Recent Blogs

Blog

6 Ways Microfinance Institutions Can Adapt to the Digital Age

Microfinance has a relatively good record of serving the poor in a socially responsible way. But it must adapt to continue serving those customers in the digital age, argues CGAP CEO Greta Bull.Blog

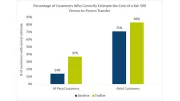

Kenya’s Rules on Mobile Money Price Transparency Are Paying Off

Kenya's pricing transparency rules have made customers more aware of the costs of using certain digital financial services, according to a new CGAP survey.Blog

Can Agro-Dealers Be the Last-Mile Rails for Digital Finance?

New CGAP partnerships test large agribusinesses' potential to bring financial services to millions of rural farmers.Blog

Data Privacy and Protection – Providers Share Their Perspectives

Just like customers themselves, providers deeply value the protection and security of the customer data they hold. They just have different reasons.Blog

The Many Faces of Social Exclusion

FinScope consumer data shows how people experience social exclusion differently and points to groups that are especially excluded, including farmers, women and youth.Blog

Who’s Getting Financial Inclusion Funding in Sub-Saharan Africa?

Funding for financial inclusion in Africa has reached $4.7 billion, up 270 percent over the past several years. So which countries are getting the most funding? And are these investments making a difference?Blog

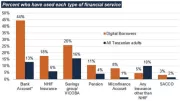

Kenya’s Digital Credit Revolution Five Years On

It's been five years since Kenya launched its first digital credit solution. A new CGAP survey shows that one in four Kenyans has taken a digital loan, mostly for working capital and day-to-day consumption.Blog

5 Insights into Credit Scoring for Smallholders

Agricultural lending remains a frontier area even as the alternative lending space fills up with new players. Here are some early insights from CGAP's work on alternative credit scoring for smallholder farmers in Uganda.Blog

KYC Utilities and Beyond: Solutions for an AML/CFT Paradox?

From KYC utilities to blockchain apps and new ways to collaborate on customer due diligence, recent developments are chipping away at a major barrier to financial inclusion: the high cost of meeting anti-money laundering and terrorism financing requirements.Blog

Women’s Financial Inclusion: What the Gallup World Poll Tells Us

Gallup data shows that 81 percent of women worldwide own a mobile phone. Yet regions with high ownership rates have some of the lowest rates of women's financial inclusion.Blog

Building Rural Digital Ecosystems: A New Role for Agribusinesses?

Bringing digital finance to the rural poor will require financial services providers to work more creatively with agribusinesses that have extensive experience serving last-mile clients.Blog

An Innovator’s Dilemma: Teaching Mobile Payments

The hard work of educating customers about mobile payments is increasingly falling to start ups offering services like water and solar. In Ghana, Safe Water Network is showing how this can be done in partnership with providers.Blog

Pay-as-You-Drink: Digital Finance and Smart Water Service

A pilot in Ghana is showing that the pay-as-you-go solar model can be adapted to change how water is delivered to poor customers.Blog

Super Platforms in Africa: Not if, but When

Super platforms like Ant Financial are likely to expand into Africa and impact financial services providers, regulators and customers.Blog

Connecting the Dots: Interoperability and Technology

For interoperability to work, technology must do more than move transactions from Point A to Point B. It must be optimized to ensure security, encourage use, promote innovation and handle the inevitable time when something goes wrong.Blog

Helping or Hurting? 10 Facts About Digital Credit in Tanzania

A nationally representative phone survey shows who's using digital credit, how they're using it, and whether it's living up to the hype of helping families cope with emergencies.Blog

QR Codes and Financial Inclusion: Reasons for Optimism

QR codes are gaining traction in China as a way to make digital payments, but will they catch on in other countries?Blog

FinTech Partnerships: Choose Carefully, Then Evolve

FinTech startups in developing markets are leveraging partnerships to reach customers as diverse as women's savings groups, dairy cooperatives and smallholder farmers.Blog

Balancing the Economics of Interoperability in Digital Finance

Interoperability in digital payments hinges on more than the right technology. It also requires the right balance of economic incentives for participants.Blog