Recent Blogs

Blog

How do Low-Income People in Senegal Manage their Money?

A survey of 1,052 people in Senegal living just above and below the poverty line describes their aspirations, the financial risks they face, and the financial strategies they adopt.Blog

How do Low-Income People in Cote d’Ivoire Manage their Money?

A survey of 1,000 low-income people in Côte d'Ivoire revealed interesting patterns around how Ivorians manage and approach money.Blog

IMF Survey: Financial Access Gap Narrows in Sub-Saharan Africa

The financial access gap in Sub-Saharan Africa is fast narrowing when compared to other areas, according to the IMF’s latest Financial Access Survey (FAS).Blog

Better Than Cash, or Just Better Cash?

Far from replacing cash, mobile money has made cash much more efficient.Blog

More on Why OTC Makes Sense for Kenya

Cashless goals are too focused on designing products that make people want to switch to e-money, even though most still prefer cash.Blog

Does Outpatient Care Through Microinsurance Offer Value?

Is there a business case for microinsurance? Does it provide value for clients? In Tanzania, The MicroInsurance Centre's MILK Project found two clear benefits to clients: getting them to a doctor sooner and efficiently financing health shocks.Blog

A National Experiment: Sharia-Compliant Finance in Sudan

Sudan's banking system went Islamic in the 1980's and can offer several lessons on delivering Sharia-compliant financial products to the poor.Blog

From Diagnostic to Action: Developing Microinsurance in Nigeria

A Microinsurance Country Diagnostic in Nigeria revealed that while there is a huge opportunity for the development of a microinsurance market, low-income people in the country have limited knowledge of insurance and the value it can deliver.Blog

New Rwanda Diaries Ask, “Can We Build A Better Goat?”

Portfolios of Rwanda is a new report that analyzes the daily cash flows of Rwandan households to better understand their financial needs. In many cases, the challenge is no longer an issue of access to financial services, but one of relevant products.Blog

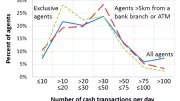

Mobile Money Agents in Tanzania: How Busy, How Exclusive?

The Financial Sector Deepening Trust of Tanzania (FSDT) undertook a census of cash outlets in the country, and discovered that half of all agents do more than 30 transactions per month and nearly two-thirds of agents are exclusive to M-PESA.Blog

East And Southern Africa: A Region On The Move

In 2012, the region has made strides in financial inclusion through innovative products such as M-Shwari, as well as creative financial sector regulation and policy.Blog

Who Is Targeted? Financial Pyramid Schemes and the Poor

In Kenya, where the qualitative research provided input to a policy diagnostic on financial consumer protection issues and approaches, at least one person in each of 14 groups was personally affected by a pyramid investment scheme.Blog

Innovations in Islamic Microfinance for Small Farmers in Sudan

To enable financial inclusion for small farmers, the entire value chain needs to be understood and supported, and financial products have to be designed keeping in mind their unique needs. We at Bank of Khartoum believe that Islamic microfinance products can effectively reach small farmers in Sudan when customized to their needs.Blog

What Policies Make Finance Work for Africa’s Smallholder Farmers?

In some African countries as much as 80% of the population is employed in the agricultural sector. Even so, these countries need improved productivity and access to financial services to ensure food security and reach their potential. So, what policies can support innovative finance that reaches smallholder farmers?Blog

Are You Getting Your Share? Revenue Protection in Mobile Money

Mobile money has had bad press lately for fraud-related cases. Most of the reported cases were either the result of internal employees misusing the system to cause operator losses or fraudsters trying to scam unsuspecting users. There is another angle that rarely gets any press—when users or agents abuse the platform and use it in rogue ways that it was never intended.Blog

Training MFI Directors on Governance

Some MFIs do have informed and knowledgeable board members who lead the institution and take decisions and actions to define the organization’s mission, establish policies, and determine control mechanisms to allocate power, establish decision making processes and set up procedures for performing specific tasks.Blog

The Role of Organized Retailers in Financial Inclusion

We have previously discussed on this blog how consumer goods retailers can be part of the financial inclusion landscape. Today, we start to expand on that theme, explaining briefly why retailers are an exciting opportunity for financial inclusion but how that opportunity is not present in every market and, where it is present, how certain types of retailers could place themselves better to serve low-income consumers.Blog

Jipange Kusave: A Mobile-only Attack on the Kenyan Mattress

When we launched Jipange KuSave – a mobile-only savings product – in Kenya in early 2010, our goal was to out-compete the mattress. Back then, Safaricom’s M-PESA service was in hyper-growth phase and ramping up to become the de facto national retail payment system. But even more exciting was M-PESA’s potential as a pervasive and low-cost delivery channel for a wider set of financial services.Blog

Can Third-Party Providers Lead to New Business Models?

Until recently, Zoona, formerly known as Mobile Transactions could have been considered the best kept secret in Africa. Operating in Zambia on a shoe-string budget, they have been developing their own unique business model for electronic financial services slowly and with little media attention. Now, as of February 2012, this small company has secured investments from three big investors, Omidyar Network, ACCION Frontier Investments, and Sarona Asset Management. All three are banking on the fact that Zoona’s experience and innovative approach to serving a range of consumers situates them to fill crucial gaps in the mobile money transactions and payments market in Africa.Blog