Recent Blogs

Blog

Measuring Financial Sales Staff Behavior: Evidence from Mexico

A recently completed study in Mexico sought to determine how the perceptions sales staff have of different types of consumers and their knowledge impacted the quality and quantity of information consumers receive when shopping for an individual credit or savings product.Blog

Indonesia Moves Towards a Cash Light Economy

In mid May 2013, the three leading mobile network operators in Indonesia surprised the financial services industry by announcing they will interoperate their wallets.Blog

Three Thoughts for Financial Inclusion Entrepreneurs

I am one of the founders of Coda Payments, a company that makes it possible for customers in emerging markets to make small-value purchases using their mobile accounts. There are three essential lessons for aspiring entrepreneurs in this space.Blog

Microinsurance is Key to Managing Risk: Wrapping-up

CGAP's recent blog series on microinsurance brought together over a dozen thought leaders and confirmed that microinsurance is an important service to help poor households protect their fragile livelihoods and lives against inevitable risks and unexpected catastrophes.Blog

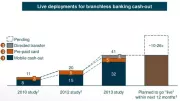

International Remittances and Branchless Banking: Emerging Models

The landscape of international remittances through branchless banking continues to evolve, with a variety of new players and models entering the market and driving change.Blog

Lessons from the MIX in Tracking Islamic Microfinance Development

Consistently tracking and analyzing the performance of Islamic microfinance providers will be key to improving their services and, in turn, broadening their outreach.Blog

Latest on Branchless Banking from Indonesia

In early May 2013, Bank Indonesia released long-awaited guidelines for banks and mobile network operators to outsource some banking operations to agents, unleashing the potential for branchless banking across the country.Blog

Credit Market Saturation: Anatomy of a Recent Debate

Two recent posts on repayment of microfinance loans in Tamil Nadu has sparked a debate between the authors. Both of whom raise a question for the industry as a whole: how can we better measure over-indebtedness and market saturation?Blog

Financial Inclusion: Blurred Lines, Sharper Vision

Financial Access 2012 shows a clear—albeit nascent—recovery from the financial crisis, with growth rates of both deposit and loan penetration picking up. The world as a whole had 47 ATMs and 17 commercial bank branches per 100,000 adults in 2011.Blog

Recognizing Two Approaches to Balancing Returns in Microfinance

If microfinance is to rely on impact investors to fund its future growth, it's crucial that it build credibility with both financial-first and below-market investors. Without clearer and more accurate investment propositions, microfinance could progressively alienate all its investors.Blog

What Do We Know about the Impact of Microinsurance?

Knowledge is still patchy but key insights are emerging on the impact of microinsurance products including financial protection and better access to health care.Blog

Top 7 Opportunities for Funders to Advance Microinsurance

The Microinsurance Network and its members have identified interesting opportunities for donors and funders, based on experiments already underway, to further galvanize the sector.Blog

Smart Policy: Why Islamic Banks Matter in Indonesia

With financing a key need for millions of micro to mid-sized entrepreneurs, empowering Islamic financial service providers to reach more clients is not only good for business. It’s smart policy.Blog

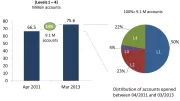

Mexico’s Tiered KYC: An Update on Market Response

In August 2011 Mexico approved a tiered scheme for opening deposit accounts at credit institutions. The innovation is that it incorporates several “levels” of simplified accounts – requirements increase progressively as restrictions on transactions and channels are eased.Blog

Can Islamic Banking Offer Some Lessons to Islamic Microfinance?

The journey of Islamic banking may offer some lessons - including product diversity - to Islamic microfinance.Blog

Why is the Progress of Mobile Money so Gradual and Patchy?

Mobile money may be inevitable, but progress thus far has been slow and results scant.Blog

Mobile Money: Even Data Analytics Has Limitations

While quantitative data analysis is a useful first step in understanding active mobile customers, it is even more insightful when providers actually go and talk with their customers directly.Blog

Defaults Versus Over-indebtedness in Morocco

In Morocco, microcredit borrowers don't default only when they are unable to repay loans. Individual or collective defaults also result when credit providers lose legitimacy and borrowers are not willing to repay.Blog

Does Outpatient Care Through Microinsurance Offer Value?

Is there a business case for microinsurance? Does it provide value for clients? In Tanzania, The MicroInsurance Centre's MILK Project found two clear benefits to clients: getting them to a doctor sooner and efficiently financing health shocks.Blog