Recent Blogs

Blog

Meeting Education Finance Needs in Rural Uganda

In Uganda, CGAP partnered with a solar company to better understand the education finance needs of rural customers and explore how pay-as-you-go solar companies can get into education financing.Blog

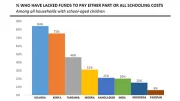

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

Agents for Everyone: Removing Agent Exclusivity in Kenya & Uganda

Mobile money and banking agents blend seamlessly into the daily economic lives of consumers in countries like Kenya and Uganda, offering convenience and expanding access points to financial services. But agent exclusivity clauses can limit customers' choices.Blog

Tugende: Analog Credit on Digital Wheels

In Uganda, Tugende has helped over 3,000 motorcycle taxi drivers on the path to ownership by leveraging new technologies that enable the purchasing of an asset over time. Tugende's success has four key lessons for other digital finance plus initiatives.Blog

Linking Mobile Banking with Village Groups in Uganda

In Uganda, WSBI and PostBank Uganda sought to encourage active individual savings for village group members while simultaneously providing efficiency gains via group lending. The solution? PBU’s low-cost VSLA Group Account, which has reached over 500,000 members.Blog

Achieving Financial Access through Village Banking and Data

In its work towards Universal Financial Access (UFA) by 2020, WSBI is using data to improve understanding of customer behaviors and needs.Blog

New Bill, Big Changes in Digital Financial Services in Uganda

In Uganda, the recently-passed Financial Inclusion Act Amendment Bill provides legal grounds for positive changes in the field of digital financial services, in terms of allowing new business models and greater choice and protection for customers.Blog

The Impact of Shutting Down Mobile Money in Uganda

Citing a threat to national security, the Uganda Communications Commission ordered mobile network operators to disable Uganda's mobile money platforms ahead of February 2016 elections. How were customers, mobile money agents, and other businesses affected by this shutdown?Blog

Digitizing Agricultural Value Chains: How Buyers Drive Uptake

Most companies don’t want to be the first in a sector to try something new and potentially unpopular. Dominant buyers must lead the way to drive large-scale mobile money uptake by smallholder farmers.Blog

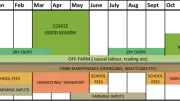

Digitizing Agriculture Value Chains: Seasonal Cash Flows

Examining the cash flows of coffee and sugar farmers in Uganda for a CGAP-commissioned project revealed a seasonal cycle that is unsuited to monthly accounting practices. There are many ways that financial services could be designed to assist these farmers.Blog

Lessons from Aggregator-Enabled Digital Payments in Uganda

To understand factors impacting aggregator profitability regarding digital bulk disbursements, we took a close look at a pilot in Uganda, where six USAID funded organizations tested digital payments to end recipients via payment aggregators.Blog

Crowdsourcing at Work: Mapping Financial Access in Uganda

Dynamic, rapidly changing agent networks translate to a need for sophisticate, real-time location data and analysis tools. The Humanitarian OpenStreetMap Team is initiating a pilot program in Uganda to crowdsource data on financial services available in Uganda.Blog

Digital Finance and Illiteracy: Four Critical Risks

Illiteracy is still a global problem, and most financial services are not designed for illiterate customers. The Helix Institute is working with financial service providers to help develop products and services that can work better for those who cannot read.Blog

Fraud in Uganda: How Millions Were Lost to Internal Collusion

Kampala’s Anti-Corruption Court is at the epicenter of a major mobile money fraud. The very public nature of this case will hopefully lead to some positive outcomes among industry actors in mobile money markets around the world.Blog

Mobile Money Moves Forward in Uganda Despite Legal Hurdles

Despite unfavorable financial sector laws, Uganda is among the most successful countries in Africa with regards to mobile financial services (MFS).Blog

Don’t Forget the Value Proposition for G2P E-Payment Recipients

Theory indicates that G2P payments can be a gateway to financial inclusion, but behavior on the ground suggests that receiving social cash transfers electronically has not influenced recipients to become e-payment users in general.Blog

Infrastructure, Consistency are the Backbone of G2P E-Payments

A new Focus Note examines the opportunities and challenges involved in implementing social cash transfer schemes in Uganda, Haiti, the Philippines, and KenyaBlog

E-Payments in Low-Income Settings: Cutting-Edge or High Risk?

Seen as having great potential for advancing the effectiveness of social and foreign assistance, e-payments can increase efficiency in a variety of ways. Four case studies take a closer look at programs in Haiti, Kenya, The Philippines and Uganda.Blog

The Art of Discovery: Incubating Mobile Money Ideas In Uganda

How can we creatively design products that can have a real impact on the mobile money market? This post shares the experience of Grameen App Lab in Uganda.Blog