Recent Blogs

Blog

A Tale of Two Markets

For people in sub-Saharan Africa getting by on $2-$5/day, on the cusp of poverty but not yet secured in Africa’s middle class, are economic challenges more easily weathered in formal or informal markets?Blog

The Graduation Approach: Building Partnerships with Governments

In Rwanda, the government is an active and engaged partner and strong buy-in from political leadership has helped ensure the success of some development interventions. Concern Worldwide’s adaptation of the Graduation Approach targeting vulnerable households is one such example.Blog

Leading – by Learning – on Customer Centricity

Pioneer, a Philippines-based company, participated in a May 2016 learning visit to South Africa and Zambia to learn from other CGAP partners working on customer centricity: Zoona, PEP, and Hollard. What did they learn?Blog

Graduation Case Studies: An Opportunity to Learn & Scale Up

To further understand the opportunities and challenges faced by governments in the implementation of a Graduation Approach, the Ford Foundation has commissioned three case studies to examine the planning and execution of Graduation programs launched by the governments of Colombia, Peru and Ethiopia.Blog

User-Centered Financial Services Build Household Resilience

"Resilience" refers to the ability to anticipate, respond to and recover from shocks. Freedom from Hunger used “resilience diaries” with 46 households in Burkina Faso to research whether financial services could play a greater role in building household resilience.Blog

Understanding Customer Inactivity with Customer Data from Kenya

Account dormancy among mobile money users is an industry-wide problem. WSBI is working to understand the driving forces behind customer inactivity in Kenya.Blog

Linking Mobile Banking with Village Groups in Uganda

In Uganda, WSBI and PostBank Uganda sought to encourage active individual savings for village group members while simultaneously providing efficiency gains via group lending. The solution? PBU’s low-cost VSLA Group Account, which has reached over 500,000 members.Blog

Could Energy Service Be the Key to Banking the Rural Poor?

Driving financial inclusion and expanding energy access have traditionally been considered separate development objectives. But thanks to revolutions in the distribution and financing of off-grid solar, that may be about to change.Blog

Financial Inclusion and Off-Grid Solar: Three Takeaways

Pay-as-you-go solar energy is gaining popularity in sub-Saharan Africa, and it is also playing a role in driving financial inclusion.Blog

Building a Digital Finance Ecosystem in Zimbabwe

Mobile operators are increasingly looking toward a next generation of financial and non-financial services that leverage mobile money. In Zimbabwe, Econet is diversifying its products while simultaneously driving mobile money usage in other sectors, including energy, education, agriculture, and health.Blog

New Bill, Big Changes in Digital Financial Services in Uganda

In Uganda, the recently-passed Financial Inclusion Act Amendment Bill provides legal grounds for positive changes in the field of digital financial services, in terms of allowing new business models and greater choice and protection for customers.Blog

Enhancing Financial Inclusion for Women in Nigeria

Even though Nigeria has a higher level of financial inclusion than Sub-Saharan Africa across three of five indicators, the gender gap in Nigeria is higher. What can be done to lower the barriers to female financial inclusion?Blog

The Impact of Shutting Down Mobile Money in Uganda

Citing a threat to national security, the Uganda Communications Commission ordered mobile network operators to disable Uganda's mobile money platforms ahead of February 2016 elections. How were customers, mobile money agents, and other businesses affected by this shutdown?Blog

Tigo Nivushe, Tanzania: 5 Ways to Build Trust in Digital Lending

‘We will trust you until you give us a reason not to:’ Tigo launches an innovative mobile lending product in Tanzania.Blog

Five Fresh Facts from the Smallholder Diaries

How are smallholder families managing their money? What challenges do they face? What financial solutions can help? CGAP’s Financial Diaries with Smallholder Households ("Smallholder Diaries”) spent a year with 270 farming families in Mozambique, Tanzania, and Pakistan to find out.Blog

Is the Hunger Season Really the Sick Season?

For many smallholders, "the hunger season," when little can be harvested, is the worst time of the year. What financial and other tools might help farmers to better endure the rainy, sick, and hungry months?Blog

Digitizing Agricultural Value Chains: How Buyers Drive Uptake

Most companies don’t want to be the first in a sector to try something new and potentially unpopular. Dominant buyers must lead the way to drive large-scale mobile money uptake by smallholder farmers.Blog

Helping Smallholders Buy Inputs, One Scratch Card at a Time

What if there was a way to construct a digital finance product that was based on habits and behaviors that are already part of smallholders’ lives? There is: Meet the myAgro scratch card model.Blog

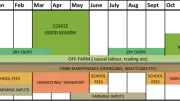

Digitizing Agriculture Value Chains: Seasonal Cash Flows

Examining the cash flows of coffee and sugar farmers in Uganda for a CGAP-commissioned project revealed a seasonal cycle that is unsuited to monthly accounting practices. There are many ways that financial services could be designed to assist these farmers.Blog