Recent Blogs

Blog

Postal Savings Bank of China: Inclusive Finance in Rural China

The Postal Savings Bank of China has five advantages over the "big 4" commercial banks when it comes to serving the rural population.Blog

Bridging the Urban-Rural Corridor in China

Migrant workers remain one of the most financially excluded population segments in China. Without bank accounts, sending money home via remittances can be complicated and expensive.Blog

China and Kenya: Different Models for Scaling Branchless Banking

In China, branchless banking initiatives are starting to reach scale, but the story has different foundations from other country success stories, such as Kenya.Blog

Balancing Regulatory Uncertainty in Branchless Banking Design

For providers of mobile money services looking to navigate complex regulatory environments, there are valuable lessons that can be extracted from failed experiences - which can sometimes be traced back to challenging legal environments.Blog

Microcredit Impact Revisited

A more nuanced picture is emerging that supports broad financial inclusion efforts. Mounting evidence shows that on the whole, access to formal financial services helps poor families in developing countries improve their lives.Blog

Branchless Banking in China: Will Regulation Support Innovation?

China's pilot of 500,000 banking agents show significant promise for financial inclusion. Allowing these agents to offer a greater variety of services, such as taking deposits and opening new accounts, could lead to faster growth and more usage.Blog

Financial Inclusion in China: Will Innovation Bridge the Gap?

Technology and innovation hold great promise for deepening financial access in China. But despite recent improvements, China is home to a huge unbanked population - second only in size to India.Blog

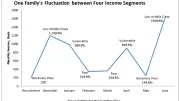

Seasonal, Unsteady Income Drives Economic Vulnerability in Brazil

Although nearly 30 million Brazilians have moved out of poverty and into the middle class in the last decade, millions remain vulnerable due to seasonal and unpredictable income patterns.Blog

M-Shwari in Kenya: How is it Really Being used?

In recent years, Safaricom has launched a number of value-added services through its M-PESA product in Kenya, aiming to move its customer base beyond basic money transfers. M-Shwari is by far the most popular of the offerings.Blog

Digital Finance Helps Expand Access to Electricity

Mobisol combines solar energy with innovative mobile technology and microfinance. Their lease-to-own solar home systems are paid off through a microfinance installment plan via the customer’s mobile phones – making them affordable for households with low incomes in developing countries.Blog

Do Agents Improve Financial Inclusion? Evidence from Brazil

With more than 400,000 agents, Brazil has one of the largest agent networks in the world, but their impact on financial inclusion is mixed.Blog

Savers Deserve More Attention and Protection

Access to finance in the West African Economic Monetary Union and Economic and Monetary Community of Central Africa grew significantly from 2001 to 2011. However, more attention must be paid to savings and savers.Blog

Redefining Failure: Why Getting it Wrong is Part of the Equation

In the first of a blog series on innovation in branchless banking, we take a look at why failure might actually be something to strive for.Blog

Water by Phone: Transforming Utilities in the Developing World

As World Water Day is being recognized around the globe this Saturday, we take a look at how mobile money is making clean water more affordable and accessible in Kenya.Blog

Transitions from OTC to Wallets: Evidence from Bangladesh

Despite being a relative newcomer in the mobile financial services arena, Bangladesh is already making its mark.Blog

Do Mobile Money Clients Need More Protection?

On this year’s World Consumer Rights Day, Consumers International has chosen a timely target: mobile phones. We take a look at some critical questions that must be asked to ensure the poor are being adequately protected.Blog

E-Payments in Low-Income Settings: Cutting-Edge or High Risk?

Seen as having great potential for advancing the effectiveness of social and foreign assistance, e-payments can increase efficiency in a variety of ways. Four case studies take a closer look at programs in Haiti, Kenya, The Philippines and Uganda.Blog

Postal Networks: a Physical Link to the Digital Economy

The latest White Paper from the U.S. Postal Service exploring the potential to build its existing financial services products to help the poor is getting a lot of ink in the press, and rightfully so.Blog

The Global Landscape of Mobile Microinsurance

Since 2010, two-thirds of all new mobile microinsurance products were launched in low-income countries, particularly in Sub-Saharan Africa. A number of these were by non-traditional players innovating through new channels and with new products.Blog