Recent Blogs

Blog

Small Business Finance and Financial Inclusion in Latin America

Limited acceptance of digital payments and high fees associated with using such services are two obstacles to greater financial inclusion in Latin American countries. Can these issues be solved at the retailer level, rather than the individual level?Blog

DaviPlata: Taking Mobile G2P Payments to Scale in Colombia

DaviPlata, a mobile wallet offered by Banco Davivienda in Colombia, is an application helping to shift social safety net payments – often paid in cash – to digital delivery.Blog

Cashless & Cashy: The Yin-Yang of Digital Delivery in Peru

When it comes to delivering financial services to lower income segments in Peru, innovators have struck an interesting balance between cashless and cashy transactions.Blog

Five Lessons about Agent Networks in Peru

CGAP recently completed a study of five agent networks in Peru comprising more than 26,000 agents and 24 million monthly transactions to identify key success factors in reaching poor and rural areas.Blog

Regulation and Innovation: Hand in Hand?

The United Kingdom's Financial Conduct Authority just launched a new approach to dealing with the natural tension between consumer protection, innovation, and ensuring financial inclusion. Project Innovate is the UK's answer to supporting innovation where it could genuinely improve the lives of consumers.Blog

Can Agents Improve Conditional Cash Transfers in Peru?

Innovations for Poverty Action is working with the Peruvian Government to test conditional cash transfer programs that help poor people save more and receive their payments in more convenient ways.Blog

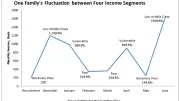

Seasonal, Unsteady Income Drives Economic Vulnerability in Brazil

Although nearly 30 million Brazilians have moved out of poverty and into the middle class in the last decade, millions remain vulnerable due to seasonal and unpredictable income patterns.Blog

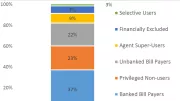

Using Demand-side Surveys to Segment Client Groups in Brazil

Using data from a national household survey in Brazil, we segmented Brazilian respondents into six categories: Financially Excluded; Unbanked Bill Payers; Selective Users; Privileged Agent Non-Users; Banked Bill Payers; and Agent Super-Users.Blog

Do Agents Improve Financial Inclusion? Evidence from Brazil

With more than 400,000 agents, Brazil has one of the largest agent networks in the world, but their impact on financial inclusion is mixed.Blog

Preventing the Digital Trail from Going Cold: Lessons from Mexico

In recent years, digitizing and delivering Government to Person social payments into individual recipients’ bank accounts has been considered a potential gateway to financially include significant numbers of poor people. A five-year project in Mexico is analyzed to help answer key questions.Blog

Graduation Programs as Part of Targeted Social Policy

After more than 15 years, conditional cash transfer programs have become the backbone of targeted social policies in Latin America. But we must create programs that maintain progress while continuing to move people out of poverty and into sustainable livelihoods.Blog

Nicaragua’s System for Resolving Financial Complaints

Nicaragua has made significant strides in consumer protection and financial inclusion since 2005, especially regarding its formalized complaints channel for credit card disputes.Blog

Growth in Women’s Businesses: The Role of Finance

Across the globe, the share of women who become entrepreneurs is significantly below that of men. Access to formal finance remains a major obstacle for women looking to grow their businesses.Blog

Vivid Profiles of Mobile Account Users in Rural Mexico

Nearly 30 million Mexicans live in rural communities and lack basic infrastructure. As Telecomm brings basic mobile banking services to rural communities, we hear how users benefit from using these accounts in their daily lives.Blog

Improving the Lives of the Poorest in Peru

CGAP staff document a field visit to the Peru Graduation Pilot, where several communities outside of Cusco are participating in a project to understand how safety nets, livelihoods and access to finance can help the poorest graduate from extreme poverty.Blog

Voices from the Field: Reaching the Poorest in Peru

CGAP's Michael Rizzo was in Peru and spoke with some of the pioneers and partners that have witnessed the Graduation Program evolve over the last few years.Blog

Measuring Financial Sales Staff Behavior: Evidence from Mexico

A recently completed study in Mexico sought to determine how the perceptions sales staff have of different types of consumers and their knowledge impacted the quality and quantity of information consumers receive when shopping for an individual credit or savings product.Blog

A New Wave of E-Money in Latin America

In Latin America, the banking sector is highly rooted in the economy, and to think about non-bank issued electronic money is almost heretic. But things are changing.Blog

Consumer Lending and Financial Inclusion in Latin America

Regulators in Latin America are starting to build regional consensus and sharing successful policies across markets on consumer lending.Blog