formal financial system, many are not yet leveraging its full value. Emerging regimes for data sharing and payments flexibility have the potential to bypass traditional financial sector development and give poor customers better products and more choices.Blog

4 Keys to a Successful Developer Portal for Digital Finance APIs

Here are some practical tips on how digital financial services providers can build a first-rate developer portal for their APIs.Blog

Former PAYGo CFO: Smart Subsidies Can Scale Energy Financing

Well-designed subsidies could create a stronger foundation for the solar home system industry and enable it to reach more low-income customers, according to entrepreneur and former PAYGo executive Joshua Romisher.Blog