Recent Blogs

Blog

Bridging the Urban-Rural Corridor in China

Migrant workers remain one of the most financially excluded population segments in China. Without bank accounts, sending money home via remittances can be complicated and expensive.Blog

China and Kenya: Different Models for Scaling Branchless Banking

In China, branchless banking initiatives are starting to reach scale, but the story has different foundations from other country success stories, such as Kenya.Blog

Balancing Regulatory Uncertainty in Branchless Banking Design

For providers of mobile money services looking to navigate complex regulatory environments, there are valuable lessons that can be extracted from failed experiences - which can sometimes be traced back to challenging legal environments.Blog

Microcredit Impact Revisited

A more nuanced picture is emerging that supports broad financial inclusion efforts. Mounting evidence shows that on the whole, access to formal financial services helps poor families in developing countries improve their lives.Blog

The Road Ahead: Implementing Kaleido at Scale

Janalakshmi, an urban microfinance institution in India, is putting its customers at the center of its business with a mapping tool called Kaleido.Blog

Branchless Banking in China: Will Regulation Support Innovation?

China's pilot of 500,000 banking agents show significant promise for financial inclusion. Allowing these agents to offer a greater variety of services, such as taking deposits and opening new accounts, could lead to faster growth and more usage.Blog

Passing the Baton, but to Whom? Considerations for Investors

The number of exits from microfinance equity investments is anticipated to accelerate in the next few years because equity funds are maturing, MFIs are maturing, and social investors are moving on to new frontiers.Blog

Financial Inclusion in China: Will Innovation Bridge the Gap?

Technology and innovation hold great promise for deepening financial access in China. But despite recent improvements, China is home to a huge unbanked population - second only in size to India.Blog

Preparing to Spend a Year with Smallholder Farmers in Tanzania

The preparations for the smallholder farmer household financial diaries continue in Tanzania, Pakistan and Mozambique. Here we discuss the site selection process in Tanzania, which we completed in advance of the sampling and recruiting of households.Blog

Selecting a Site for Smallholder Financial Diaries in Pakistan

CGAP and Bankable Frontier Associates have begun a study that examines the financial lives of smallholder agricultural families in Mozambique, Pakistan, and Tanzania. Here, we look at how we chose an appropriate site in Pakistan.Blog

Why Financial Diaries to Understand the Needs of Smallholders?

CGAP is working with Bankable Frontier Associates to conduct a financial diaries project on 90 families in Tanzania, Mozambique, and Pakistan.Blog

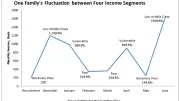

Seasonal, Unsteady Income Drives Economic Vulnerability in Brazil

Although nearly 30 million Brazilians have moved out of poverty and into the middle class in the last decade, millions remain vulnerable due to seasonal and unpredictable income patterns.Blog

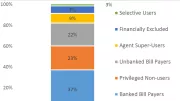

Using Demand-side Surveys to Segment Client Groups in Brazil

Using data from a national household survey in Brazil, we segmented Brazilian respondents into six categories: Financially Excluded; Unbanked Bill Payers; Selective Users; Privileged Agent Non-Users; Banked Bill Payers; and Agent Super-Users.Blog

M-Shwari in Kenya: How is it Really Being used?

In recent years, Safaricom has launched a number of value-added services through its M-PESA product in Kenya, aiming to move its customer base beyond basic money transfers. M-Shwari is by far the most popular of the offerings.Blog

Digital Finance Helps Expand Access to Electricity

Mobisol combines solar energy with innovative mobile technology and microfinance. Their lease-to-own solar home systems are paid off through a microfinance installment plan via the customer’s mobile phones – making them affordable for households with low incomes in developing countries.Blog

Turning Good Ideas into Profitable Products

In the second in our series on failure, we learn some key lessons from the Grameen Foundation's AppLab Money.Blog

Do Agents Improve Financial Inclusion? Evidence from Brazil

With more than 400,000 agents, Brazil has one of the largest agent networks in the world, but their impact on financial inclusion is mixed.Blog

Savers Deserve More Attention and Protection

Access to finance in the West African Economic Monetary Union and Economic and Monetary Community of Central Africa grew significantly from 2001 to 2011. However, more attention must be paid to savings and savers.Blog

Redefining Failure: Why Getting it Wrong is Part of the Equation

In the first of a blog series on innovation in branchless banking, we take a look at why failure might actually be something to strive for.Blog